- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Received a 1099 MISC for a state surplus, one time refund. NOT from self employment which is how Turbo Tax wants to categorize it. How do I report it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099 MISC for a state surplus, one time refund. NOT from self employment which is how Turbo Tax wants to categorize it. How do I report it?

for Minnesota

Topics:

posted

March 7, 2024

12:31 PM

last updated

March 07, 2024

12:31 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099 MISC for a state surplus, one time refund. NOT from self employment which is how Turbo Tax wants to categorize it. How do I report it?

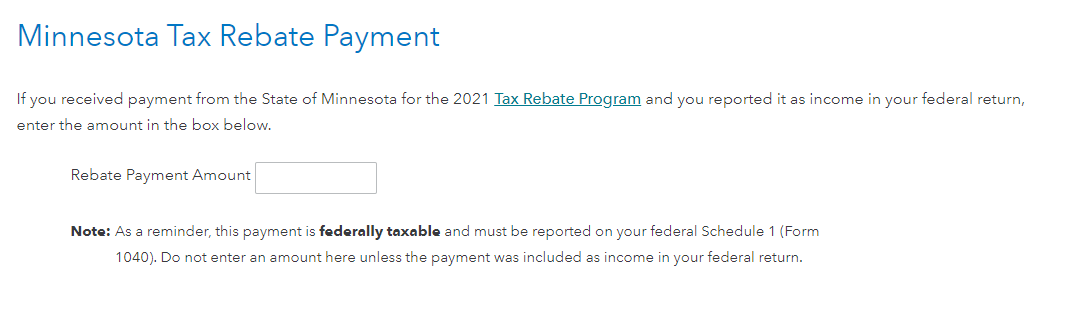

Are you referring to the Minnesota Tax Rebate Payment? If so, the Minnesota payments are taxable income on the Federal 1040 tax return but not subject to self-employment income.

The payment is not taxable income on the Minnesota state income tax return. Follow these steps to report the payment reported on IRS form 1099-MISC.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Less Common Income.

- Select Miscellaneous Income, 1099-A.

- Select Other reportable Income.

- As a description enter MN Direct Tax Rebate Payment.

In the Minnesota tax return, remove the income at the screen Minnesota Tax Rebate Payment.

Information on the Minnesota Direct Tax Rebate Payments may be found here.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 7, 2024

12:38 PM

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kohal18

New Member

winstonalbertine

New Member

amund

New Member

ltcolamac

New Member

jim_robyn_hoffma

New Member