- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Re: how to enter self employed tips?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to enter self employed tips?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to enter self employed tips?

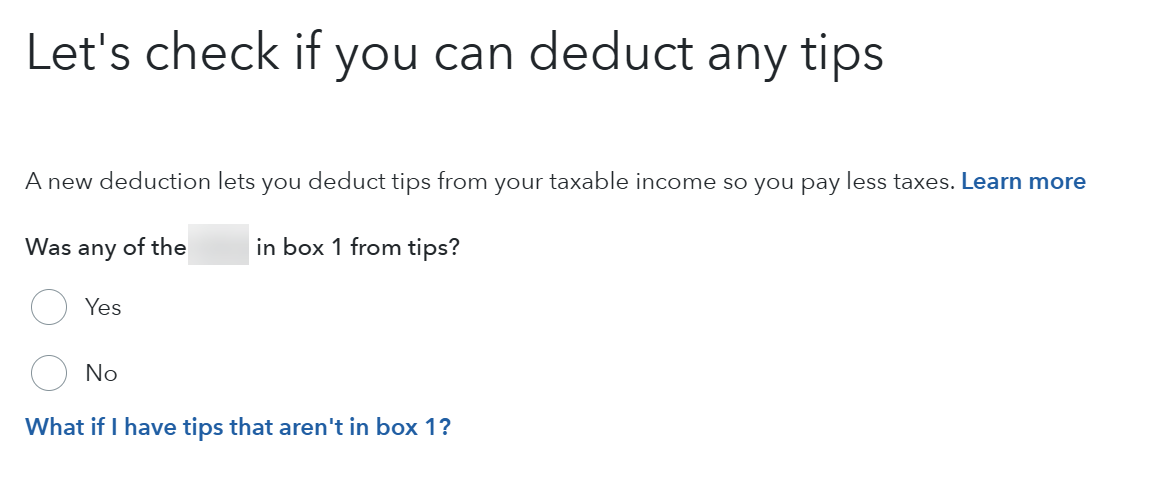

They have to be reported on a 1099 in order to deduct them. If they are reported on 1099, TurboTax will ask you when you enter the 1099, whether or not any of the income is tips or overtime. How to enter self-employment income. You won't be asked about tips or overtime if your self-employed income comes from only cash or checks (non-1099 income).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to enter self employed tips?

Can someone please reference IRS rule/regulation that states it "HAS TO BE ON A 1099 form. I am not able to location this information. I do taxes for a Salon/Hairdresser.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to enter self employed tips?

If the hairdresser is employed by a salon, they can use Form 4137 to report tips, but it still has to be linked to their W-2 or 1099 form reporting income. A self-employed hairdresser can report income received on a 1099-K with a personal record of tips to report tips. Here's more detailed info from the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to enter self employed tips?

You can enter the tips but the deduction does not lower the taxable income??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to enter self employed tips?

When you are entering your income for self employment, TurboTax will ask if any of that income will includes tips. The tips must be included in a Form 1099-k, 1099-MISC, or 1099-NEC. You have to keep logs that show the date, the customer, and tip received.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zoeydtexas99

New Member

lizko6999

Level 1

user17722056080

New Member

Simpleton

Level 3

aysegulyayli

New Member