- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Tax law changes

- :

- Waive underpayment penalty on repayment of excess 2023 Premium Tax Credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Waive underpayment penalty on repayment of excess 2023 Premium Tax Credit?

I received advance payments of the ACA Premium Tax Credit in 2023, but the amount advanced exceeds the amount I can actually take. Repayment of the excess credit is triggering an underpayment penalty (otherwise I would not have a penalty).

Can I request a waiver of this penalty? TurboTax indicates I can do so but provides little assistance doing so.

Is this old rule from 2014, https://www.irs.gov/pub/irs-drop/n-15-09.pdf , still in effect?

PENALTY RELIEF RELATED TO ADVANCE PAYMENTS OF THE PREMIUM TAX CREDIT FOR 2014 Notice 2015-9 Purpose This Notice provides limited relief for taxpayers who have a balance due on their 2014 income tax return as a result of reconciling advance payments of the premium tax credit against the premium tax credit allowed on the tax return. Specifically, this Notice provides relief from the penalty under § 6651(a)(2) of the Internal Revenue Code for late payment of a balance due and the penalty under § 6654(a) for underpayment of estimated tax. To qualify for the relief, taxpayers must meet certain requirements described below. This relief applies only for the 2014 taxable year.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Waive underpayment penalty on repayment of excess 2023 Premium Tax Credit?

That was only for tax year 2014. You can see if annualizing your income lowers or eliminates the penalty.

Waiver of underpayment penalties

If you have an underpayment, all or part of the penalty for that underpayment will be waived if the IRS determines that:

- In 2022 or 2023, you retired after reaching age 62 or became disabled, and your underpayment was due to reasonable cause (and not willful neglect); or

- The underpayment was due to a casualty, disaster, or other unusual circumstance, and it would be inequitable to impose the penalty. For federally declared disaster areas, see Federally declared disaster, later. Form 2210

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Waive underpayment penalty on repayment of excess 2023 Premium Tax Credit?

TurboTax thinks I *can* apply for a waiver. Is it mistaken?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Waive underpayment penalty on repayment of excess 2023 Premium Tax Credit?

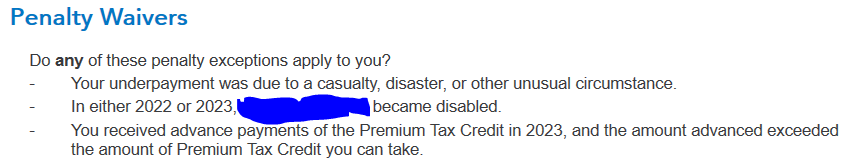

TurboTax is asking if any of the listed penalty exceptions apply to you. If you answer "yes", the program will provide entry screens for additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

77542164

Level 1

amcnaughton

New Member

loehrjosam

New Member

DavidDwight

Level 1

johnmichael352

New Member