Use the option to type it in yourself instead of importing it.

Try clearing your cache and deleting your cookies. Review the TurboTax Help article How to clear your cache and How do I delete cookies? for specific instructions for your browser. Also, reboot your computer.

If you still need assistance, reply back to us.

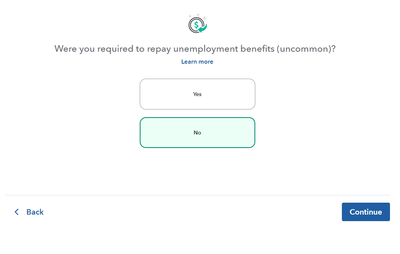

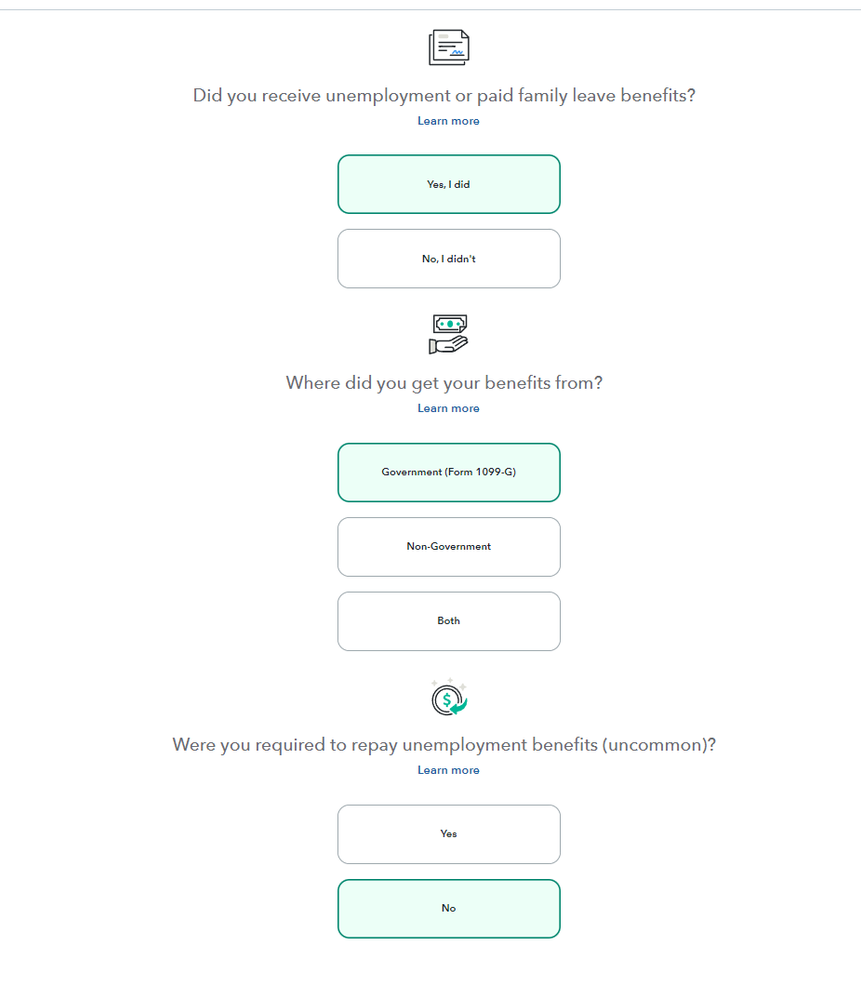

The issue is that when I select Continue I get the issue of Something went wrong. I don't get any options to put in my 1099G. I'm not uploading it or anything. I'm just trying to get past the questions.

I work in tech support so I have done the majority of things to fix it. I have restarted my computer, cleared the cache, and used a different browser (Chrome, Edge, and Firefox)

