assuming it's a single member LLC, yes, you can still amend your 1040 return for 2018.

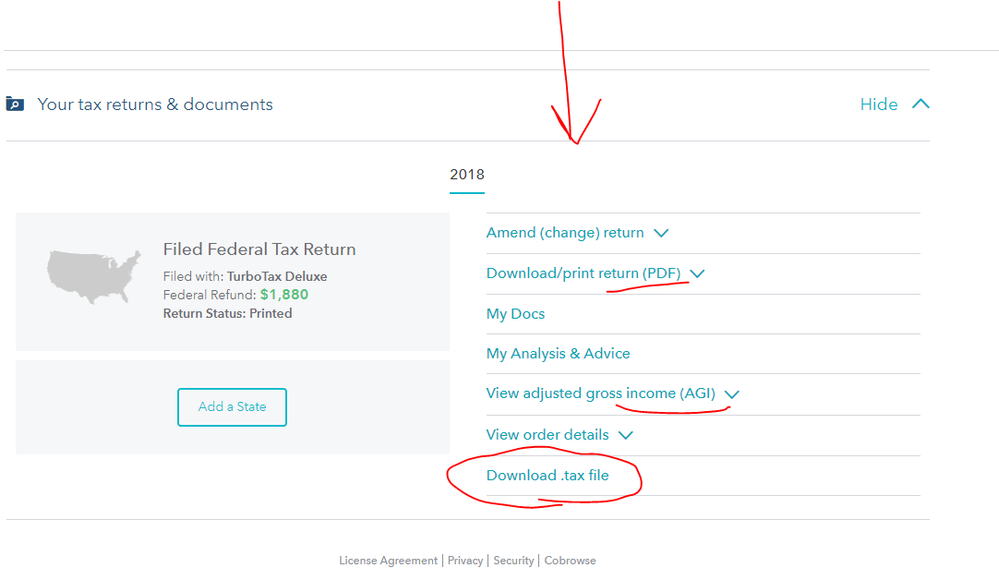

see the Turbo tax instructions

https://ttlc.intuit.com/community/amending/help/how-do-i-amend-my-turbotax-online-return/00/27577

You cannot change or add anything on the return that you just e-filed, nor can you stop it. It is too late, just like when you put an envelope in a US mailbox

If you left out a W-2, or a dependent, or a 1099 etc…DO NOT change your return while it is pending. The changes will go nowhere.

Now you have to wait until the IRS either rejects or accepts your return. If your return is rejected, you will be able to go into your account and make the necessary changes to your tax return and re-submit your return.

If the IRS accepts your return, however, then you have to wait longer until it has been fully processed and you have received your refund. THEN you can prepare an amended tax return and mail it in. You have to be able to work from that return exactly the way it was when it was e-filed originally. You will need to use a form called a 1040X. You cannot e-file an amended return. They have to be mailed, and it takes at least 2-4 months for the IRS to process an amended return. Meanwhile, DO NOT go in and start changing anything on your return in the system, or you will make a mess for yourself. Sit tight and wait until you see what the IRS does with the return you just e-filed