First make sure you know your control number, see this: Importing Tax Data from Computershare into TurboTax®

Then follow these steps: How do I import my 1099?

HI: Done all that and keep getting a massage to try later, this is the fifth time i try same thing each time! in two days, im try the Premium Version! last two years i use home & business and had NO problem importing my computershare! Is the problem with the Premium Version software?

To clarify, are you using TurboTax Online or TurboTax Desktop?

The 1099 might not be ready to import yet. You have to ask Computershare. Maybe their website will say. Some places are not ready until late February.

Maybe this will help. When can you import a 1099?

Hi: I was able to import but now I have another problem. I want to get the import for my wife shares, turbotax has my name on them and it wants me to review why? it doesn't let me edit!

Needs review WALMART INC C/O COMPUTERSHARE | Joe | $0.00 | $0.00 | $0.00 | Review |

Needs review WALMART INC C/O COMPUTERSHARE | Joe | $46.05 | $46.05 | $0.00 | Review |

| Total | $46.05 | $46.05 | $0.0 |

Since the import is causing a 'needs review' experience, I suggest you remove that entry, however you may want to try to remove any data your computer is remembering that you wanted it to forget. If that doesn't do the trick move to the next step below.

It may be easier to delete the information from the import, then enter this transaction (Form 1099-DIV) manually. Write down the correct amounts and boxes to fill in before you delete the imported entry.

Has anyone been able to download 1099B from Computershare into TurboTax yet?

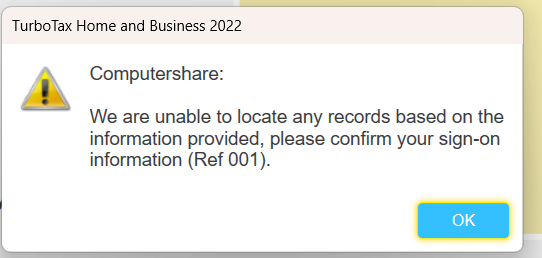

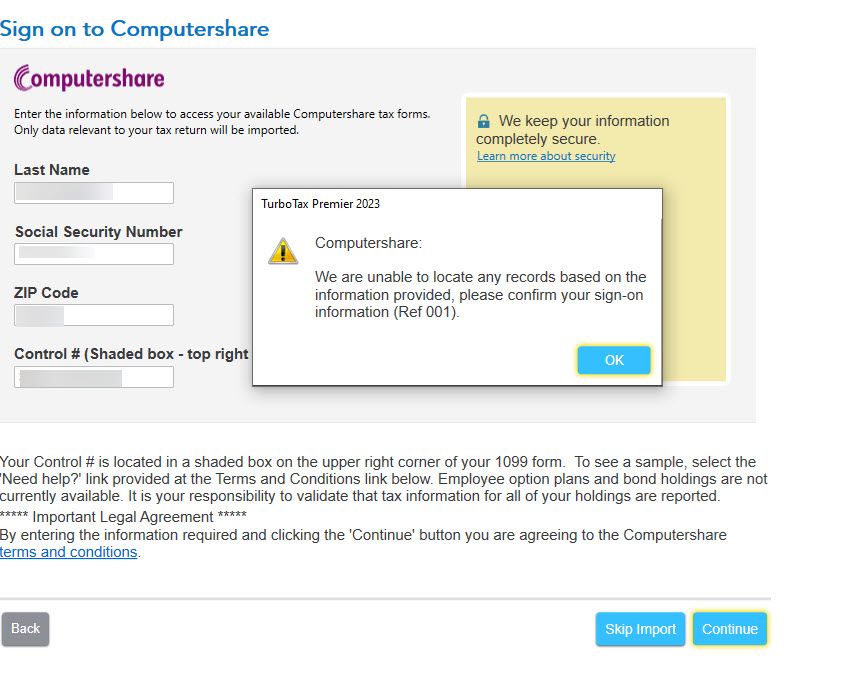

I keep receiving this message

Their website says starting February 18, or later.....

Thanks

If you are using the Download/Desktop version, you will need to make sure you have updated your software. To manually update for Windows, please see the Help Article here. For Mac, please see this Help Article.

To troubleshoot a Windows installation.

To troubleshoot a Mac installation.

Please see the Help Article here that provides troubleshooting steps for importing 1099s. The instructions mention Schwab but that is just to serve as an example.

I get the same error. I just sent an inquiry to Computershare. I'll see if they respond.

You can always use direct entry if you choose, with summary totals. The only exception if wash sales, which must be entered separately, if you have any.

TurboTax Online:

- Open or continue your return (if it's not already open) and search for stock sales

- Select the Jump to link in the search results

- Answer Yes to Did you sell any of these investments in 2023?

