No. Deferred income is not earned income in the year it is deferred.

It will be earned income in the year it is received.

Why is income from a nonqualified pension on a W-2 not considered "earned income" in the year you receive the non-qualified income on a W-2? For 2021 taxes turbotax told me it was earned income and as a result advised I should open a Roth for 2021. This year for 2022 Turbotax it is saying it is not "earned income" and I need to cancel the Roth I opened, because I have no earned income. That is a nightmare. What changed from 2021 turbo tax to 2022 turbo tax? In 2021 taxes it said it was earned income, now it is saying the same nonqualified pension distributions are not earned income, one year later for 2022. Help.

It's not a change in the TurboTax programming; rather, it's a situation in which amounts reflected in Box 11 of your Form W-2 can have a different characterization from one year to the next.

According to Box 11 in the Instructions for Employee on the back of Form W-2:

This amount is (a) reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or nongovernmental section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior year deferral under a nonqualified or section 457(b) plan that became taxable for social security and Medicare taxes this year because there is no longer a substantial risk of forfeiture of your right to the deferred amount.

So, if a Box 11 amount was reported in Box 1 of Form W-2 one year, an amount can be included in Box 3 and/or 5 the next, characterized differently because "there is no longer a substantial risk of forfeiture of your right to the deferred amount."

Please see Box 11 -- Nonqualified plans in the General Instructions for Forms W-2 and W-3 for more information.

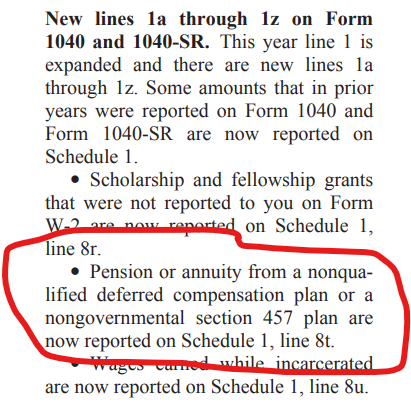

What changed is the way the IRS handles box 11 amounts. The instructions for form 1040 for 2022 page 6 (here) include a "What's new?" section. The deferred compensation for a pension/annuity (box 11 amount) now goes to a new line 8t on schedule 1 (see screenshot below).

That removes the amount from form 1040 line 1a which is part of earned income. According to Publication 596 (here) income that is not "Earned Income" includes "pension and annuity payments."