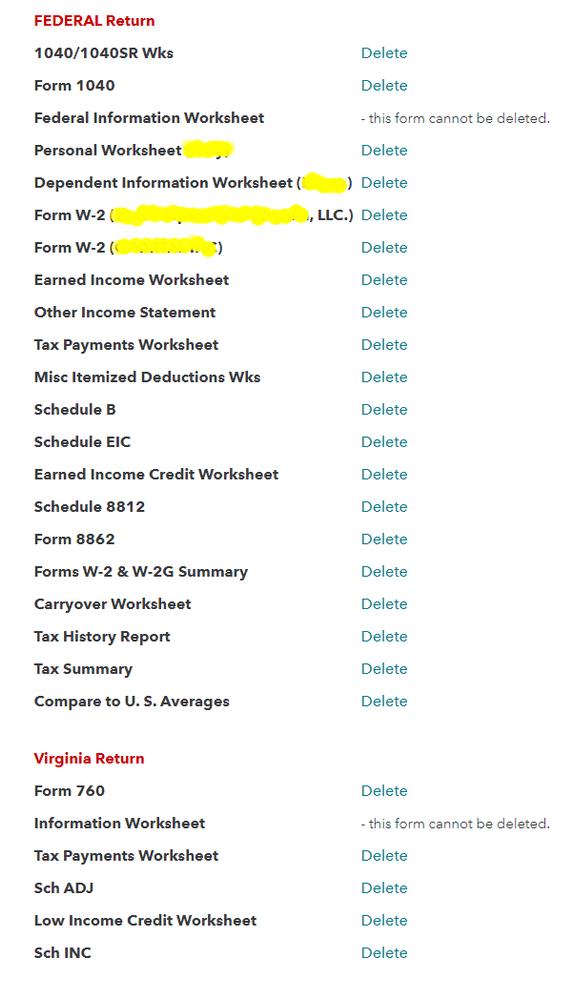

Since you’ve tried a number of things already, it can’t hurt to try this. See if (somehow ) Form 1099-G already exists in your program and, if so, delete it. Here’s the procedure for deleting forms in TurboTax Online:

- Open TurboTax Online

- Select Tax Home in the left pane

- On the Hi, let's keep working on your taxes! screen, select the dropdown on the right side of any box in the middle of the screen, then select Start or Review/Edit

- After more topics generate in the left pane, select the Tax Tools dropdown

- Select Tools

- In the pop-up window Tool Center, select Delete a form.

- Select Delete next to Form 1099-G and follow the onscreen instructions

There isn't a 1099G. I haven't been able to include anything from my 1099G at all. I'm looking to input it by hand, but I can't get past the screen I've showed you. I haven't added it. There's not one to delete.

To clarify, is Box 1 and Box 3 the same amount?

Is there anything reported in Box 2?

Hi,

I'm not sure what you need on the boxes for. I can't add the 1099G AT ALL. I have NOT entered any information from the 1099G. I cannot continue from this point and I get "Something went wrong". It's not uploaded, inputted, or anything. I can't add it even manually. It's an error on TurboTaxs side. You really need to allow me to call cause this is getting a bit silly that I'm saying and showing everything I've done.

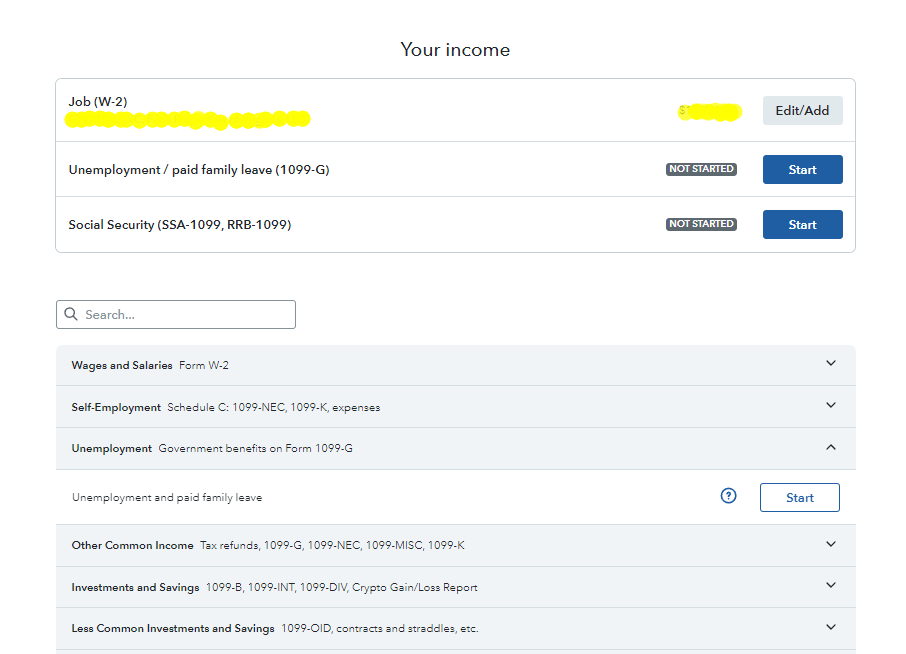

This is the steps from start to finish on what happens if I attempt to start adding it from either Start location.

Let me clarify. My two job W-2s have gone in without any issues.

Try going out of TurboTax and back in. Clear your Cache and Cookies (browser history).

Make sure you run all TurboTax updates that are available when you open your program.

If you have any 1099-G already entered, delete them and re-enter them.

