- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- My husband passed in 2022 but received a 2023 1099 misc in his name and ssn for paying out of unused vacation time. Do I report this 1099 misc on my tax return?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband passed in 2022 but received a 2023 1099 misc in his name and ssn for paying out of unused vacation time. Do I report this 1099 misc on my tax return?

Topics:

posted

February 13, 2024

8:49 AM

last updated

February 13, 2024

8:49 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband passed in 2022 but received a 2023 1099 misc in his name and ssn for paying out of unused vacation time. Do I report this 1099 misc on my tax return?

It depends. If the money was actually received by you then it now belongs to you, include it on your tax return. Do not enter the 1099-MISC, instead use the steps below to report this as 'Other Income'.

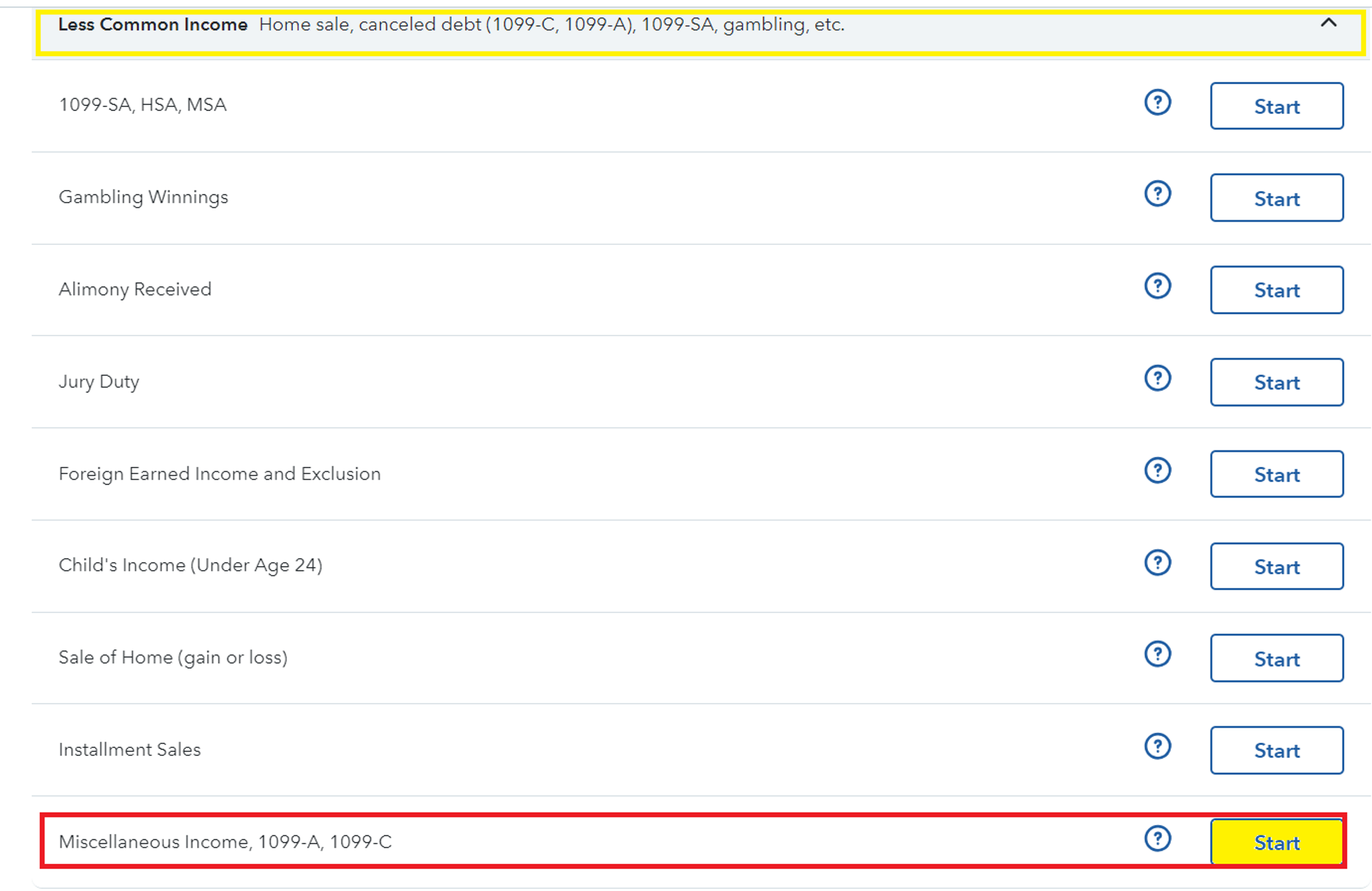

- Click on Wages and Income and scroll down to Less Common Income

- Go to the last selection, Miscellaneous Income and click Start

- Go to the last option, Other reportable income and click Start

- When it asks, "Any other reportable income?" > yes and then type in a description and the amount to report it on your tax return.

- TurboTax Online and TurboTax CD/Download will use the same procedure

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 13, 2024

8:58 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband passed in 2022 but received a 2023 1099 misc in his name and ssn for paying out of unused vacation time. Do I report this 1099 misc on my tax return?

Thanks Diane, had the same effect of reducing my refund but at least I know I am reporting it correctly. 😊

I had previously entered it under 1099-MISC. but was unsure of this since it has his name and SSN# listed.

February 13, 2024

10:29 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tax20252

New Member

liemlieu327

New Member

kswst16

Level 1

fall72

New Member

JDWMOON

New Member