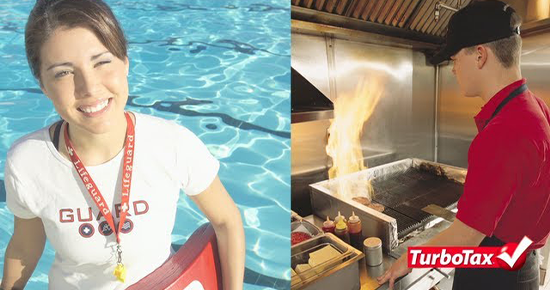

Whether you got a new job, received unemployment benefits, or started doing freelance work, having multiple sources of income during the year means you'll get multiple forms come tax time.

Depending on how much your income changed, you could be in a new tax bracket now. They can change slightly every year and depend on your filing status, but generally, the more income you have, the higher your tax rate.

If you got a new job, it's a great time to update your W-4 to make sure your withholding amounts are up to date with your current situation.

taxtime-1 in

Get your taxes done

taxtime-1 in

Get your taxes done

How can I add my employer on this one as well?

szymonwrz78 in

Retirement

szymonwrz78 in

Retirement

We pulled from 401k because I lost my job. Do we have to pay the taxes on it still?

elitresslife in

After You File

elitresslife in

After You File

I started a new job about 3 months ago and I haven't had any federal taxes taken out