that should not be possible. a second e-filing with the same SSN as a previous filing while possible should result in you getting a rejection e-mail. look for it.

"(I forget the exact prompt)"

It's pretty hard to e-File accidentally but somehow you managed.

Log back in ... scroll down ... click on ADD A STATE to let you back in ... then click on TOOLS ... then PRINT CENTER and save a PDF of the current return ... do you see a 1040X in the file ? If so you may have filed an incorrect amended return. If you did then wait for the IRS to process the incorrect amended return (could take a few months) and then amend the return again to undo the false changes.

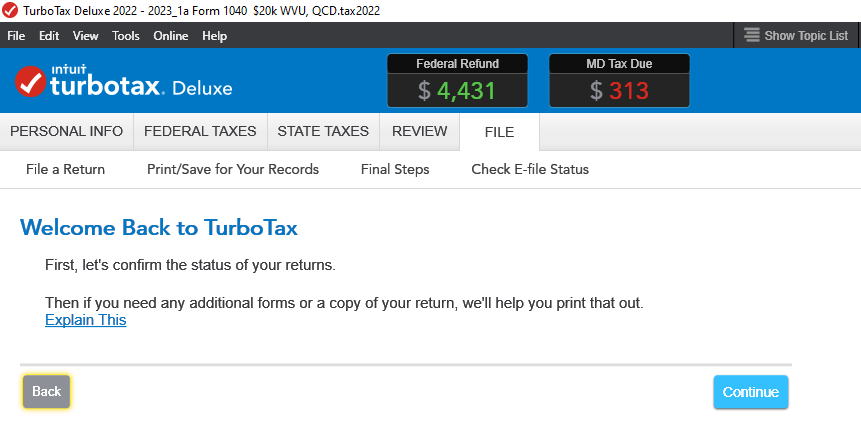

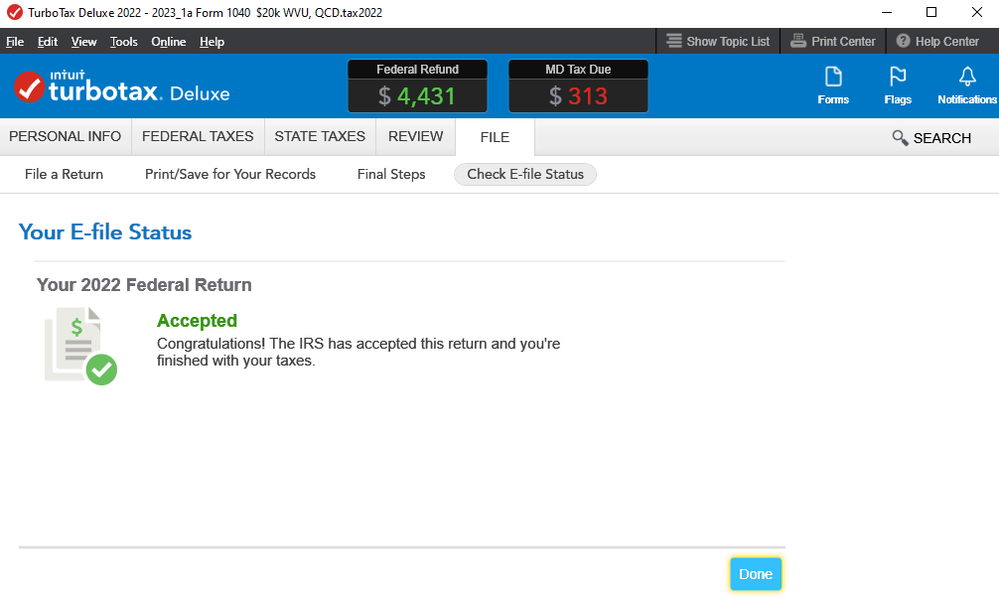

I'm reasonably sure that the following pic shows the prompt. (This occurs whenever I load one of my unfiled charity scenarios. Now I just click on \View\Forms to ignore the prompt.) When I clicked on "Continue" it efiled. (See second pic.) There was no warning prompt such as, "Are you sure you want to efile?" So perhaps it's really not so difficult to accidentally efile.

