- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Can I deduct a percentage of my self employment tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct a percentage of my self employment tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct a percentage of my self employment tax?

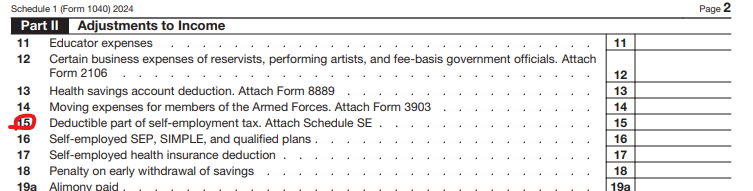

@doriamcmanious , when you tell TurboTax that you have a 1099-NEC or that you are self-employed / single member LLC, it will walk you through the process of filling out Schedule-C and then Schedule-SE. 50% of the SE Taxes would appear as an adjustment on 1040 ( to make it fair compared to the wage earners / W-2 ).

Is this what you are asking about ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct a percentage of my self employment tax?

The deductible portion (50%) of self-employment tax is deducted on line 15 of Schedule 1 Additional Income and Adjustments to Income.

See this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rar31966

New Member

bid-rich

Level 1

simonacypher

New Member

madawaska53

New Member

gshenk12

New Member