- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Double counting of LLC income from Business and Personal income sections on Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double counting of LLC income from Business and Personal income sections on Turbotax?

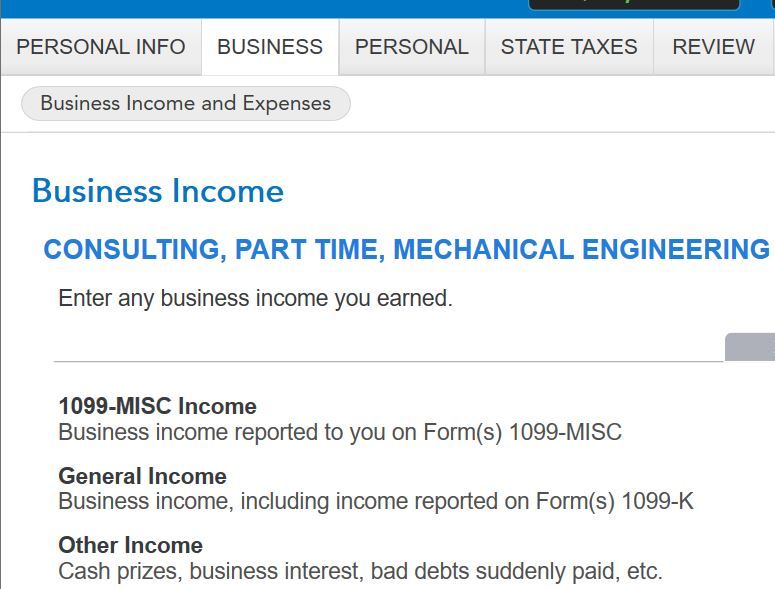

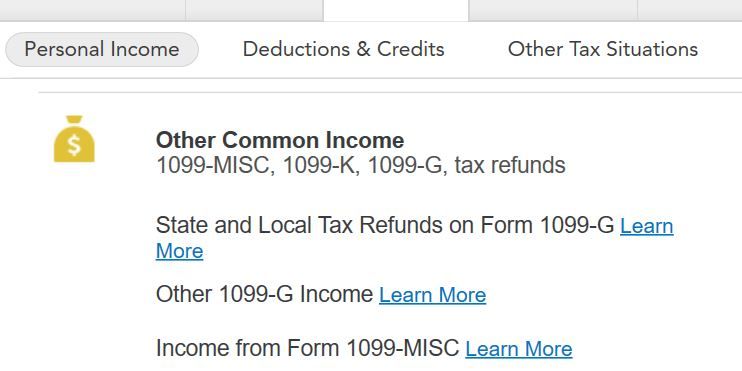

Hello. Using Turbotax 2019 Home and Business Version, I have income from LLC for engineering consulting. I received two (2) 1099-mscs from my clients and entered the income and information in the 1099-msc Business and Expenses section (on Business Tab). Under Personal/Personal Income Tab, I also entered Other common income, Income from Form 1099-msc, I re-entered the two (2) 1099-mscs from my clients. Is this double counted and should I delete either the Business or Personal 1099-msc info? It is more appropriately categorized as 'business income'. Thank You.

I included screen shots of the areas which may cause me to double-count 1099 msc income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double counting of LLC income from Business and Personal income sections on Turbotax?

@nblizard wrote:

I received two (2) 1099-mscs from my clients....

Just enter those two 1099-MISC forms under the Business tab; do not enter them again under the Personal tab.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double counting of LLC income from Business and Personal income sections on Turbotax?

@nblizard wrote:

I received two (2) 1099-mscs from my clients....

Just enter those two 1099-MISC forms under the Business tab; do not enter them again under the Personal tab.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double counting of LLC income from Business and Personal income sections on Turbotax?

Yes, you have entered your 1099-MISC forms twice. Delete the ones you entered under Other Common Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Jimnkim

Level 3

Jim314

New Member

Jeff_AZ

Returning Member

nmartens

Returning Member

elmo1943

Returning Member