If your 1099-G shows an amount in box 1, go here for alternate instructions, as the steps below won't work.

if your 1099-G has amounts in box 2, follow these instructions

For TurboTax Online:

- Open or continue your return in TurboTax.

- Go to Federal, then Wages & Income, then Other Common Income.

- Select Start or Revisit next to Refunds Received for State/Local Tax Returns.

- Answer a few more questions about your refund until you get to the Tell us about your refund screen.

- Enter your total refund received in 2023.

- Enter the amount in box 2 (state or local income tax refunds, credits, or offsets).

- If you received multiple 1099-Gs for the same state or locality, both with the same tax year in box 3, enter the box 2 sum.

- For example, you received two 1099-Gs from Colorado. They both have 2023 in box 3, and their box 2 amounts are $1,000 and $800 respectively. You'd enter $1,800 in Total refund received in 2023.

- Enter your total of all your payments and withholding.

- Enter the total taxes you paid to the state or locality for the same tax year as the refund (this includes withholdings as well as estimated tax and other payments).

- You can get this amount from your state or local tax return for the tax year of the refund. Look for a line near the bottom, often bolded, that includes the phrase total payments.

- Enter tax year of refund, which is box 3 of your 1099-G.

For TurboTax DeskTop:

- Select Federal Taxes (in Home & Business, select Personal).

- Select Wages & Income (in Home & Business, select Personal Income).

- Select I'll choose what I work on.

- Scroll down to 1099-MISC and Other Common Income.

- Select Start or Update for State and Local Tax Refunds on Form 1099-G.

Click here for information about entering Form 1099-G.

Please feel free to come back to TurboTax Community with additional questions or information or click here for information on Turbo Tax Support. You can connect with a Live TurboTax Agent and share your screen.

I'm having this exact same issue but with just adding self-employment income. I select to add it and I get this error message as well. I've cleared caches and cookies and tried another browser. There is an error on turbotax online when it gets to this page.

I spend days trying to fix mine and multiple calls. I was about to give up and we ended up deleting the whole thing and starting over. That was the only way I was able to fix it

I am still having the issue. I even tried via my Iphone app....same issue. Seems like a Turbotax issue. Any other thoughts?

Please call TurboTax Customer service. Here is a link: Turbo Tax Customer Service

Just to note, I called them 4 times. I was on the Live Chat 3 times and on the phone once. I deleted my forms and completely started over. That was the only fix for it for 2023. I was able to file and complete it. None of the agents were able to resolve the issue.

Yeah, I also tried restarting from scratch before leaving this post and that didn't work for me. I also tried chat, couldn't find a phone number to call either. So I gave up and went over to H&R Block. They lost my business this year!

Having the same problem with TT 2024. "Hmm, something went wrong. On line with Customer Service twice for over and hour each. No resolution except to enter the data manually in the 1040 Schedule A and then the Tax and Interest worksheet and open the form for multiple entries, which interesting enough had my two entry names. I filled in the data and it appears on my Easy Step now. If I click on Update, it just tells me I qualify for the standard deduction and no option to enter the data. What a piece of crap. The CSR was worthless and told me that sometimes this is what one has to do and they is why they are there. Wow! I thought Easy Step was to make my data entry easy - silly me. Next time H&R Block.

I am not sure if I am late answering your question but I had the same issue, the only resolution was to clear and start over my tax return. Once I did that, I was able to enter my 1099-G unemployment tax details. Hope this works for you too!

I am not sure if I am late answering your question but I had the same issue, the only resolution was to clear and start over my tax return. Once I did that, I was able to enter my 1099-G unemployment tax details. Hope this works for you too!

**Added comment: once you start over fresh/new you will be able to upload the form or enter it manually.

I am not sure if I am late answering your question but I had the same issue, the only resolution was to clear and start over my tax return. Once I did that, I was able to enter my 1099-G unemployment tax details. Hope this works for you too!

Once you start over fresh/new you will be able to upload the form or enter it manually.

I am not sure if I am late answering your question but I had the same issue, the only resolution was to clear and start over my tax return. Once I did that, I was able to enter my 1099-G unemployment tax details. Hope this works for you too!

Once you start over fresh/new you will be able to upload the form or enter it manually.

** I wouldn't use the "Other 1099-G" Income Type. Once you clear and start over you should be able to enter your unemployment details under the "Unemployment Benefits" section.

I have cleaned my cashe and deleted my cookies. I have rebooted my computer. Every time I go on Turbotax I get a message that says oops something went wrong.

You should call Customer Support for your issue: Turbo Tax Customer Service. You can call them at 1-800-446-8848.