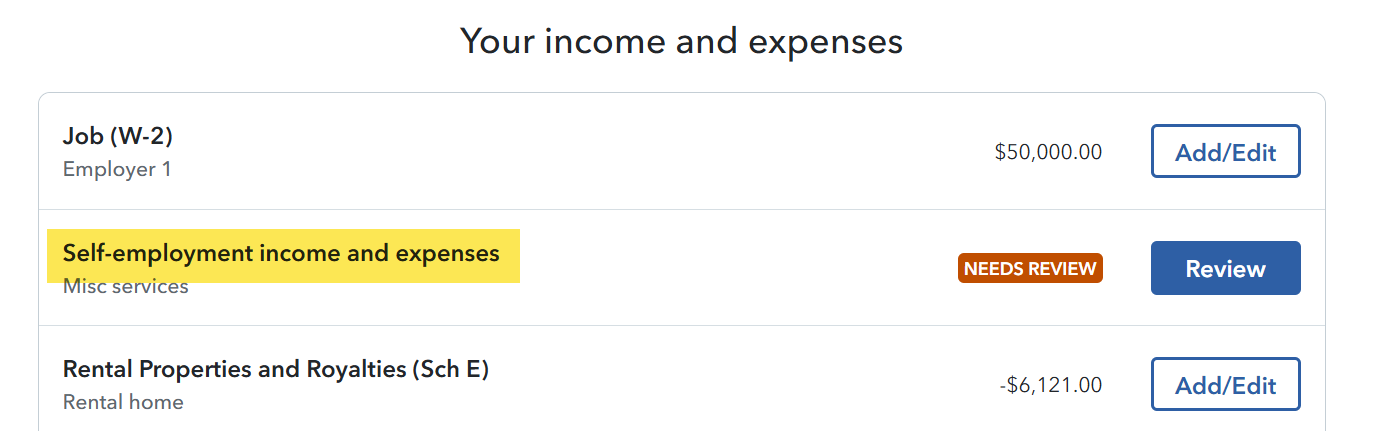

You need to enter your expenses associated with income reported on a Form 1099-NEC in the Self-employment income and expenses section, which you will find under Wages and Income. Income reported on a Form 1099-NEC is considered self-employment income so you need to set up a business in TurboTax to report it and the associated expenses:

In that section, you will be prompted to enter your Form 1099-NEC and then the expenses associated with it.

The section you mention is for employment expenses associated with salary income reported on a Form W-2.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"