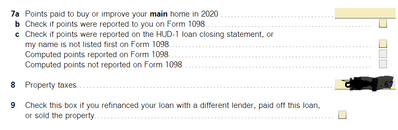

The specific problem is that on the "Deductible Home Mortgage Interest Worksheet", a loan that was paid off in February still shows as "12" in "Months loan oustanding". This is even though on the "Home Mortgage Interest Worksheet" I have checked box 9 ("paid off this loan") and included the payoff date in the Home Mortgage Interest Limitation Smart Worksheet.

Looks like a similar issue was reported last year:

just enter one 1098 with the amount of total interest that you paid

Won't that confuse the IRS? There would be a disparity with the information furnished to the IRS vs the information in the Deductible Home Mortgage Interest Worksheet, right?

Best I can come up with is to override line 7 of the Qualified Loan Limit with the correct value. Sigh.

I have a similar issue where I purchased a new home in December 2019 and borrowed $800k but did not sell my prior home until January 2020. TT is adding the full payoff amount of the second home to determine the denominator of the deductible ratio even though I only had that loan for one month in 2020. I haven't determined the best way to "trick" the software into doing it correctly, but this bug almost cost me $2,500. I feel bad for anyone who trusts TT without reviewing the calculations. Seems like I should get a refund of the money I spent for this under their Maximum Refund Guarantee.

I am on a similar boat. I refied on 2019 and my loan was sold to another bank in 2020. I ended up with 2 1098s for 2020. I am in the process of doing my taxes now and using the ONLINE turbo tax. I believe its thinking I am over the $750k. I think its combining the two amounts and automatically clicking "yes" for Does your mortgage interest need to be limited? I do not have the option to click "no". Its not allowing to continue without entering the "Limited amount to report on SchA, line 8a". I have no idea what to put there. I have an amount automatically entered on the line above, "Sum of lines 5a through 5d below". I am considering entering the same amount. Anyone know?

My "workaround" for now is to create a synthetic 1098 that combines the values. So it has the sum of the interest that I paid on both loans, but a principal amount that's equal to the weighted average principal that I held throughout the year.

I included a note to the IRS explaining the situation.

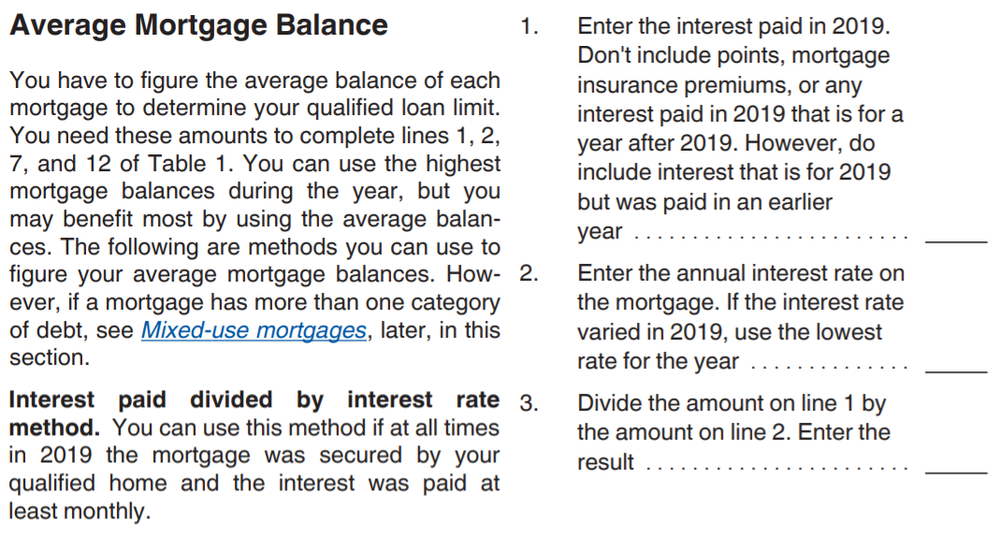

At the end of the day, the correct amount of the deduction is a function only of 1) total interest paid, and 2) average amount of origination principal. So using this workaround produces the correct amount of tax. I wish that TurboTax could do this correctly on its own though. I feel like if I had access to the source code I could fix it quickly.

This is definitely still a problem this year which is even more absurd given how many people reported it as a problem last year. I entered my original mortgage first, selected that it is the original mortgage for my house and it has no points to amortize. Then I enter the refi information, no points, then select that this is a refinanced loan and no cash was taken out. Then when I hit Done after both forms are in the software knows to ask me what date I paid off one of the loans and it asks for the final payoff value as well as the year end value for the refi. When I go into the Forms view it shows that the refi had no beginning balance and the loan was taken out in 2020. When I got to the original mortgage the box in Line 9 is not checked saying that I paid off this loan but even when I manually check that box it still doesn't work.

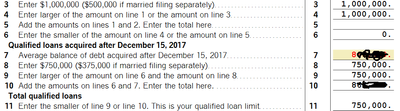

The problem is clearly on the next form the Deductible Interest Worksheet. The months of loan outstanding is listed as 12 for the loan that was paid off, obviously wrong, but overriding that to 3 does nothing. The real problem is Line 7 where it calculates the average balance. It is just adding the 2 loan balances from Part 1 of the worksheet and giving me a number over $1.6M. If I override that number with the real average balance it calculates the deductibility limit correctly on Line 12.

