Have you tried leaving this spot blank? Also you can try to clear your cache and refresh. Help with doing so has been provided by clicking here.

Try deleting the input fields or use a different browser. If that doesn't work, you will need to contact customer support for further assistance using this link so that an agent can see what is going on.

I already tried deleting the input fields.

when I follow those instructions to get support it requires that I upgrade to plus. I’m not going to pay extra just to get support with a technical issue with the app.

Assuming you are referring to the adjustment for the page titled Any Charitable Cash Contributions as shown in the following example?

If so, try to delete any input in the box again if you did not make any contributions during the year.

If you did make charitable cash contributions, you can enter it here, but you should also enter it as follows to ensure you receive the higher of the standard deduction or itemized deductions as it applies to your particular situation.

You will make this entry in the Federal interview section of the program.

- Select Deductions & Credits

- Scroll down to All Tax Breaks and select Charitable Donations

- Select Start to the right of Donations to Charity in 2020

- Proceed to enter the details of your charitable cash contribution by entity as applicable in this section.

- Once you have completed entering your details, select Done with Charitable Donations

Cash charitable donations information

Please comment if you are still having issues and include the version of the program you are using, whether is be desktop or online and we will work on rectifying the issue. Thank you!

I deleted everything from the box and it still says it’s an unacceptable value

Desktop and Online are a bit different:

TurboTax ONLINE

Click Tax Tools on the left side bar

Click Tools from the drop-down

Click the "Topic Search" box on the screen

Type or scroll down to standard deduction and exemptions

Click GO

The next screen gives you an option to change your selection from Standard to Itemized and back. You do not need to change your selection

Scroll down to the bottom of that screen and click CONTINUE

The next screen is the Charitable Cash Contributions under Cares Act screen

IF YOU ARE CLAIMING STANDARD DEDUCTION enter the amount of cash contributions you made, up to 300

IF YOU ARE ITEMIZING DEDUCTIONS enter 0

Scroll down and click Continue

Click Continue on the next screen

DESKTOP

Go to Step-By-Step input

Click Federal

Click Deductions & Credits along the top

Click “I’ll choose what I work on”

Edit or Update Donations to Charity in 2020 if needed, then click “Done with Charitable Donations”

Scroll down the “Your 2020 Deductions & Credits” screen and click “Done with Deductions”

Click Continue on the “Let’s Check Your Deductions and Credits” screen

Continue through the following interview questions until you get to the “Here Are Your 2020 Deductions & Credits” screen

Click Continue

If the next screen says “The Standard deduction is Right for You!” click Continue

ON THE NEXT SCREEN enter the cash contribution made in 2020 and click Continue

Your 1040 should update

"The new "up to $300 above the line cash charity donation" is available for tax year 2020. This allows a Taxpayer to claim up to a $300 credit which is subtracted from income on the 1040 line 10c if the Taxpayer is claiming the Standard Deduction. (If you Itemize Deductions, all your donations will be listed on Schedule A.)"

I did enter 0. That’s the problem. I entered nothing, 0, 0.0, 0.00, 0.

nothing is accepted

@Molnar1 Thank you for sharing this information. It is our desire to find a resolution for you and others that might be having a similar experience in the program.

Please note the exact message and where you are encountering that message in the program. We will work with you towards a resolution to file your return accurately.

