- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I put in when asked for bank name for bluebird direct deposit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

You should have received a direct deposit form that would have the bank name, account and routing numbers when you initially signed up. If you did not, then you can go to www.bluebird.com and log into your account and pull one up. However, when looking at their FAQs on how to deposit from tax refund, it shows American Express Centurion Bank as the bank name.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I have my owe account number I did after I filed my taxes how can I use my account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Once your return has been accepted (or mailed), it's too late to change direct deposit bank account information or how you will receive your refund. If the info you provided is for a closed or invalid account, the government will just mail you a refund check. The IRS will begin accepting tax returns on February 12, 2021.

- If your return is rejected, open your return in TurboTax and go through the File section again to update your bank account before re-submitting your return with any applicable corrected information.

- If accepted, you'll get your refund check in the mail or will be direct deposited if you listed a valid bank account or selected the Turbo Visa Debit card when you filed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

What do I put in when asked for Swift code for bluebird direct deposit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@nisbd24 Not sure what you mean by a "swift" code. When you are in the FILE section of the TurboTax software you can enter your bank account number and routing number in order to get your refund by direct deposit. If you enter incorrect banking information the refund will be sent back to the IRS and then the IRS will issue a check to the address on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

I want to receive money from a foreign country so I need – SWIFT code or IBAN for wires transfer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

The IRS will not DD or wire refunds to foreign accounts ... your ONLY option is a check in the mail if you do not have a US bank account or debit card which allows IRS deposits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@nisbd24 READ the instructions from Bluebird on DD from IRS : https://www.bluebird.com/faqs/money-in/direct-deposit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Are you getting a deposit FROM a foreign country? Ask your bank for the wire transfer number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Good catch ... not an IRS refund but money from a foreign source ... again ask your bank for the info needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

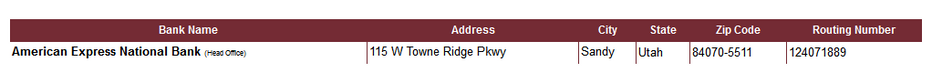

UPDATED ANSWER 2022-09-06:

The name of the bank American Express uses for BlueBird accounts is no longer "American Express Centurion Bank". It is now "American Express National Bank." Please see screenshot below from the routing number lookup tool on the ABA website (https://routingnumber.aba.com/).