====================================================================

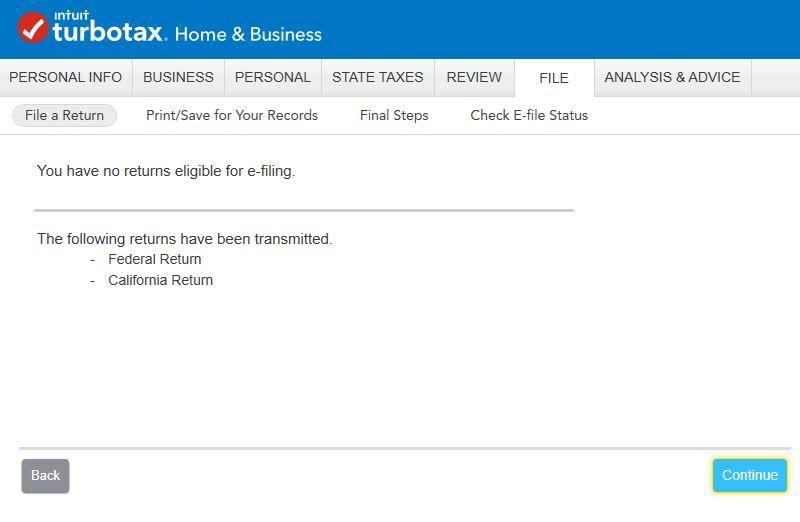

That seems normal. That is the status of your return. The first one was Accepted. It won't let you efile again unless it takes you though all the FILE steps and gives you the big SUBMIT button. Did it give you all 3 steps again?

Have you checked the filing status here?. Open your return and go up to menu item

File > Electronic Filing > Check Electronic Filing Status

Critter-3 --

I am using the downloaded version, not the online, so I can just open the accidental efile.

After I save the pdf, where would I look for the 1040X? (The top of the form says "1040-SR".) Note that I never did anything to indicate that I was filing an amended form -- I just clicked the Continue button.

I opened my test return. It says the same thing. Try clicking on that first File a Return tab and keep going through and try to efile it again. At the end it should tell you it was already filed.

VolvoGirl --

There was never a big SUBMIT button. TT just submitted after I pressed the Continue button (see pic in previous post).

When I check the filing status I get --

VolvoGirl --

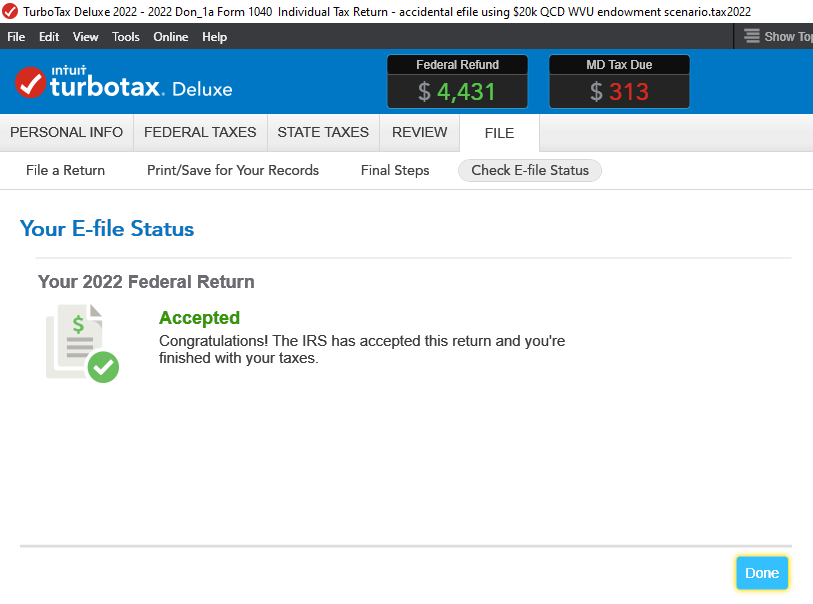

The file that was accidentally efiled had a different name than the one that I officially filed. Is that possibly why TT might have allowed a second efile? (What criterion does TT use to determine whether a form has already been efiled?)

No you did not efile again. That's just the status of your actual filed return. Even in my test file with another name it shows that, because I'm in a copy of my actual return after I had filed. You can't efile a ssn a second time. Even if you put in a fake ssn the IRS would reject it. Go ahead and TRY to efile again, it won't let you Submit it.

@dculp still suggest looking for the reject

it will reject if the SSN has already been used

it will reject if the SSN / last name combination doesn't match the IRS file.

That 'congratulations' message may simply be the message from the original efiling - it is permanent on the file.

unless you followed ALL the steps of the "file a return" tab, you did not efile again. (and if you did, it should reject)

I would do nothing more until you get an email of accept or reject (or texts).... but I bet you get nothing - because you didn't efile a 2nd time 🙂