- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Quick Employer Forms 1099 Misc Copy A - no printed copy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

Quick Employer Forms indicates, "Quick Employer Forms only supports e-filing of the forms with the IRS and Social Security Administration. Copy A of the Form 1099 and W-2 are only used for e-filing and are not provided for printing." Does this mean the recipient does not have to send in a 1099 Misc Copy A with their tax returns to the IRS? I want to give the recipient a correct answer if they ask me why they did not get a copy A. thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

@Racewb3 That is correct. Taxpayers only have to submit a copy of 1099-MISC in order to prove that taxes have been withheld, either state or federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

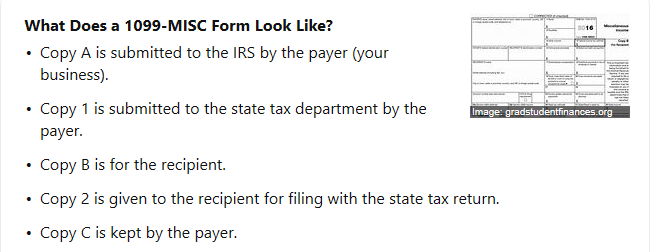

Copy A of 1099-MISC is the copy that you, as the issuer, would provide to the IRS. Copy A is not issued to your contractors. See the image below for clarification.

*Please click the thumbs-up icon if this response was helpful.

**Please click "Mark As Best Answer" if your question has been resolved. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

It appears that Quick Employer forms will efile Copy A with the IRS. However it prints Copy 1 to be sent to the state, but does not print Copy 2 for the recipient. Since I as payer needs to send in Copy 1 to the state, why does Quick Employer Forms not give me a Copy 2 for the recipiant? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

@Racewb3 Are we still discussing 1099-MISC? Are you withholding state taxes from those for whom you are preparing those 1099-MISC? The reason I ask is because taxpayers need only submit a copy of 1099-MISC to the federal OR state taxing authority if respective taxes have been withheld.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

This is a 1099 - MISC. No taxes - federal or state have been withheld. Based on your comment, it sounds like the recipient will not have to submit any 1099 forms, so all they need is their copy (copy B) ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

@Racewb3 That is correct. Taxpayers only have to submit a copy of 1099-MISC in order to prove that taxes have been withheld, either state or federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

I'm not sure I trust what TurboTax says about their Quick Employer Forms. If you enter data, it might disappear instead of being saved (as promised).

On about January 10, 2020, I (eventually) figured out how to enter payee data at the TurboTax web pages for eventual printing and eFiling of IRS Forms 1099-MISC (block 7, NEC Compensation) due tomorrow, January 31, 2020. [For my 2019 returns, I upgraded to TTax Home & Business -- specifically because I wanted the advertised ability to eFile my 1099-MISC forms and know that my current 2019 data would be saved online for quick & easy transfer to next year.]

(1) It turned into a time-wasting hassle to (eventually) discover that the ability to enter 1099-MISC info via the online web pages could NOT be accessed from my freshly-created and therefore existing 2019 TTax file in my desktop computer. Instead, when first opening TTax I had to click the "Start a new return" button and from there choose to enter 1099-MISC (or W2, etc.) data. That worked and I manually entered data for about 30 payees. I chose not to eFile at that time (TTax FAQs explain that my data would be saved online for later eFiling and for transfer to next year). Instead of immediately eFiling, I opted to wait until the end of January (i.e., today, 01/30/2020) in case errors needed to be corrected before eFiling. [NOTE -- There was NO "sign out" link or button available on any of the screens that appeared for me, so I simply closed the browser window. Chrome browser.]

(2) Today, 01/30/2020, I am trying to get back to my previously-entered 1099-MISC data that is supposed to be stored someplace within my online account at TTax ... ... ... and, after successfully logging in with my username and password, I cannot find any of my previously-entered data. The option to enter brand new data appears, but NO saved data from a couple of weeks ago. AARRGGH! A link to previously-saved data does NOT appear when I use the "Start a new return" button when TTax first loads. I cannot find a link to my already-entered data when I go back into my already-started 2019 tax file that's stored in my desktop computer. AARRGGH!

Now I wonder why I wasted my time and money upgrading my TTax product so that I could (supposedly) enter and eFile 1099-MISC forms via TTax to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

ok, but what if the IRS asks me why i did not send copy A

in on one of the two 1099's i had to prepare? The 1096 shows 2 1099's. do i just mark out copy the 1099 on the state one i don't have to send in and put an A on that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quick Employer Forms 1099 Misc Copy A - no printed copy

@ben1031 I'm not understanding your question. First, are you preparing using Quick Employer Forms? Or are you preparing using TurboTax Home & Business Desktop software (and your computer)?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JWain

Returning Member

leashg8

New Member

kibitz

Level 2

mjedlin66

Returning Member

JCMA25

Level 3