- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- 1065 K-1 Box 20 AJ Code

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

I am in the same boat, with both issues. They’ve been working on this for a week. As much as I would like to continue giving Turbo Tax our business, this has me considering paying an accountant, or using another company to do our taxes also if this is not resolved by the end of the week. @TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

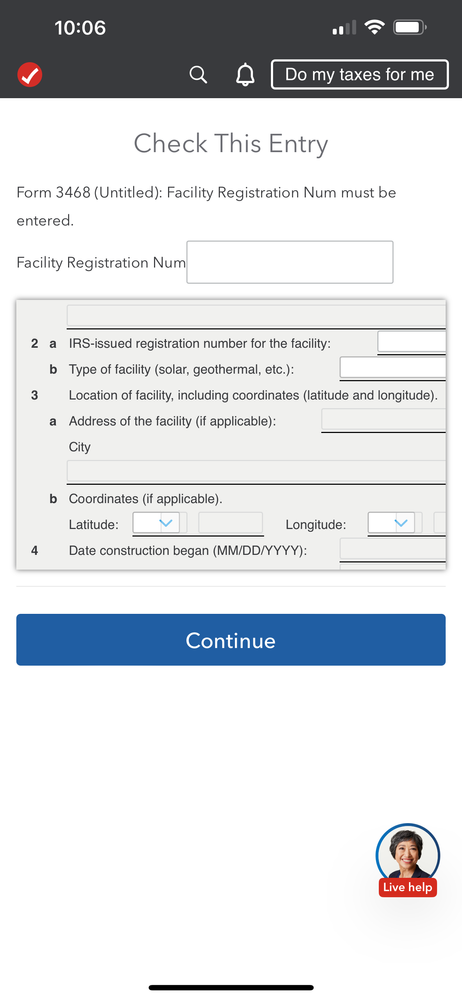

It appears as though the original problem was solved (the gasification section no longer is prompted to be completed) but now it's taking me to several sections of form 3468 which do not seem to apply either. It's getting really frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Yup, this is what shows up for me now. This is getting ridiculous @TurboTax I would really like to just be done with my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

@Lalo86 have you figured out any workaround for this? The last time the correction updated, it made a significant difference my amounts. I'm hesitant to ignore this afraid it will be wrong in the total calculations. This is so frustrating to have these issues and no support from turbo tax in acknowledging the problem or any resolutions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

I’m still waiting. It now allows you to insert your numbers in “other”, and I tried that, distinguishing each amount Income/Deductions. But doing that, as you said, made a big difference in my return which I am about 90% sure is incorrect. Not to mention that took me down a rabbit hole of new questions that also seem not to relate to my tax return. The most sensible advice I’ve received by one of the tax experts is to leave the sum of Income/Deductions in the gasification box. And push it through. I’ve had the most success doing that than anything else I’ve read in here, and my return is closer to what I was expecting as well. I’m going to continue waiting it out but, this has just been unacceptable. @kmadsen12 @Intuit @turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

The link indicates that the problem is solved. Today, 3/9/24, I updated the software, and am still getting the error message. I'm getting annoyed as I will probably miss the lower cost filing of state returns due to this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Today, 3/9/24 I'm still getting the gassification error and the description for code AJ does not match what I have on my K1 or the description on the IRS webpage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Disclaimer: I am not an accountant or a tax expert; only the poor schlump that has to figure out my wife's and my taxes. So here is how I finally resolved this (in the Desktop version).

The problem: information in your K-1 for the code AJ is reporting two figures: An aggregate for income and and aggregate for deductions. Note that these are only relevant if the K-1 is reporting an overall loss for the business, which is going to end up on your schedule E, along with other potential losses from other businesses, like on a Schedule C. If there is a loss, and it the loss is also subject to the excess business loss rules (explained by PatriciaV), you would have to figure that limitation separately on Form 461, which TurboTax does not include. However, TurboTax does not give a guide to how to enter the information you've received.

Actually, what TurboTax is giving you is a record-keeping mechanism for recording the information you received on your K-1, to be used if needed to fill out a Form 461. If you have no losses, the AJ information is not going to appear on any forms the IRS will see in your submission. However, for the sake of completeness, you still might want to get these numbers into TurboTax.

So, in order to keep TurboTax consistent with the K-1, here's what I did:

- In the Step-by-Step, enter two AJ line entries in the Box 20 info for the two figures provided in my K-1 Statement explanation for the Aggregate Income and Aggregate Deduction. If this is all you do, you will get the error about the gasification amount.

- When the Step-by-Step asks for Other Box 20, information, I put two line items, which I labeled "AJ - Aggregate Business Income" and "AJ - Aggregate Business Deductions" with the appropriate amounts from the K-1. Now, TurboTax reports no errors.

This can also be accomplished (or double-checked) in the desktop version by going into the forms and putting the information in the relevant places. This would include the K-1 Partner form Part III item 20 and/or the K-1P Addl. Info, same section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

You can clear the error by going back to the K1 entry in the interview and on the page that ask you about gasification enter 0 in all the fields in the top part. In the bottom where it says other leave the text field blank but put the numbers required in the error screen in the number field. Click continue and the check federal review to see if it cleared your error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Go to the menu on the left side of the screen, select tax tools, then tools, then delete a form, select form 3468 and confirm the delete. This will clear the error for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

I am having this same problem. For this year I have three numbers for Box 20 AJ in the supplemental information page of my K1:

AJ AGGREGATE BUSINESS ACTIVITY GAIN (LOSS) OF DISPO. OF PROPERTY. $XXXX

AJ AGGREGATE BUSINESS ACTIVITY GROSS INCOME $XXXX

AJ AGGREGATE BUSINESS ACTIVITY TOTAL DEDUCTIONS $XXXXI have three amounts listed in the description of Box 20 AJ. I am not being given the ability to parse these three numbers on the current update of TurboTax which updated today Mar 18th when I logged into my TurboTax app on my computer. I am not using the web based version.

