- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- How can I report 1099-NEC income properly as survivor income, not subject to self-employment taxes? My mother received insurance commissions earned by my late father.

Announcements

Attend our Ask the Experts event about Tax Law Changes - One Big Beautiful Bill on Aug 6! >> RSVP NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report 1099-NEC income properly as survivor income, not subject to self-employment taxes? My mother received insurance commissions earned by my late father.

My father passed away in 2014. My mother has been receiving his commissions since then as his survivor. CPA I hired for 2023 tax return advised income earned by someone else is not subject to self-employment tax by the survivor.

posted

April 9, 2025

11:42 AM

last updated

April 09, 2025

11:42 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report 1099-NEC income properly as survivor income, not subject to self-employment taxes? My mother received insurance commissions earned by my late father.

It is not business income so let's go through the steps. Online and desktop have a little difference but this should get you through either one.

- Open your return to the federal income section

- Select income from Form 1099-NEC

- Enter the information from your form

- Continue

- Describe the reason

- Continue

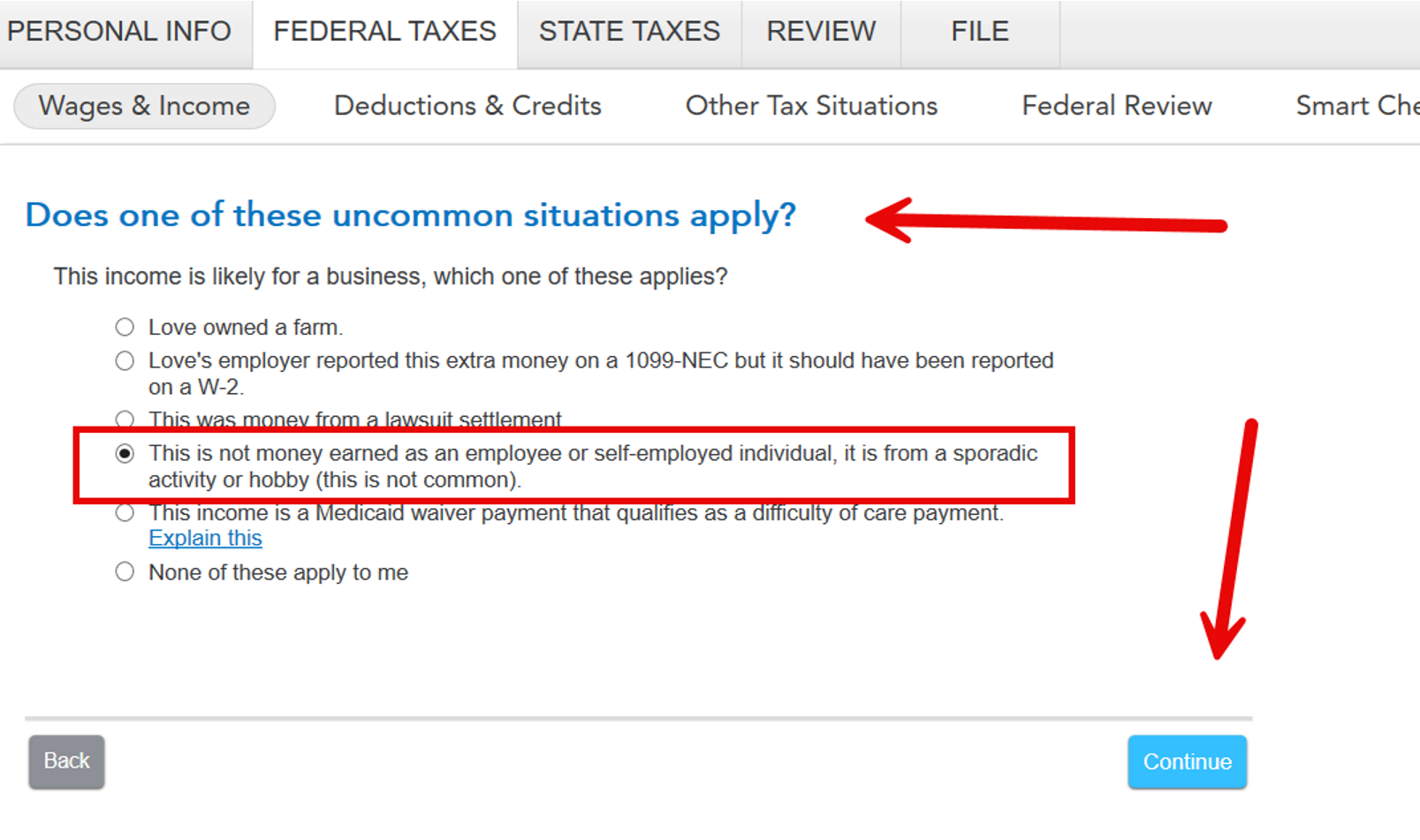

- Does one of these uncommon situations apply?

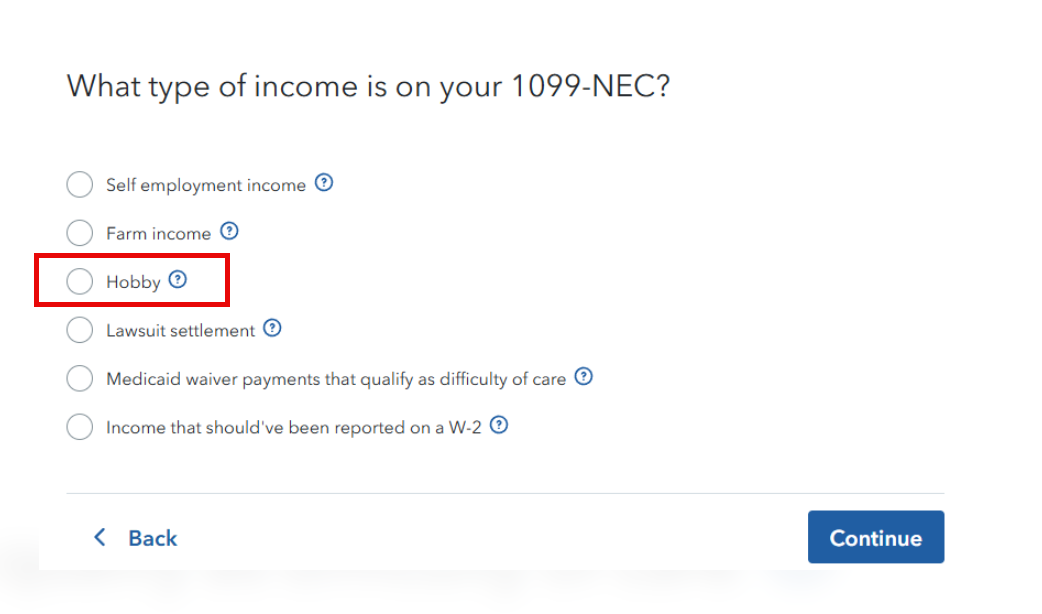

- Select not earned, sporadic, hobby - the screenshots different -

- online, select hobby

- desktop chooses sporadic

- Continue

- See the NEC summary

- Done

I am very sorry for your loss.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 9, 2025

11:48 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy-miles-POA4-molly-miles

New Member

rongoldner

Level 1

tomoquick

New Member

tylerf21-

New Member

Taxedguy2022

Level 1