This is the closest I get to a workaround that I'm comfortable with so far. The IRS will receive 2 1098's from 2 different lenders so I don't like the idea of putting values from a fake 1098 that combines the information. According to the IRS website you can calculate the average balance for your loans by dividing the interest paid by your loan interest rate if it's a fixed rate mortgage. If I do that for each loan and then add the two together the math works out so that's what I'm going with. I'm just not sure if I should change the Average Balance line from the top of the worksheet as well where is shows Loan 1 & Loan 2 information.

Edit to add: I'm using TurboTax Premier downloaded on a Windows PC.

If you would be willing to share a diagnostic copy of your tax file, it could be helpful to examine the situation in more detail.

To do so, follow the instructions below and post the token number along with which version of TurboTax you are using in a follow-up thread.

Use these steps if you are using TurboTax Online:

- Sign in to your account and be sure you are in your tax return.

- Select Tax Tools in the menu to the left.

- Select Tools.

- Select Share my file with agent.

- A pop-up message will appear, select OK to send the sanitized diagnostic copy to us.

- Post the token number here.

If you are using a CD/downloaded version of TurboTax, use these steps:

- Select Online at the top of the screen

- Select Send Tax File to Agent.

- Click OK.

- Post the token number here.

@AnnetteB6 should I undo the manual Override in the forms view first?

I had this same issue with mine, says that I need to enter a limited mortgage interest amount on the review screen. When I spoke with an agent, they told me to put the total amount of interest paid over the year but that doesn't seem right. Is there a fix?

Token Number: 714711

Turbotax 2020 for Mac (CD/Download)

Application: 2020.r14.034

Build Date: Jan 23, 2021 at 10:12:48 AM

Note the error on the "Deductible Home Mortgage Interest Worksheet" where a mortgage held from January through mid-February is listed as having "12" Months loan oustanding.

Even if I override this "12" into a "1" or "2" the "average balance of debt acquired after December 15, 2017" is computed as a simple sum of the "average balance" of each of the two mortgages.

In reality, I only held both mortgages simultaneously for 7 days, so the "average balance of debt acquired after December 15, 2017" should be only slightly more than the sum of the "average balance" divided by 2.

Please also note that there is an analogous problem with the California 540/540NR Deductible Home Mortgage Interest Worksheet, where Average balance of all home acquisition debt is calculated incorrectly.

It looks like a duplicate bug has been filed here: https://ttlc.intuit.com/community/tax-credits-deductions/discussion/mortgage-interest-deductible-limit/01/1827488/highlight/true#M171042

You may wish to choose one of these to be the canonical bug report to make things easier on your engineering team when they go to address the issue.

I had this problem this year since I did refinance.

To handle multiple issues on the forms, I handled it as below:

Use case:

Loan 1 - Opening balance 900,000 (Closed during the year)

Loan 2 - Opening balance 100,000 (Closed during the year)

Loan 3 - NEW 900,000 - Closing balance by end of the year 890,000

Interest on Loan 1 - 20000

Interest on Loan 2 - 3000

Interest on Loan 3 - 7000

I did fill the turbo tax data as below, since I have 3 Form 1098.

Box 1 - Mortgage Interest - 30,000

Box 2 - Outstanding Mortgage Principal - 1,000,000 (sum up box 2 values of Form 1098 of loan 1 and loan 2)

Box 3 - Mortgage origination date - 1/1/2018 (from box 3 of Form 1098 of old Loans)

In the subsequent box - for outstanding loan balance on Jan-1st-2021, I keyed in 890,000.

This ensures that the

- no. of months of the loan to be 12 (in the worksheets)

- average balance to be 945,000

- Interest of 30000 distributed as 750K / 945k - calculated as 23809 for claiming as interest deduction.

I understand this doesn't represent true values in the worksheets. But with Turbo tax constraints, this workaround seem to be addressing the issue.

Pl. share your thoughts.

@Ashramx4 this is the workaround others have suggested but I personally don't like it. The IRS is going to receive 3 1098s for your various loans but your tax return will only show 1 1098. Even though the numbers are the sum of all 3 that seems like it would be an easy red flag for the IRS. That's why I was entering all of my 1098's and then just edit the average balance to the correct number in the worksheet. I don't know that there is a "right" answer yet.

Working on year 2 of this bug for me. This year is even more fun since I have 4 1098s (4 sperate companies handled the mortgage on the same property (with a refinance thrown in)). TT wants to total all 4 mortgages together which isn't even close to correct. I'm willing to submit a diagnostic again this year, since I'm sure I am a bit out of the norm.

I agree that it's a ridiculous "fix" but the IRS only see the final calculated deduction, not how you arrived at it.

It'd be no different if you worked it out manually and filed on paper.

@jlbrick I wasn't aware of that. I still have lots of forms I'm missing so I hadn't gotten that far in the process. That is disappointing if that is true.

Inability to e-file with overrides is why I'll probably use the synthetic single 1098 strategy rather than form overrides.

Ideally, of course, Intuit would fix the software bug. Isn't this software supposed to save us time compared to doing everything by hand? 🙂