- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

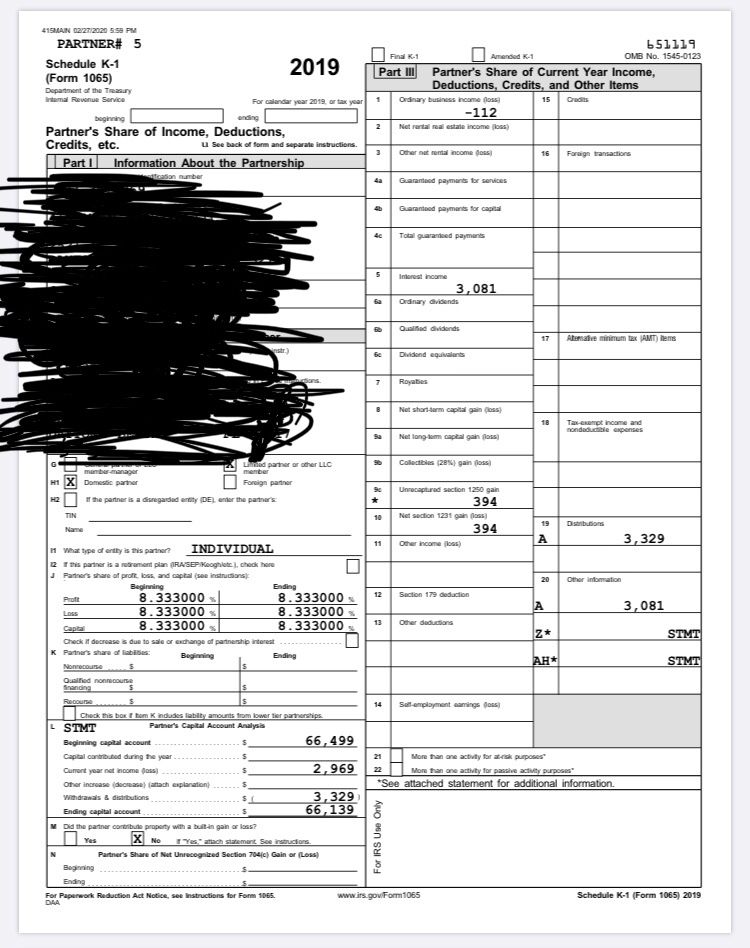

- Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

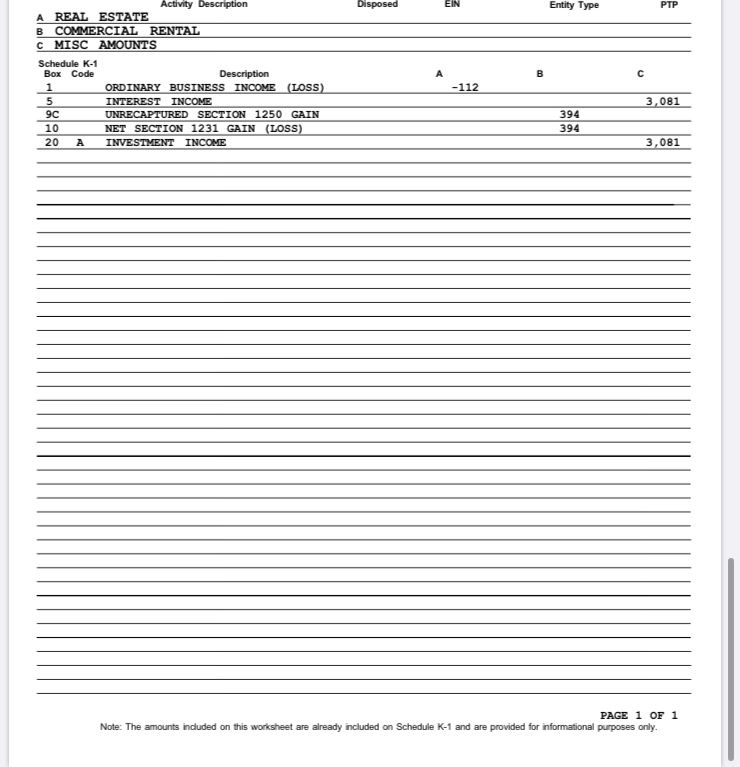

first the reporting was on the wrong line if as you say it's a rental real estate operation. it should have been line 2. did you check you materially participate? if so, the loss is no longer passive and will not appear on form 8582.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

Sorry , actually we are holding papers for the building collecting morgage not rent . That’s why it’s under box 1 . Someone told me it’s a qbi but how do I do that

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

Did the Partnership sell the building in an Installment Sale? If so, Box 1 is still wrong. You really need to talk with whoever prepared the Partnership return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

if your collecting a mortgage and the property was sold, then part should normally be on the line for interest income and part as gain on sale but not line 1. this would be portfolio income and as such is not eligible for QBI/199A deduction. the partnership is required to report any 199A info in box 20 if there is any. if property not sold, then the principal would be non taxable and the interest would show up on interest income line. What code section or other authoritative literature is the preparer using to justify reporting interest income on line1 and for that matter maybe the gain associated is the collection of the mortgage.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