Thanks for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

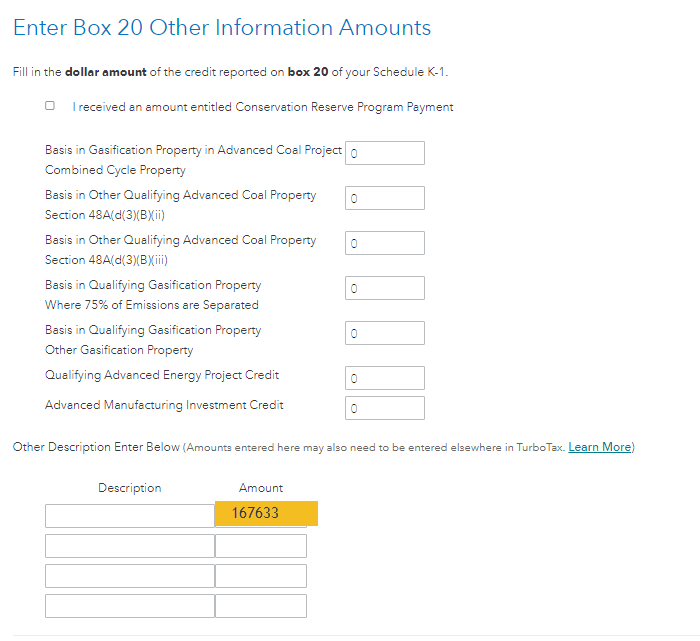

If you follow the steps below, the information from Schedule K-1 Box 20 Code AJ will appear on an Additional Information worksheet as part of your return. How you use this information is left for you to determine and enter as appropriate. Note that Code AJ is for Excess Business Losses, which would be used only if your net losses from all businesses are more than $289,000 ($578,000 if filing a joint return). If this doesn't apply to your tax situation, you may completely omit the following entries.

- Working through the Schedule K-1 entry screens, check the box for Box 20.

- Continue to the page to Enter Box 20 Info.

- Choose AJ - Excess business loss limitation from the drop down.

- Do not enter an amount here.

- The next page allows you to Enter Box 20 Other Information Amounts.

- In the section under "Other Description", enter the Supplemental Information provided with your K-1. Choose relevant descriptions then enter the amount for each line.

- Continue to back to the K-1 Summary page.

You can review the result using Forms Mode.

- Find K-1 Partner [name of K-1] in the forms list on the left.

- Click on K1P Addl Info 1 under that form to open it in the large window,

- Scroll to the bottom of the form to Code AH to ZZ: Other Information.

- Confirm that your entries for Box 20 Code AJ appear on Line 6.

- Click Step-by-Step to return to the main screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Thank you, Patricia V, for this concise answer. Much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Hi Patricia,

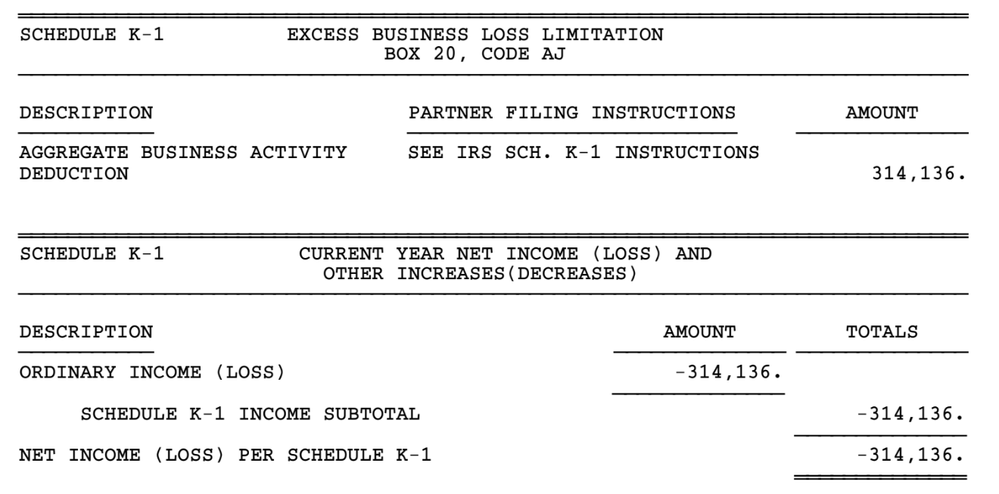

I am trying to follow what you said here. I have AJ in box 20. The supplemental page is as the screenshot below.

Question 1: Should I put in 2 entries in the Other Description step, where I enter the description manually as none of the listed ones show up in my form? One entry for "Aggregate Business Activity Deduction" with the amount of 314,136. And the other entry for "Ordinary Income (Loss)" with the amount of -314,136?

Question 2: I am filing jointly. I was expecting to see the loss from this (Box 1 shows -314,136) to offset my other income (W2, etc.). But the TurboTax doesn't seem to reflect this loss in my income. Any idea why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

1. No. From the Supplemental Information given, you have one line for Box 20 Code AJ - Aggregate Business Activity Deduction of <314,136>.

The second section of that page shows that the K-1 reported a net ordinary loss for the year. This should appear on the Schedule K-1 in Box 1.

2. The loss from the K-1 should appear on Schedule 1 Line 5. The total from Part I "additional income" is shown on Form 1040 Line 8. Your total taxable income is shown on Form 1040 Line 15. You should be able to trace the K-1 income through these forms to understand how the loss affected your total taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bocogbill

New Member

w961hmk

Level 2

drbhales

New Member

1mvirginia

Returning Member

kevin7rm

Level 1