- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Starting business with large inventory - Help with Schedule C Part III

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

I have been collecting for 30 years and have many boxes of inventory (about $10,000). I am older and decided to start selling my inventory on Ebay and Etsy this past year to supplement my income. Trying to do the Schedule C part 3, but as a new business turbotax doesn’t let you put a starting inventory. So when I put an ending inventory the COG just comes out to 0 when I know my cost of the goods I sold this year was $2,245. How do I account for all my starting inventory? Called intuit support but they didn’t know. Help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

So, your ending inventory is $10,000 and you didn't sell anything? If so, your COG is correct at $0. If you sold any items your inventory value went down and needs to be adjusted.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

You have entered the amount on Line 36b as a positive number. Enter this as a negative so the number on line 40 is a positive number. After deducting ending inventory, this should result in the correct COGS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

If you're using TurboTax Desktop, go to FORMS at the upper left when you are at the 'Enter Ending Inventory' page in the interview. You will be on a 'Schedule C Worksheet' where you can type in the amount of your 'Beginning Inventory'.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

Turbo tax does not let you put starting inventory for a first year of business. It auto puts 0. That is my problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

Put in zero for ending inventory also and enter 2,245 for Purchases. Your COGS will equal the same amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

Thanks for taking the time to answer. Sounds like a work-around, but then I will have the same problem next year. Because I will still need a starting inventory and it will be 0 again if that is my ending this year. I was hoping to find out how people deal with starting inventory their first year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

Since a business doesn't start with assets or inventory, you need to be entering the "investment" of your inventory into your business.

Enter the negative of your beginning balance value on the Purchases Withdrawn for Personal Use line within the Cost of Goods section of TurboTax. For example, if your starting inventory value is $10,000, enter -10000 on this line.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

Thanks for answering. So I put $10,000 in Purchases? I thought that line was for purchases just in the tax year 2022. Will it be a red flag to have that much purchases in 1 year when my income is not that high now as semi retired? But it would work in terms of COG and ending inventory and reporting next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

No, you are entering a negative (opposite) "Purchase Withdrawn for Personal Use". While you and your business are essentially the same things when you report as a disregarded entity (Schedule C), the business still needs to "buy" the items in order to resell them. It will not raise a red flag because it will be a large "purchase" from yourself and you are only expensing what you actually sold in 2022 when you enter your ending inventory value.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

Thanks again Alicia for trying to help me, but when I put -$10,000.00 next to "cost of items withdrawn for personal use" and then put ending inventory, it still comes out with COG as 0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

So, your ending inventory is $10,000 and you didn't sell anything? If so, your COG is correct at $0. If you sold any items your inventory value went down and needs to be adjusted.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

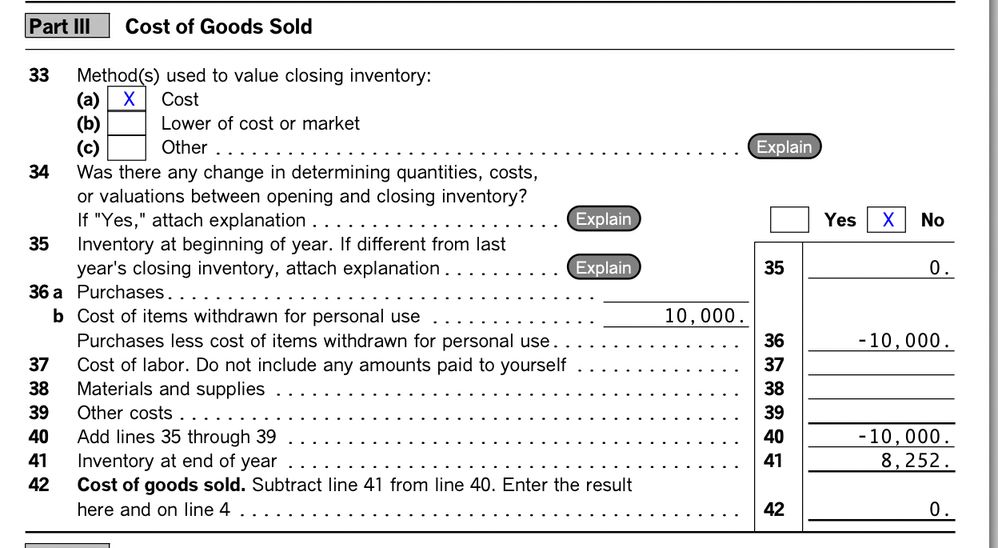

Sorry, I am obviously not getting it. Thank you for your patience. These are not real numbers but lets say end of inventory is $8252 so COG should be $1748 ( if I started with 10,000). See screenshot from turbo tax attached. COG still 0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

You have entered the amount on Line 36b as a positive number. Enter this as a negative so the number on line 40 is a positive number. After deducting ending inventory, this should result in the correct COGS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

Thank you Patricia! That did work. I don't understand why it worked ha ha. I guess it knows I had to have 10,000 in purchases in order to withdraw that much for personal use. Still very odd. Thanks to Alicia also!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting business with large inventory - Help with Schedule C Part III

I'm glad I came across this post. I'm going through the same thing. I'm still a little confused as you are but I know how to do it now. Thanks to all

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

LGW2

Level 1

TheWisdom

Level 3

LifeinPTC

Level 2

kirkdb

Level 1

chantellemoline

Level 2