- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Form 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC

Why is TT Deluxe treating this income as a business? It is a form I received from a company name Public Partnerships LLC which was used by Costco to make an extra payment for COVI-19, but I never worked for that company.

I know it has to be entered as an income but it seems TT is treating this as a self-employed income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC

This applies to Form 1099-NEC also.

Enter it in the personal section, Other Common Income Form 1099-MISC. To ensure it does not go to Schedule C (self-employment), you will answer the follow-up questions accordingly.

On the Describe the reason for this 1099-MISC screen, enter a description of the other income. (award/stipend)

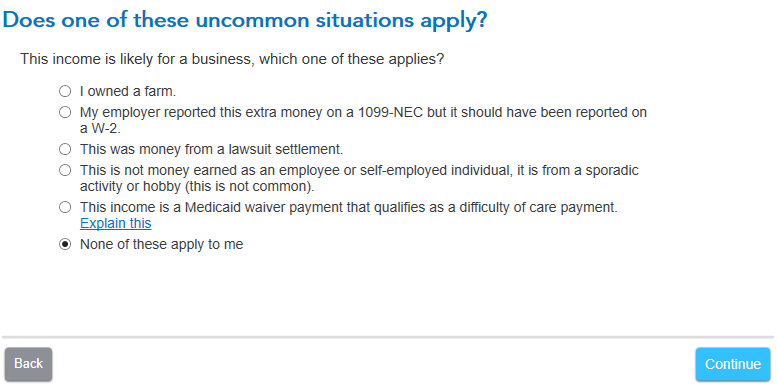

Select None of these apply on the Does one of these uncommon situations apply? screen.

Select No, it didn’t involve work like my day job on the Did the involve work that's like your main job? screen.

Select I got it ONLY in 2023 on the How often did you get income for? screen.

Select No, it didn’t involve intent to earn money on the Did the work involve an intent to earn money? screen.

Answering differently to any of these questions will imply self-employment and generate Schedule C.

Please give feedback. If this helps click “Thumb” or “Best Answer” if it’s a solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC

I will check again but do not recall any of those questions.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC

Checked again. Deleted the form to start fresh, entered the payer's TIN, then selected none of these apply to me.

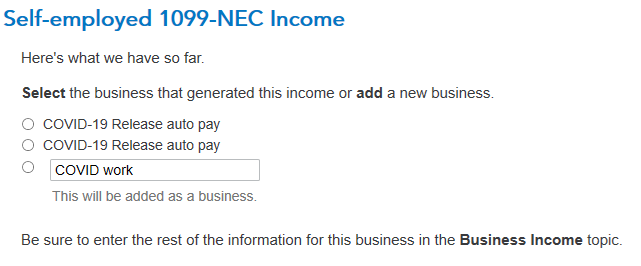

Then the question about the following pic:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC

It is not self employment. For this reason you should delete Form 1099-NEC entry (see below), but keep the document and information that shows it was paid by Public Partnerships LLC which was used by Costco to make an extra payment for COVID-19. Next report the income using the steps below in TurboTax Online Deluxe.

You'll need to delete this form 1099-NEC.

- If you're using TurboTax Online software and need to delete a form, click here.

- If you're using TurboTax CD\Download software and need to delete a form, click here.

Other Miscellaneous Income:

- Go to the Wages and Income section of TurboTax

- Scroll to Less Common Income > Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable Income > Enter a description (----) and the amount

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-NEC

Thanks, did that.

Now TT Deluxe is prompting me to address a question from the form I had deleted when reviewing the taxes. Pointing me back to Schedule C where I had info from the 1099-NEC form.

EDIT: I went into the Schedule C form and manually removed that company info and such, smart check ran fine this time.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

hdefontes

New Member

dibbeena1

Level 2

tiffanyraewebb

New Member

jjkim1

New Member

lbestram

New Member