- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Do I need to report MISC income from coinbase???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

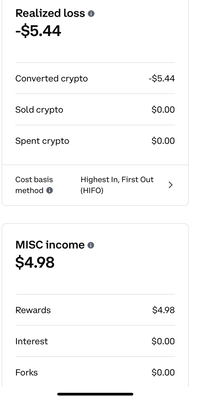

Do I need to report MISC income from coinbase???

When I was doing my taxes I asked my parents about reporting crypto and they said no???? so i didnt. But i just looked on the app today and not sure if i should amend and re-file???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report MISC income from coinbase???

You do have to report crypto transactions any time you sell, convert, exchange, or spend crypto. And you do have to report interest income from crypto the same as any other investment. Technically you probably should have reported the "rewards" as interest income. But you don't amend a tax return for such a small amount. The IRS doesn't care about a $5 omission. It costs them a lot more than $5 to process an amended return. So you should not amend your tax return.

The tax rules for crypto are in a state of flux. The rules might still change for 2022, and will almost certainly change for 2023. And you might have larger transactions in 2022 or later. So keep an eye out for changes in the rules, and get tax advice from a tax expert or authoritative sources. Don't rely on your parents, unless one of your parents is a tax professional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report MISC income from coinbase???

Under the current rules, you determine your gain or loss every time you have a transaction for something real. For example, if you bought $100 of BTC when it cost $10,000 per coin, you have 0.01 BTC. If you buy coffee for $10 but use BTC and BTC is now worth $20,000, then your coffee cost 0.0005 BTC. That 0.0005 BTC has a cost basis of $5 but was worth $10 to you, and that $5 gain is taxable income.

If you lose money (because the currency dropped in value), you might or might not be able to deduct the loss. Opinions vary.

Every transaction counts, not just the big ones, so it can be hard to keep track of. Your coin trading site is supposed to do this for you but I don't know how good a job they do keeping track or giving you proper statements.

I agree that technically, your $5 reward is taxable income. Your $5 loss might or might not be deductible. I also agree not to bother amending for such a small amount.

Keep an eye on the IRS, and check back here in January for information about any new rules you need to follow for your 2022 tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

samman2922

New Member

4md

New Member

g456nb

Level 1

dabbsj58

New Member

dinesh_grad

New Member