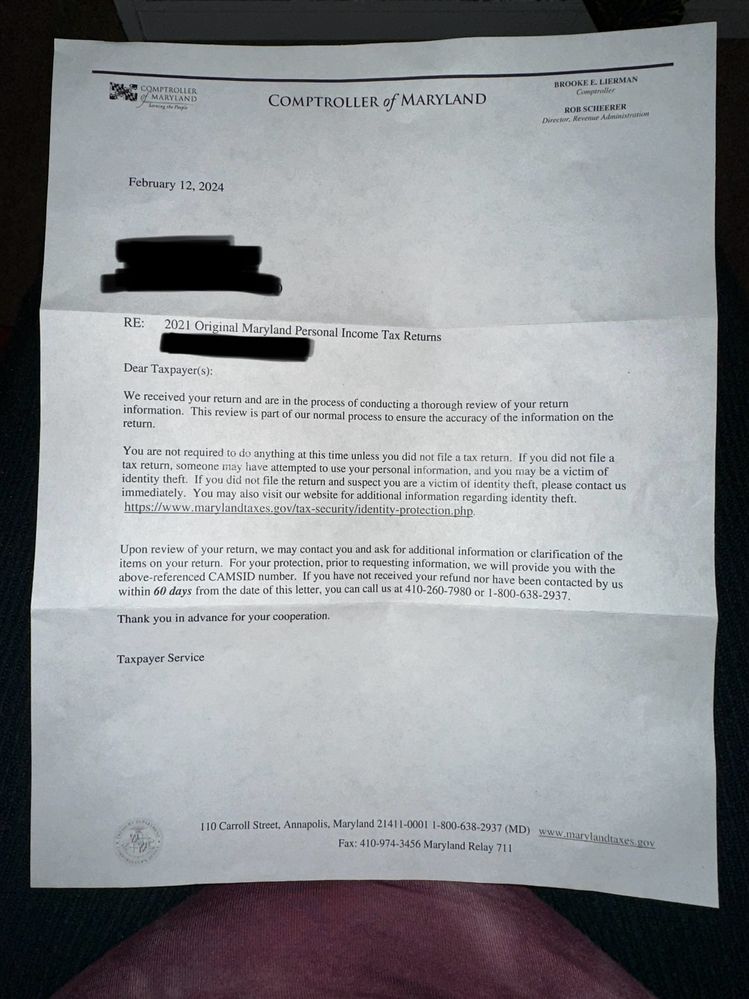

This is a letter about your 2021 MD return. It takes tax agencies one to four years to enter tax returns, evaluate them, cross reference them, and then decide if they want to send you a letter asking for more information or whatever. In my experience, a lot of such letters come from the IRS in the year after you file, whereas for California, they might send dunning letters four years after you file.

However, since I assume that you filed your 2021 return, you can be reasonably sure that this is probably not identify theft, so just put this letter in your tax file (no, not the circular file), and go on with your life.

If they later send you a letter, then answer it; otherwise, don't worry about it.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"