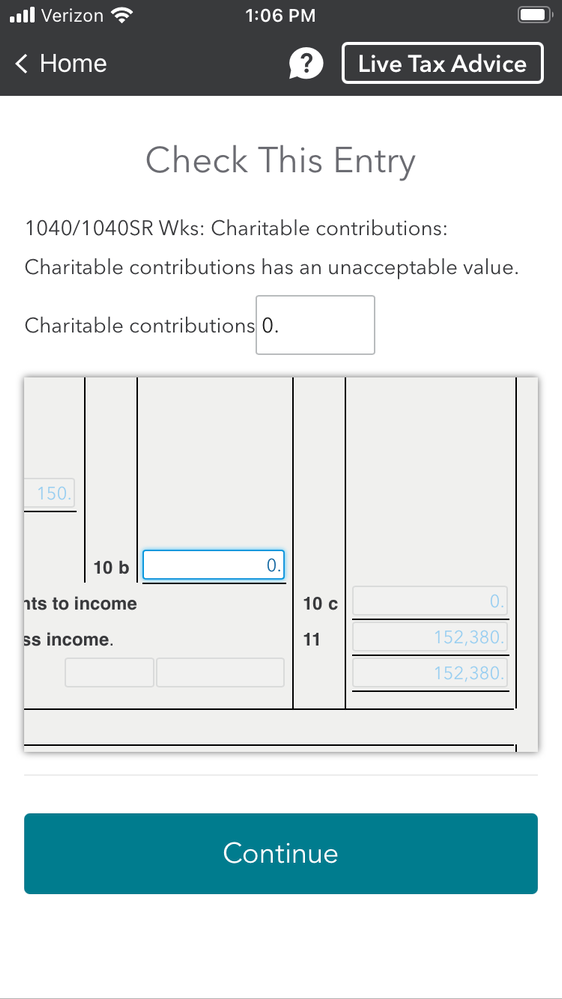

This is the message I receive when trying to sign my return. I took the standard deduction. I do not wish to claim charitable contributions. I have tried every version of 0 that I can think of.

See if you can just remove the zero and leave the box empty.

If still a problem, let me know and I will find a work around for you.

If you read the previous comments you will see that I have tried this and it was not effective

Thank you for sharing this information. It is our desire to find a resolution for you and others that might be having a similar experience in the program.

Can you provide the browser and version you are using, as well as the type of device you are using the browser on?

This is the third or fourth time that has been suggested. I’ve tried it and still get the error message

Please contact TurboTax support for assistance because what can be done over the online forum is limited.

So ultimately in order to fix this bug in the system I have to pay for “plus” benefits in order to talk to a live person? I really tried to play along here because I’ve been a TurboTax customer since I started doing my own taxes in my 20s and I don’t want to switch to a different company, but this is ridiculous. I’m going to H&R Block and giving you guys a one star review. Get it together.

@ Molnar1 wrote:So ultimately in order to fix this bug in the system I have to pay for “plus” benefits in order to talk to a live person?

No, you do not, if you are in a paid edition. PLUS is an add-on to the Free Edition, so if you are using a paid edition of Online TurboTax or the Mobile App, you are ALREADY in a higher edition than PLUS, and do not have to pay for phone support.

You mentioned using your phone. Are you using Online TurboTax in a browser, or are you using the Mobile App? If you are using the Mobile App, you can also sign in and work on your return in Online TurboTax in a browser on a computer or portable device and switch back and forth, which is sometimes helpful when something is problematic.

If you don't get any further suggestions in this user forum, here's how to reach them.

Hours are 5AM-9PM Pacific (8AM-12 Midnight Eastern) 7 days/week.

You can use this contact form to get a phone number:

https://support.turbotax.intuit.com/contact

Or you can contact a TurboTax Support agent directly for free via messaging at Twitter or Facebook.

https://twitter.com/TeamTurboTax

or

https://www.facebook.com/turbotax

I revised my comment above a bit since I see you are preparing your return on a phone, but you may have been emailed the original. If you are using the Mobile App, here's a method to reach a specialist inside the Mobile App. See the following and read the info at the link about "SmartLook" first.

The TurboTax mobile app uses SmartLookTM technology to connect you with a support specialist. You can also opt for a callback:

- Sign in to the mobile app if you're not already and select the question mark in the upper-right corner to open the TurboTax Assistant.

- If you're using the iOS app, type in Talk to a specialist and follow the prompts to be connected.

- Free Edition (without PLUS): When you select Talk to a specialist, you'll be asked to add PLUS benefits first. (Doesn't apply if using a paid edition, i.e., Deluxe or higher.)

- Select Get a phone call and follow the prompts to schedule your call or you can select Live chat to chat with a specialist directly in the app.

I have the exact same problem. Doing mine on a Mac. Can't file because there is NO solution that works. Please fix this!

FYI: Had similar issues completing my TurboTax (TT) 1040 because TT software allowed me to manually enter charitable contributions twice. One entry did not override the other. This was the "bug" for me. First, if you are manually entering itemized deductions under "Deductions and Credits", TT is building Schedule A to compare itemized deductions to the "Standard Deduction" for your filing status to determine which is best for you. Second, in a subsequent section when you are informed you can deduct up to $300.00 (depends on your filing status) without itemizing. This amount is added to Schedule 1. After I removed my first manually entered charitable tax deduction under "Deductions and Credits" the software accepted the allowed deduction that does not require Schedule A for itemizing.

This is the second year this has happened to both me and my partner.

0

0.

0.00

_blank_

NOTHING WORKS.

TurboTax, for $138.00 you can do better. Fix this. Please.