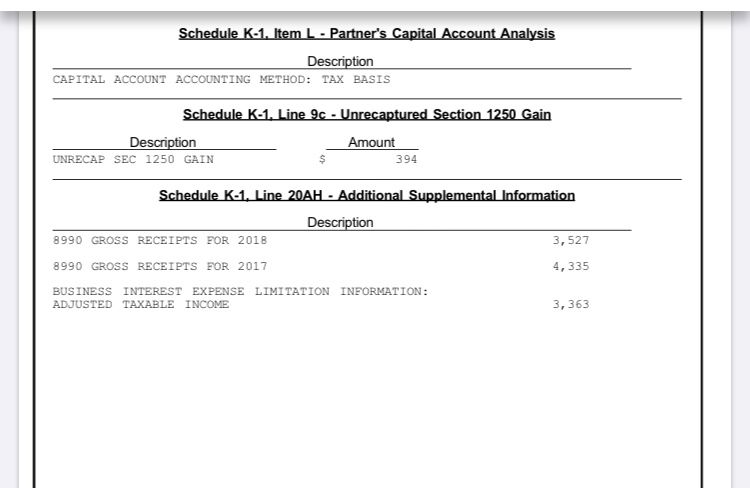

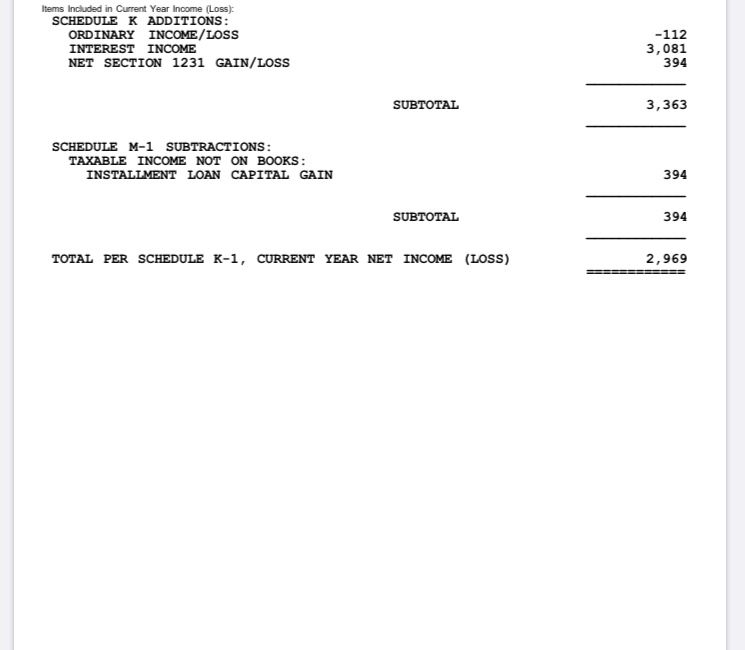

Maybe I am not explaining it properly . I am attaching screenshots of the k1 and the statements . my two concerns are , shouldn’t I have a 8582 with the -112 amount only ?and is the 394 considered a gain. ?because it is populating a capital gain form

- thanks .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

@nkhemlani wrote:shouldn’t I have a 8582 with the -112 amount only

is the 394 considered a gain. ?because it is populating a capital gain form

*IF* it is properly in Box 1, no, Form 8582 would not apply. But that is why we are questioning if it should be in Box 1 or not, and why I suggested talking to the person that prepared the Partnership return.

Yes, the 394 is a capital gain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

@AmeliesUncle wrote:

@nkhemlani wrote:

shouldn’t I have a 8582 with the -112 amount only

is the 394 considered a gain. ?because it is populating a capital gain form

*IF* it is properly in Box 1, no, Form 8582 would not apply. But that is why we are questioning if it should be in Box 1 or not, and why I suggested talking to the person that prepared the Partnership return.

If the loss is in Box 1 and if the user indicates that there was no material participation (as mentioned by @Anonymous earlier), then the Box 1 figure will wind up on Form 8582 (i.e., it is a passive loss).

Conversely, if the user indicates the user materially participated in the partnership's business activities, the figure will be reported as a nonpassive loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

Thanks for the clarification Tagteam. I forgot about Material Participation (for some reason, I tend to assume Material Participation unless stated otherwise).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

and the $394. 00 both on 1250 and 1230 would be on a capital gain ? please see photos of tax statements above

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

Yes, the figure would appear as a capital gain and on the Unrecaptured Section 1250 Gain Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

@AmeliesUncle wrote:

Thanks for the clarification Tagteam. I forgot about Material Participation (for some reason, I tend to assume Material Participation unless stated otherwise).

It is just my opinion, but this should be clarified in TurboTax; it is somewhat rare for limited partners to materially participate in business activities (they actually lose their liability protection as limited partners if they do materially participate).

TurboTax should probably default to "No" on that question after users indicate that they are limited partners.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,I Entered a schedule K1 Partnership . it had a business loss of -112.00 (box1) this partnership is interest in a commercial real estate building collecting rent.

thank you all of you ! appreciate the help .

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

fillini00

Level 2

fillini00

Level 2

palmtree33

New Member

joycesyi

Level 2

Martin Yue

New Member