- If you land on Your investment sales summary, select Add more sales

- On the OK, let’s start with one investment type screen, select Stocks, Bonds, Mutual Funds, then Continue

- On the Let's import your tax info screen, select I'll type it myself

- Step through the interview and select Sales section totals when prompted to choose how to enter your sales

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue

- You can add additional sales totals by selecting the Add another sales total on the Review your sales section totals screen

TurboTax CD/Download:

- Open or continue your return (if it's not already open) and search for stock sales

- Select the Jump to link in the search results

- Answer Yes to Did you sell any investments in 2023?

- If you land on Here’s all the investment accounts we have so far, select Add more sales

- Answer Yes to Did you get a 1099-B or a brokerage statement for these sales?

- On the screen Let Us Enter Your Investment Sale Info, select I’ll type it in myself and Continue

- Enter the name of your bank or brokerage on the screen Which bank or brokerage sent you this form? and Continue

- On the screen Tell us about your 1099-B, select I’ll enter a summary for each sales category

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue

- On the screen Do you have another sale to enter from your 1099-B? select Yes to enter more sales from your 1099-B, or No to see a summary of the sales you already entered, then select Continue

- Once you’ve entered all the sales on your 1099-B, you’ll see a summary of all the sales reported. Select Done

If you are e-filing your tax return, then mail your statements (1099-Bs or other document showing detailed sales information) along with Form 8453 to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

If you need a blank Form 8453, you can download this pdf, enter your address information and check the box for Form 8949 (this form is really just a cover sheet)

You can always use direct entry if you choose, with summary totals. The only exception if wash sales, which must be entered separately, if you have any.

TurboTax Online:

- Open or continue your return (if it's not already open) and search for stock sales

- Select the Jump to link in the search results

- Answer Yes to Did you sell any of these investments in 2023?

- If you land on Your investment sales summary, select Add more sales

- On the OK, let’s start with one investment type screen, select Stocks, Bonds, Mutual Funds, then Continue

- On the Let's import your tax info screen, select I'll type it myself

- Step through the interview and select Sales section totals when prompted to choose how to enter your sales

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue

- You can add additional sales totals by selecting the Add another sales total on the Review your sales section totals screen

TurboTax CD/Download:

- Open or continue your return (if it's not already open) and search for stock sales

- Select the Jump to link in the search results

- Answer Yes to Did you sell any investments in 2023?

- If you land on Here’s all the investment accounts we have so far, select Add more sales

- Answer Yes to Did you get a 1099-B or a brokerage statement for these sales?

- On the screen Let Us Enter Your Investment Sale Info, select I’ll type it in myself and Continue

- Enter the name of your bank or brokerage on the screen Which bank or brokerage sent you this form? and Continue

- On the screen Tell us about your 1099-B, select I’ll enter a summary for each sales category

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue

- On the screen Do you have another sale to enter from your 1099-B? select Yes to enter more sales from your 1099-B, or No to see a summary of the sales you already entered, then select Continue

- Once you’ve entered all the sales on your 1099-B, you’ll see a summary of all the sales reported. Select Done

If you are e-filing your tax return, then mail your statements (1099-Bs or other document showing detailed sales information) along with Form 8453 to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

If you need a blank Form 8453, you can download this pdf, enter your address information and check the box for Form 8949 (this form is really just a cover sheet)

This company says they don't list a control number and to refer to Intuit (now called EquatePlus btw). So how do you download when a company doesn't list a control number. Thanks.

I meant on my previous post that EquatePlus is merged/renamed from Computershare for a lot of Stock plans. They specifically have a pop up on their site that says they don't provide a Control Number and to refer to Intuit. So if Intuit just sends us back to Computershare, etc. we are an a loop with no end 🙂

I see this on another string when a company like Computershare or Equateplus doesn't provide a control number. Not sure if this works tho for a 1099B:

I have no box D or Control Number on my W-2

A Control Number (box D) is used by many payroll departments to uniquely identify a W-2 in their system. If your W-2 doesn't have one, it's no big deal.

If you get errors when attempting to e-file with an empty box D, just enter any number in this format: 5 digits, space, 5 digits (for example, 12345 67890). The IRS doesn't care what's in box D.

If you get errors when attempting to import your W-2 with an empty box D, select Skip import and manually enter your W-2.

Equate Plus doesn't appear to be partnered with TurboTax yet. Since you can't import through Computershare you're sort of stuck on importing your statement. So you have a few options-

Enter it manually - if you only have a few transactions this is the best option.

Enter summary totals - here's how to do this. It does require that you mail in your broker statement if you have any uncovered stock sales.

Import a CSV of all your trades - You can create a CSV file and import that into TurboTax. It will require you to enter it through the interface for Cryptocurrency but the trades will be entered correctly. Here is how to do that.