- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

I'm a self-employed consultant, working entirely in the U.S.

In 2023, I had a client in China that withheld a mandatory Chinese income tax from payment for the service I provided. Therefore, I went to the Foreign Taxes section (under Estimates and Other Taxes Paid) to see if I could reduce my U.S. Federal income taxes.

I found that the TurboTax instructions on this topic are confusing, because it appears to emphasize taxes paid on foreign investment income, before stating that "Foreign taxes based on foreign earned income... may also qualify for a credit."

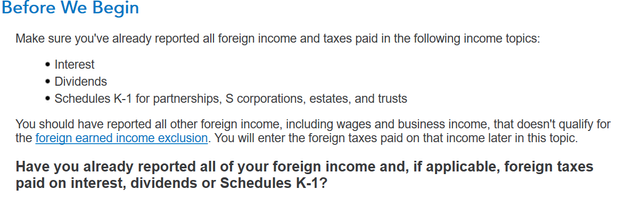

Selecting Yes, I did pay foreign taxes in 2023 takes the user to the next screen:

Why does the program put an emphasis on reporting foreign income from Interest, Dividends, and Schedule K-1s, putting it first at the beginning and then again at the end of these instructions?

Why is the statement that the user will report taxes on income that doesn't qualify for the FEIE stuck in between those two statements?

At this point in the program, no.. I have not reported my foreign taxes, but I have reported all my income in the Business Income section. But TurboTax didn't ask if any of that income was from a foreign company, so have I "already reported my foreign income", or not? Do I select yes or no? Maybe I'm the only one, but it sure wasn't clear to me what this instruction meant.

HINT: Yes is the right answer.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

First of all, answer this question None of these Apply because you have entered your income already in your Schedule C form. Now to finish the rest of the section.

- Navigate and record the entries that the program asks for and when you reach the page that mentions Foreign Tax Credit Worksheet, this is where you take notice.

- The first that you will be asked is what category of income is it, you will say General Category income.

- Next screen will say Country Summary, select add a country and then select China.

- When it says Other Gross Income - China. Here list the income you received from the client.

- Then you will navigate through the screens until you come to a screen that says Foreign Taxes Paid - China, here is where you record the amount paid under Foreign Taxes

- You should be able to continue through the sections until you finish. Do not enter deductions or anything else the program asks because if you answer these questions, this will reduce your foreign tax credit and defeat the purpose to receive the credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

Thanks @DaveF1006, but that doesn't at all address the issue I documented here.

Perhaps I can try to be more succinct:

- During entry of Business Income, TurboTax provides no information whatsoever on the proper way to enter income from a foreign company. If one earned that income while in the U.S., it isn't eligible for the Foreign Earned Income Exemption, so it doesn't go in the "Less Common" Foreign Earned Income section, but TurboTax doesn't inform the user of that fact.

- In fact, if one mistakenly selects the Foreign Earned Income option, the program instructs:

- "If you earned income from outside the U.S. , you're required to enter it here. That is an incorrect statement. It should say while living and working in a foreign country, not from a foreign country.

- And in the Foreign Tax Credit Worksheet that you reference, TurboTax improperly emphasizes investment income, de-emphasizing earned income by stating it "may also qualify for a credit."

TurboTax is supposed to help users file correctly and more easily. In regard to income earned from a foreign source, it does not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

It depends. First of all, you would not enter this in the foreign income section because you are living and working in the US. Informing the user may may helpful and we apologize that feature is not mentioned in the program.

As far as the program emphasizes investment income, de-emphasizing earned income by stating it "may also qualify for a credit." This is irrelevant, especially if you have no foreign investments. I think the program is trying to be helpful in mentioning this but this does not apply in your case.

You should have the opportunity to claim your foreign tax credit using the steps that I have provided and move past the additional roadblocks that seem to be confusing you at the moment. Be especially mindful of Step 4 and only report the payment you received from your China client as other Gross Income amount. This amount will not appear as a separate taxable item in your return but only used to determine the amount of your Foreign Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

You stating what the tax laws are isn't helpful, when TurboTax doesn't provide clear and unambiguous instructions accordingly. The whole purpose of the program is to GUIDE the user, not to assume they already know all the rules.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

Yes. I do agree with you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

So, I still have a question on this topic. I taught a class overseas (I was in the foreign country for a week) and taxes were withheld from my payment. I have reported the income during the "business" interview in turbotax, but it does not ask about foreign income or taxes. Do I wait until the "personal" interview to enter the foreign tax credit? This is really not clear to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax instructions for filing Foreign Tax Credit are confusing (and incomplete)

Although I did my work remotely while still in the U.S., I think your situation is the same as mine.

I reported my gross income in the business-income section, then reported the foreign income tax in the "other taxes paid" section (under Deductions and Credits). The program then completes Form 1116 to do the foreign-tax credit credit calculation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.