- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- How do I account for interest from Fidelity "Fully Paid - Securities Loan" shown as "other income" on 1099-Misc?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I account for interest from Fidelity "Fully Paid - Securities Loan" shown as "other income" on 1099-Misc?

The "uncommon situations" options do not offer anything close to this scenario.

If "none of these apply", Turbotax assumes this is a standalone business.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I account for interest from Fidelity "Fully Paid - Securities Loan" shown as "other income" on 1099-Misc?

This income is not business income, rather miscellaneous as indicated by your Form 1099-MISC. It's your money making money for you and not because of a service you performed.

It's important for you to select 'None of these apply" and then you should also select the following:

'No' on the screen 'Did the '____' involve work that's like your main job?'

'No' on the screen 'Did the '____' involve an intent to earn money?'

This will report the income without any business activity and it will show up on Form 1040, Line 8 (From Schedule 1, Line 8z).

You can use the Preveiw My 1040 to see the income on the appropriate lines of your return.

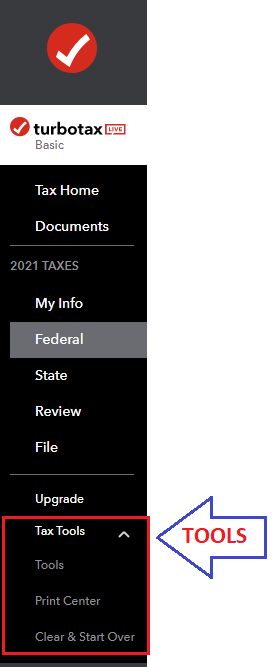

- With the Tax Tools menu open, you can then:

- View only your 1040 form: Select Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

leashg8

New Member

bdoustdar

New Member

chelseynicole3609

New Member

caitlin-m-shipman

Level 1

Hoosier-69

New Member