- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Re: Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

In my final review before filing, I received the following error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked." I have two 1099-MISC's: one for self-employment, and one for a non-taxable state rebate. This error is for my self-employment. This error did not occur until the TurboTax update loaded this morning. There is not a checked box that I can find.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

I have this same issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

You should delete the 1099-MISC from your Schedule C - in the Business section of TurboTax. Then go back and re-enter it in the Personal section. It was either entered in the Business section or somehow got linked to your Schedule C, but there is no button to ''unlink'' it, so deleting it from Sched C and then entering it in the Personal section is the way to fix that error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

thank you very much! I'll do that now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

I removed the 1099-MISC from business and reentered it in personal, along with the 1099-MISC for the CA Middle Class Tax Relief and I still get the error. When I reentered the 1099-MISC it asked me if there was schedule C, which there is - shouldn't I connect these two?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

- The Middle-Class Refund should not be attached to your business.

- If you are excluding (from income) the amount on the 1099-MISC as difficulty of care payments (Qualified Medicaid Waiver Payments) - then enter it in the personal section and do not link it to your Schedule C (select these are medicare waiver payments).

- If you want to include the payments in taxable business income, then do not enter the form in the personal section and select these are Medicaid Waiver Payments - you should enter it in the Business section, with your business income, and do not indicate they are waiver payments.

Anything you mark as MWP will not link to Schedule C. So, do you want to include the MWP in income or do you want to exclude the MWP from income?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

I have the same problem with 1099 Misc that are entered and appropriately linked to my business. I get the same error saying the MWP box is checked and it is not even an option when 1099's are entered under business. The program is messed up and needs to be corrected. Your fix above does not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

I would advise deleting your 1099-Misc entries, and rather than 'linking' them to your Business, enter them directly as Business Income.

Type 'Schedule C' in the Search area, then click on 'Jump to schedule c'.

If you have already set up your Business, EDIT your Business at the Business Summary page. If not, answer some questions about your Business and then scroll down to 'Add Income' to enter your 1099-Misc.

Continue, and you can indicate that you received a 1099-Misc and enter it there.

Here's more info on Reporting Business Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

The MWP box is not checked. I checked and then unchecked it to see if it would correct the issue. I did not have this issue before the update that rolled out in the last couple of days. Based on the number of people who have expressed the same concern in the same timeframe, I suspect it is a software issue, not an entry issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

You are not required to enter a 1099-MISC specifically into your tax return as long as all the income is reported correctly. You can delete your 1099-MISC Form from your return and re-enter the income.

To enter your income to your business in TurboTax Online you can follow these steps:

- Within your return, click on Tax Tools in the black menu on the left side of the screen.

- Click on Tools.

- Click on Delete a Form.

- Scroll down to your form and click Delete.

- Under Federal in the black menu bar click Wages & Income to get back into your tax returns.

- Search for self employed income (use this exact phrase, don't add a hyphen) and select the Jump to link at the top of the search results

- Answer Yes on the Did you have any self-employment income or expenses? screen

- If you land on the Your 2022 self-employed work summary page, select Review next to the work you're adding income for

- Answer the questions on the following screens until you arrive at Let's enter the income for your work

- Scroll down to the Income section and click Add income for this work

- Choose Other self-employed income and Continue

- Proceed entering/reviewing your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

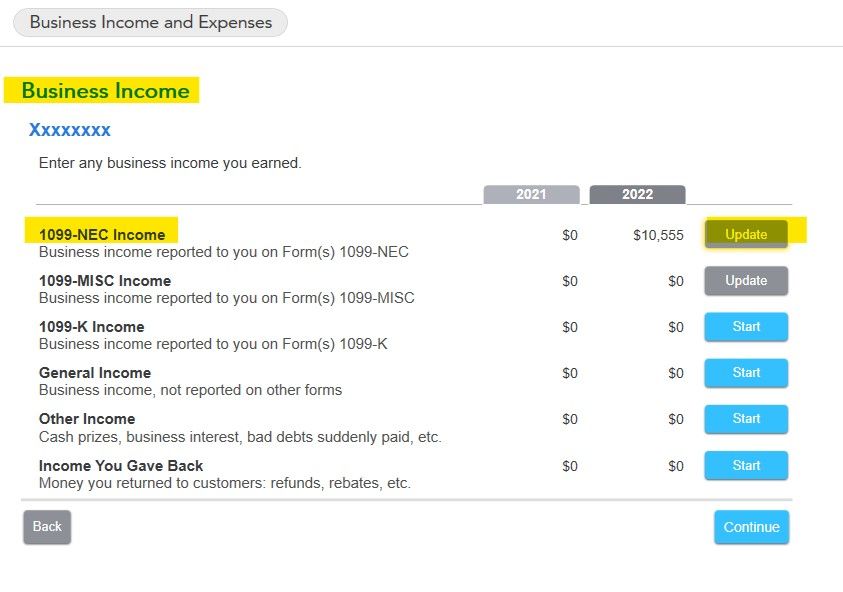

As a workaround, until we can get the error removed, try

- Deleting the 1099-MISC with amounts in Box 3 and

- Enter the form as a 1099-NEC with the amount in Box 1

The results will be the same on Schedule C. And the 1099-NEC will link to Schedule C without an error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

This error of "MWP qualifying as difficulty of care payments exclusion box has been selected."

is due to the IRS 8960 update/error.

Issue is with TurboTax desktop allowing 1099 MISC to be entered into Schedule C as income.

Even though there is a box to select and users are allowed to enter their 1099 MISC inside the Business, the Employer should have actually issued a 1099 NEC, if the taxpayer is wanting to enter this into a Schedule C.

SOLUTION / Work around:

Go to Schedule C, income, update. Remove 1099 MISC.

Go to General business Income, just below that, and click start.

Enter this income in box as 1099misc and the amount.

This allocates the income properly to the Schedule C and reports that it's a 1099 misc for the business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

I deleted the 100-MISC and re-entered the information as a 1099-NEC. Worked without an issue. Thank you for your help and guidance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error: "Form 1099-misc: a link to schedule c should not be linked when the mwp qualifying as difficulty of care payments exclusion box has been checked"

You are very welcome!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vidoucet2000

New Member

bruce55crane

New Member

user17703141755

New Member

user17685228471

Returning Member

bradjmc5dad

New Member