- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- 1099 NEC does not show up on income summary

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 NEC does not show up on income summary

I have added my 1099 NEC information but it does not show up on my income summary page. Also I have contributed to a SEP IRA and now I get a penalty for that I assume since my 1099 NEC shows $0 in the income summary. When I open the NEC though it shows all the information is there.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 NEC does not show up on income summary

It may be that you have business expenses equal to the income you entered from the Form 1099-NEC. Even if you didn't enter any business expenses, there could be suspended losses carried over from the previous year or depreciation deductions from assets entered in previous years.

I suggest you edit your business entries and on the screen that says Your (Name of Business) Business, look down the list of expenses and see if there is any amounts showing next to the expense categories.

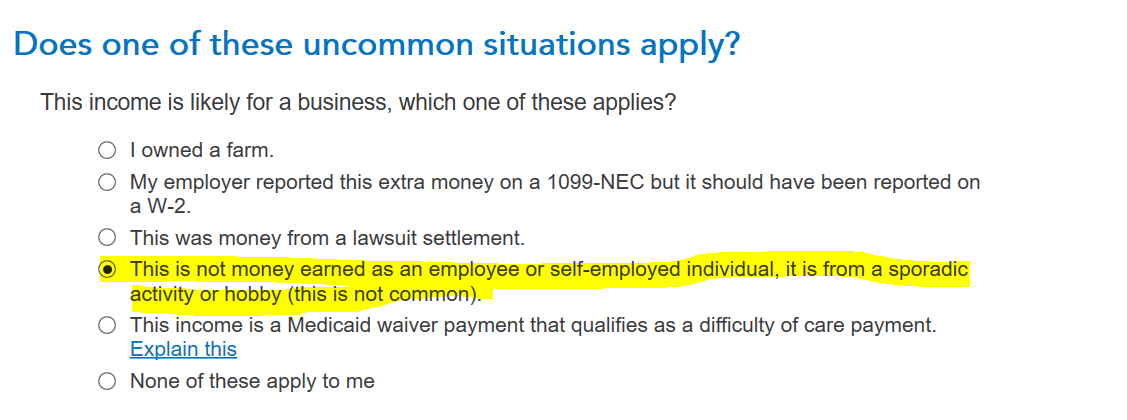

Another possibility is that you entered the form 1099-NEC income as Other Income as opposed to self-employment income. You had an option to choose that in the screens after your entered the Form 1099-NEC. You can look on your schedule 1, line 8(z) to see if that is where your income ended up. If so, it would not be considered business income for SEP IRA purposes.

You can view your form 1040 and schedules 1 to 3 while working in the online version of TurboTax by following these steps:

- Click on Tax Tools in the left menu bar

- Click on Tools

- Look under Other Helpful links….

- Choose View Tax Summary

- Look in the left menu bar and choose Preview my 1040

- Scroll down the page to see form 1040 and schedules 1 to 3

{edited 3/31/23 at 10:50 PM PST}

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pdberlage

New Member

Baadhrt2025

New Member

hgagnon73

New Member

lorraine_otero

New Member

beans44

New Member