| airdrop | Free distribution of a nominal number of coins or tokens to multiple users to foster adoption of a new virtual currency |

| altcoin | Any cryptocurrency that is not bitcoin hence an “alternative coin” |

API

| Application Programming Interface: software enabling computers to work together. A language translator of sorts, for computers |

| bitcoin (cryptocurrency) | The first cryptocurrency, which at time of writing, was still dominant in the broader crypto ecosystem |

| Bitcoin (network) | The first blockchain |

| block | A data file containing of all transactions made and validated during a specific time frame. Each new validated block is placed first among all blocks on that network, and is linked to its predecessor, forming a blockchain |

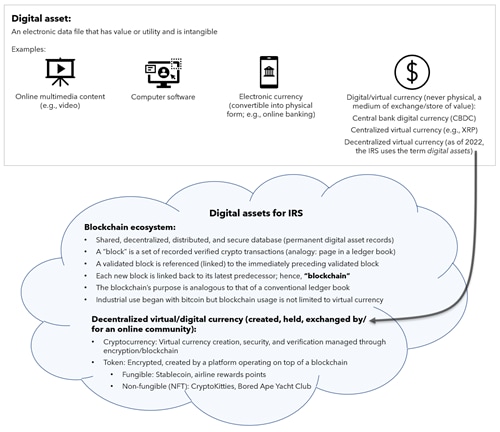

| blockchain | See the preceding definition of block, and see the preceding Section: Cryptocurrency and digital assets |

| CBDC | Central bank digital currency is: regulated solely by a country’s central bank/treasury (not decentralized). It’s intended as a digital replica of the country’s traditional fiat currency, and isn't restricted in supply like most cryptocurrencies |

| cold wallet | An offline cryptocurrency wallet or storage device for private keys. More secure but less convenient than an online hot wallet |

| consensus mechanism | A progam used in blockchain systems to ensure data safety and integrity, and keep those with nefarious intentions locked out of distributed ledgers |

| cost basis | A tax term for the dollar value of a property at time of possession. Transaction costs of obtaining e the property are included |

| cryptocurrency | See the preceding Section: Cryptocurrency and digital assets |

| cryptocurrency exchange | A platform where digital properties are bought, sold, and traded for fiat currency or other digital properties, somewhat like a conventional Dow Jones. Currently, Binance is the largest cryptocurrency exchange |

| decentralized | A decision-making and control model where a blockchain community's decisions are made by majority consensus among the blockchain's users. Unlike centralization, where a single entity has decision-making power and control |

| DAO | Decentralized Autonomous Organization: a “trustless” blockchain business model, governed by smart contracts, to avoid conventional “top down” organization structure and control |

| DeFi | Decentralized Finance: uses smart contracts on peer-to-peer blockchain networks to enable a variety of tokenized lending, trading or borrowing services without a central financier (bank) |

| delegation | Users in the community who can’t meet minimum proof of stake mining requirements can stake a lesser amount of cryptocurrency, to earn some staking rewards (similar to earning interest) while the community delegates the validation work to a proof of stake miner |

| deposit | Cryptocurrency sent to an account from an exchange, wallet, or custodian, often with a transaction (gas) fee charged by the blockchain network |

| digital assets | See the preceding Section: Cryptocurrency and digital assets |

| digital currency | See the preceding Section: Cryptocurrency and digital assets |

| distributed ledgers | Shared databases that record information that is networked for many users in different locations to access |

| ether | Ether (ETH) is the native cryptocurrency of the Ethereum blockchain, currently ranked second after bitcoin in price and market value |

| fiat currency | A medium of exchange, store of value, and unit of account issued and backed by a national government’s finances, rather than by a physical commodity (such as gold) |

| fork | After an update to a blockchain’s protocol, if some users don't agree to adopt the update, the blockchain is divided in two. See also hard fork and soft fork. |

| fungible | All units are identical, as with a commodity or a currency. A cryptocurrency (such as bitcoin) is fungible |

| gas fee | Strictly speaking, a fee for transactional use of the Ethereum blockchain network. Other blockchains may use terms such as transaction or miner fees. In practice, the term gas fees sometimes gets used to generically refer to any such fees |

| hard fork | A fork in which the old and new protocols are incompatible and users not adopting the update can’t interact with adopters. For example, bitcoin cash emerged from a Bitcoin hard fork |

| hot wallet | An online wallet |

| key | A long string of alphanumeric characters used for security in the blockchain ecosystem. See also public key and private key |

| mining | A process for validating and securing pending cryptocurrency transactions (by paid third party virtual community users- miners) before being recorded on the blockchain. See also proof of stake and proof of work |

| minting | Non-fungible tokens are minted onto the blockchain by a creator who'll connect to an NFT marketplace, upload the token to their blockchain of choice using a creation widget, specify any royalties via smart contract, pay applicable fees, then hold the NFT, or list it for sale |

| mobile wallet | A wallet app installed on a smartphone. Mobile wallets are typically hot wallets |

| node | A computer connected to a distributed blockchain network to serve various purposes such as validation of transactions, or observing activity on the blockchain |

| non-fungible token (NFT) | A unique (thus non-fungible) token, for proving ownership of a digital asset like an artwork, recording, virtual real estate or pet image. The use of NFTs is broadening to include real world assets like event tickets and limited-edition wines. Buy and sell transactions occur on NFT marketplaces such as OpenSea |

| peer to peer (P2P) | A decentralized network structure intended to work in the best interest of all parties involved, with no intermediary (bank or other institution) involvement |

| private key | Enables secure account access, and digital user ID for anonymous sign-in before performing any transaction, including “unlocking” of any cryptocurrency received |

| public address | Shortened version of a user’s public key that can receive transactions, similar in purpose to a bank account number |

| public key | A key enabling sending of cryptocurrency to a recipient user when paired to the recipient’s private key |

| proof of stake mining | A selected user will stake (ante up) a (usually) large amount of cryptocurrency for the right to validate and record a new block, and then receive a cryptocurrency staking reward, plus the return of their stake |

| proof of work mining | Miners use massive computing and electricity resources, competing to be the first to solve an epically detailed arithmetic puzzle. The winner then validates and records the pending block, and is paid in cryptocurrency |

| smart contract | An agreement that is coded, stored, secured and executed on the blockchain, visibly and irreversibly. It basically replaces conventional paper-based documents and legal intermediaries (lawyers, courts)

|

| soft fork | A backwardly compatible blockchain software update. The new protocol can still “talk to” the old one. So, upgraded network nodes can still communicate with non-upgraded nodes |

| software wallet | Holds a user's keys (public or private) and secures their cryptocurrency. Typically an app on the user's desktop or mobile device, connected online |

| stablecoin | A type of fungible token, combining the benefits of cryptocurrency with the stability of cash, efficiently and economically. Often pegged to a stable fiat currency, or, may be stabilized by other DeFi means. Tether is currently the dominant stablecoin |

| staking- delegation | See delegation |

| staking- validation | See proof of stake mining |

| store of value | An asset that will likely keep its value over time, and can be reliably retrieved and exchanged in future, such as fiat currency, real estate, and rare metals such as gold and silver |

| token | A digital asset governed by a smart contract, enabling the transfer and storing of value on a blockchain network. Can be either fungible or non-fungible |

| validation | Verification and approval of a pending transaction by a user selected by the community, under the blockchain’s verification protocol |

| wallet | A device or service providing: storage for a user’s public and private keys, and an interface for crypto asset access |