- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Do health insurance premiums count towards quarterly estimated tax expenses as a sole proprietorship?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do health insurance premiums count towards quarterly estimated tax expenses as a sole proprietorship?

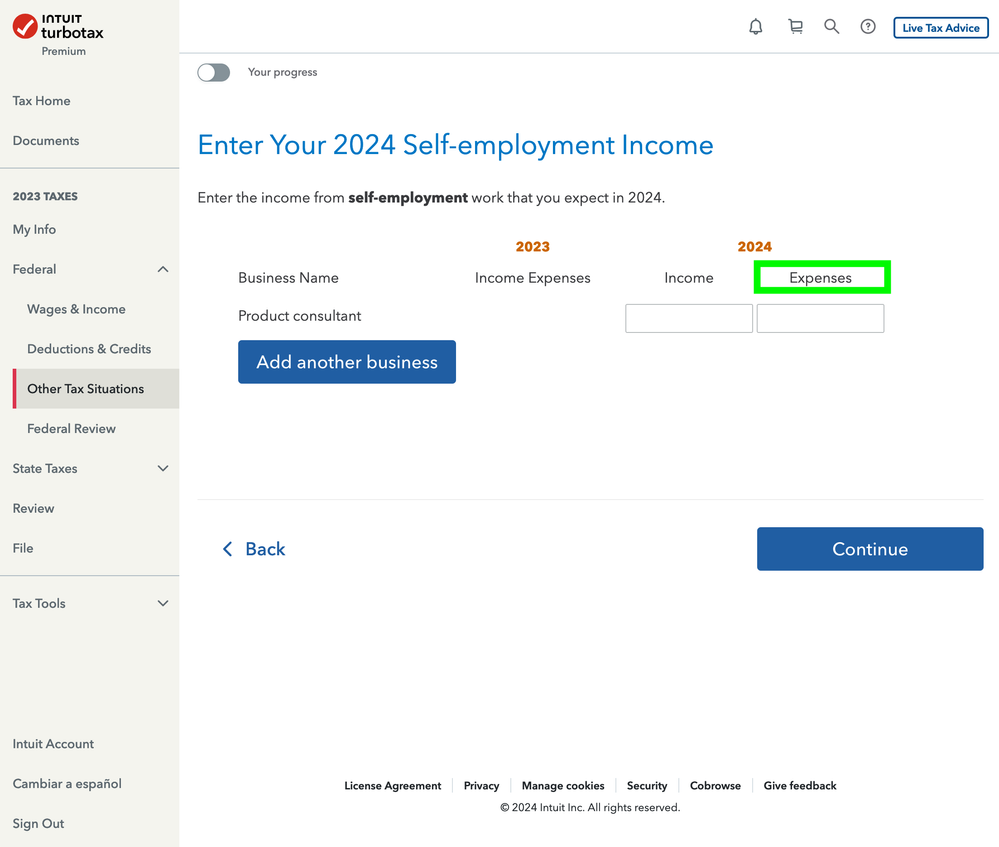

When adding the income and expenses for self-employed quarterly estimated taxes as a sole proprietorship, do you include health insurance premiums as part of your quarterly expenses? Much appreciated!

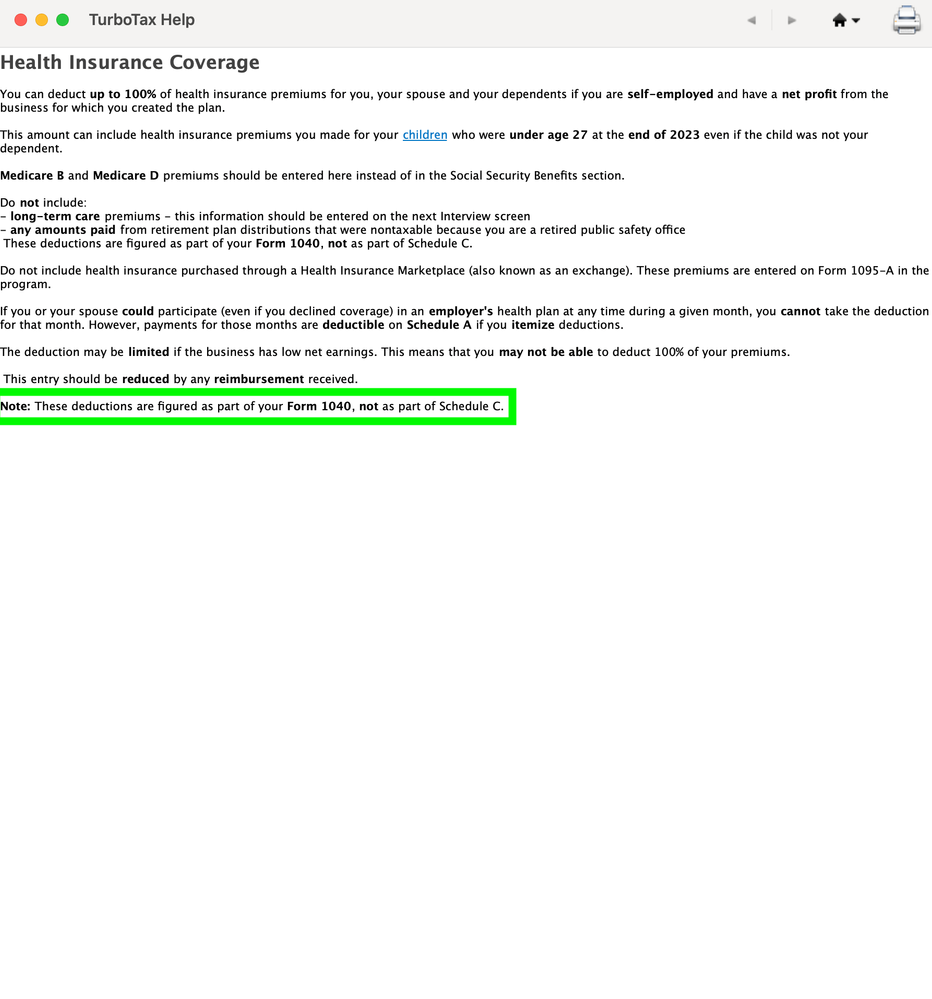

In TurboTax's more info for health insurance premiums it says "These deductions are figured as part of your Form 1040, not as part of Schedule C."

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do health insurance premiums count towards quarterly estimated tax expenses as a sole proprietorship?

Don't include health insurance premiums for you and your family (personal deduction). Only include health premiums you pay for your employees, if applicable.

Your personal health insurance deduction doesn't lower your business income on Schedule C. The deduction is taken directly on Form 1040 (Line 10). So if you include the premiums in your self-employment expenses, your estimates may be too low.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do health insurance premiums count towards quarterly estimated tax expenses as a sole proprietorship?

Don't include health insurance premiums for you and your family (personal deduction). Only include health premiums you pay for your employees, if applicable.

Your personal health insurance deduction doesn't lower your business income on Schedule C. The deduction is taken directly on Form 1040 (Line 10). So if you include the premiums in your self-employment expenses, your estimates may be too low.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do health insurance premiums count towards quarterly estimated tax expenses as a sole proprietorship?

Thank you for the helpful response @DawnC!

Does not including the health insurance premiums here still apply if I am a sole proprietorship?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do health insurance premiums count towards quarterly estimated tax expenses as a sole proprietorship?

Yes. Self-Employed Health Insurance is an adjustment to your income on Schedule 1 and does not affect your business income, even for a sole proprietorship.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

1099erGirl

Level 3

KarenL

Employee Tax Expert

skibum11

Returning Member

austeve79

Returning Member

Larry793

New Member