You can enter the 1099-MISC in TurboTax as "Other Common Income," which is reported on line 8 of 1040 Schedule 1 and will not generate Schedule C or SE tax. Please use the following steps:

- Click on Federal > Wages & Income.

- Scroll down to the Other Common Income section.

- Click on the Start/Revisit box next Form 1099-MISC.

- On the screen Did you get a 1099-MISC? click on the Yes button.

- On the next screen, Let's get the info from your 1099-MISC, enter the information from the 1099-MISC.

- On the following screens, answer the following questions:

- Did it involve work that's like your main job? No.

- You got it in 2019

- No, it didn't involve an intent to earn money

7. Continue through the rest of the interview screens. The income will appear as Other Income.

There is no box which asks if I intended to earn income so I can't say NO. Also it keeps asking me about Lines that aren't listed on the 1099MISC form I received.

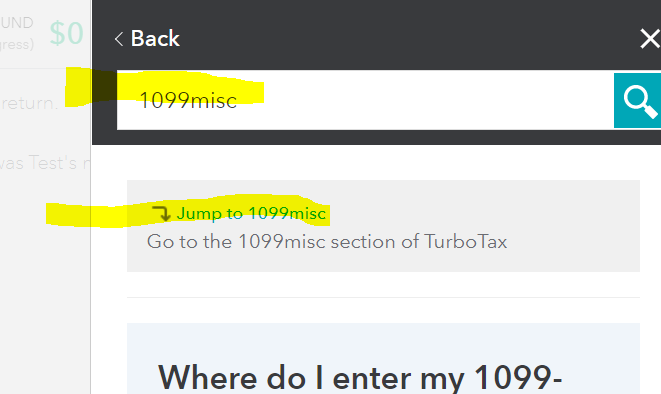

Here are screenshots to see where you can change your answers for your 1099-Misc:

- While in your Tax Home,

- Select Search in the top right side of your screen,

- Enter 1099-Misc,

- Select Jump to 1099-Misc,

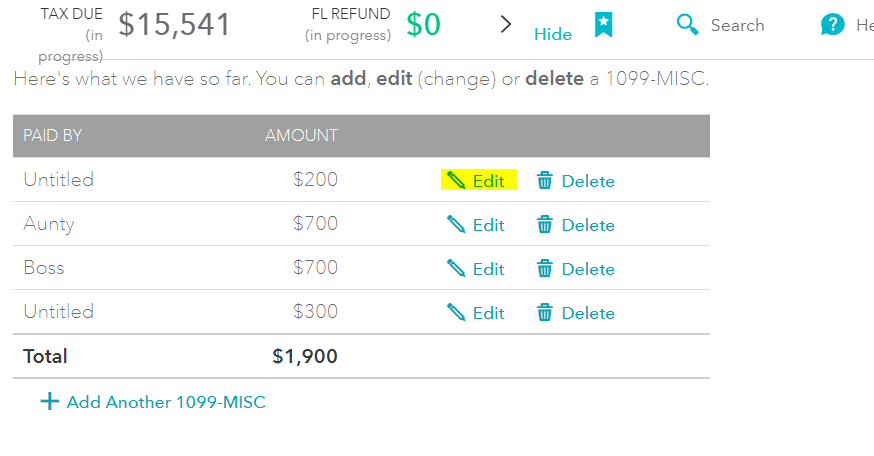

- Select Edit next to the 1099-Misc that you need to change:

- Select Continue,

- Select No, it didn't involve work like ... main job.

8. Follow the on-screen prompts to correct your 1099-Misc.

I have the same 1099-Misc issue. Followed the instructions, clicking the "Select No, it didn't involve work like ... main job" and TurboTax still creates schedule C and wants me to fill it out as if I own the business. Any other suggestions?

You also have to answer questions regarding earning similar income in the past or in future years. You need to answer no to those questions.

Good, this worked. I had also received this 1099-Misc in 2018 so I had checked 2018 and 2019. Unchecking 2018 did the trick.

Thanks.

I am using turbo tax premier and cannot get to the screen per your instructions. I am still have the problem of entering 1099 misc for imputed income of $25 from the UAW and the software still wants me to fill out a schedule C as If I am a business. The $25 is not cash and not for a business

Let's go through the steps for entering the 1099-MISC for your situation:

- Income and Expenses

- Other Common Income

- Form 1099-MISC, start

- screen Who paid you

- enter the 1099-MISC information

- Describe the reason

- UAW Health

- continue

- Screen Does one of these uncommon situations apply?

- Select None of these apply

- continue

- Screen Did the 1099 involve work that's like the main job?

- Select No

- continue

- screen How often did he get income?

- Select got it in 2019

- continue

- screen Did it involve an intent to earn money?

- Select No

- continue

@taxme1919

Amy C, I do all that and it still gives me a screen which says congrats you may qualify for additional deductions and be sure to visit business income and expense. When I go to Federal Review it says I still have six errors to correct on Schedule C which I don't want.

@taxme1919 Please contact a specialist that can work through that section of the return with you. They can see your screen and figure out how to correct things. Private information will be masked.