Form 8606 Calculation Error - Turbotax 2020

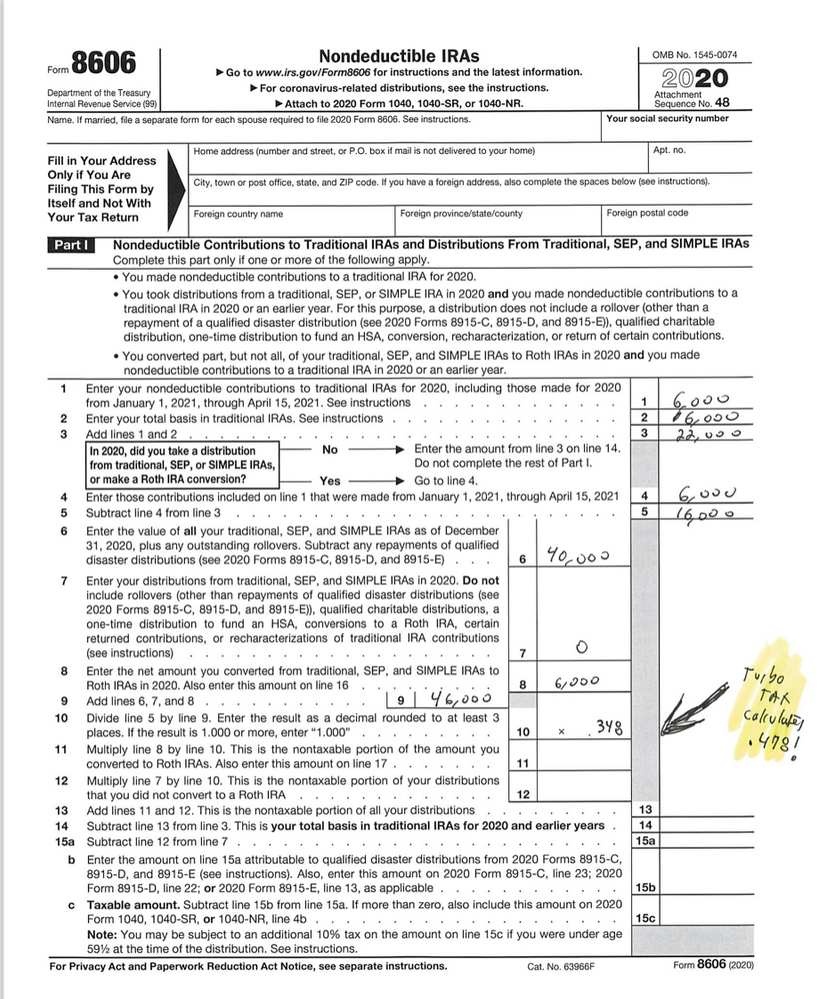

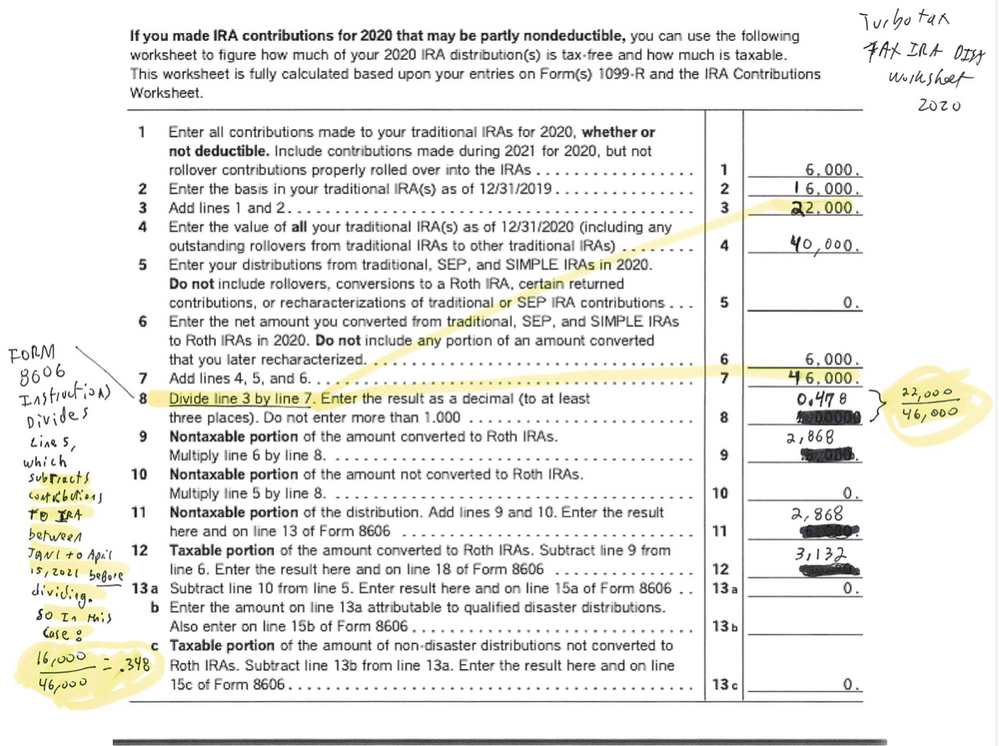

We believe we found a calculation error in the TurboTax 2020 calculation in a situation where non-deductible contributions to traditional IRAs for 2020 are made between January 1, 2021 and April 15, 2021. In the TurboTax "Tax IRA Dist" worksheet, the calculation in line 8 divides line 3 by line 7. However, in the Form 8606, the amount entered in the equivalent of line 3 SUBTRACTS first the non-deductible contributions to traditional IRAs for 2020 made between January 1, 2021 and April 15, 2021. In the Turbotax worksheet, line 3 is using the amount before subtracting back out the amount contributed in 2021. I attach a sample calculation in the picture attached using the TurboTax worksheet and using the Form 8606.

I value your thoughts community! Thanks