@Denise77 If you are trying to get the 1095-A entered, let me see if I can help. I am posting instructions and a screenshot below.

If you purchased health insurance through Healthcare.gov or your state's health insurance marketplace, you should receive your 1095-A by mid-February.

Your 1095-A should include info for everybody on your return who was enrolled in a Marketplace plan, and is required to calculate the Premium Tax Credit.

Here's how to enter your 1095-A in TurboTax:

- Open (continue) your return if you don't already have it open.

- Search for 1095-A and select the Jump to link at the top of the search results.

- Answer Yes on the Did you receive Form 1095-A for your health insurance plan? screen and Continue.

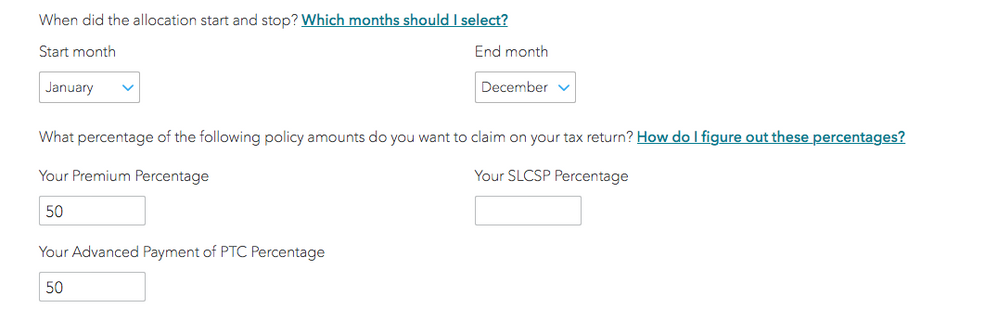

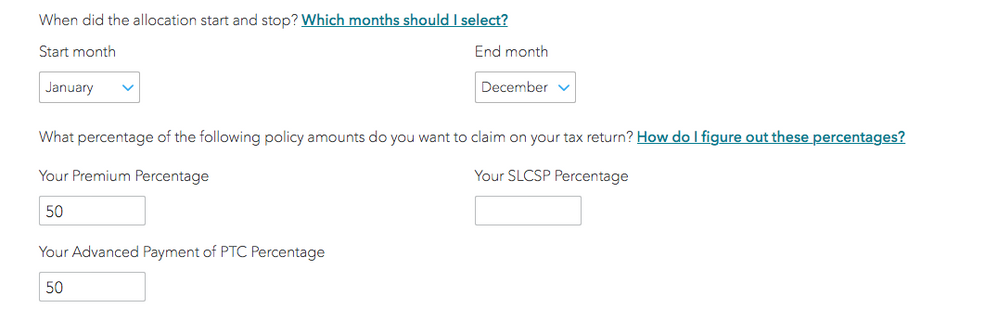

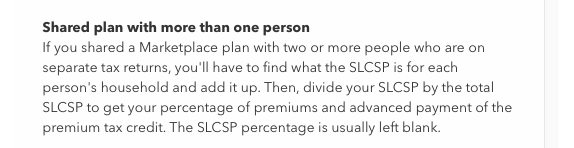

- Enter your 1095-A info on the next screen and select Continue. We don't need all the info from your 1095-A, so we'll only ask about the info that affects your return.

If you have Form 8962 and a 1095-A, and aren't sure what to do with them, go here for info on how to file them with your return.