in Investing

- Community

- Topics

- Community

- :

- Discussions

- :

- Investing

- :

- Investing

- :

- Paid by family member to manage property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid by family member to manage property

How do I handle this? I'm planning to report this on a Schedule C with the job "Assistant Property Manager" because APMs can property manage in my state without a license as long as they don't advertise their service. Is that right?

I also own and manage two Airbnbs one of which accrues a lot of miles. Can I allocate some of those miles to aforementioned Schedule C, and the remaining to that Airbnb Sch E?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid by family member to manage property

Perhaps. Given your ownership and management of two Airbnbs, it appears you are in the business of managing properties. Thus, if a family member asked you to manage a property and paid you compensation, then Schedule C is probably the correct form to complete.

Whether APMs can manage properties in your state without license under certain conditions, is something on which we cannot offer an opinion.

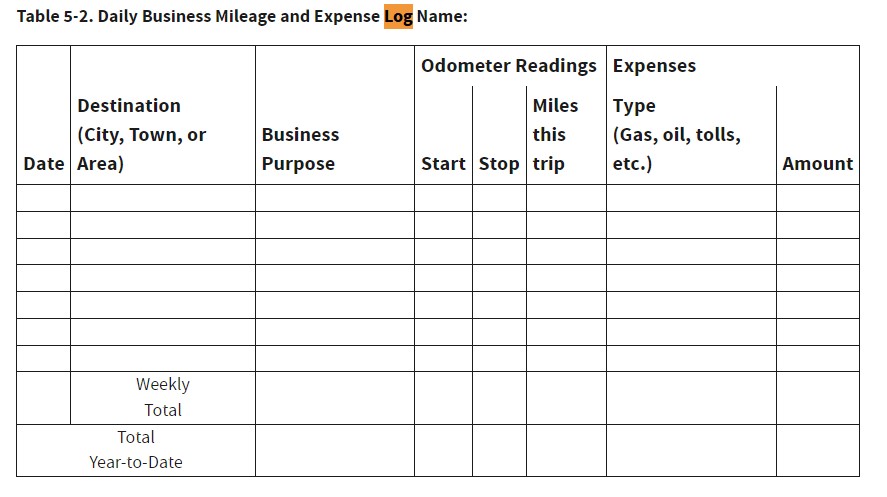

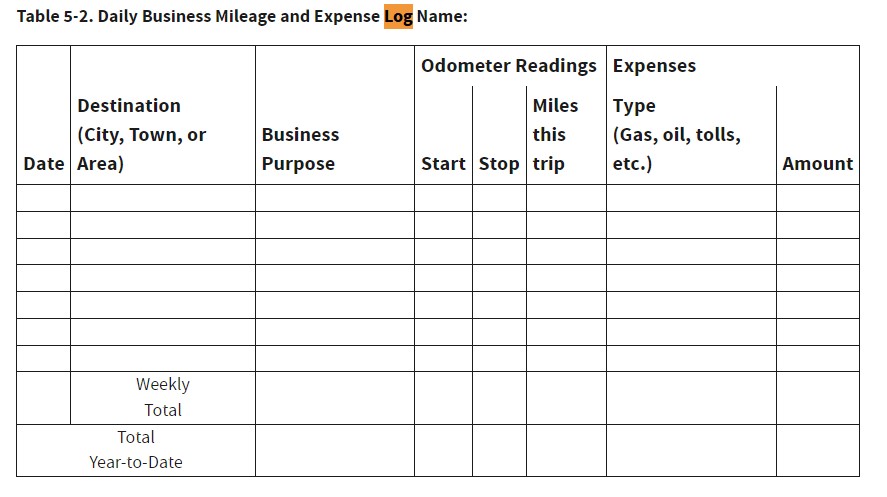

The mileage needs to be allocated to the specific business. When it comes to reporting miles, you want to have accurate and detailed records that are created contemporaneously with your business trips. Thus, you want to keep a log book, with the dates, miles driven, purpose of trip for each AirBnb and the other property. Here is an IRS mileage log obtained from IRS Publication 463.

@myraccoon

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid by family member to manage property

Perhaps. Given your ownership and management of two Airbnbs, it appears you are in the business of managing properties. Thus, if a family member asked you to manage a property and paid you compensation, then Schedule C is probably the correct form to complete.

Whether APMs can manage properties in your state without license under certain conditions, is something on which we cannot offer an opinion.

The mileage needs to be allocated to the specific business. When it comes to reporting miles, you want to have accurate and detailed records that are created contemporaneously with your business trips. Thus, you want to keep a log book, with the dates, miles driven, purpose of trip for each AirBnb and the other property. Here is an IRS mileage log obtained from IRS Publication 463.

@myraccoon

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid by family member to manage property

Thank you. That helps a lot.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JH82_WA

Level 1

avnet

Level 1

in Investing

myraccoon

Level 3

in Investing

curious4913

Level 3

in Investing

Almeida

New Member

in Investing