are you using the current IP_PIN

The IRS computers determined that the IP PIN you entered was not valid.

You should have a letter from the IRS with your IP PIN and use information from that letter.

How to retrieve your IP PIN online

You may use this Get an IP PIN online tool to retrieve your current IP PIN.

https://www.irs.gov/identity-theft-fraud-scams/retrieve-your-ip-pin

The IRS requires you to register and verify your identity in order to use the tool.

This process is essential to protect your personal and tax information.

If a dependent or qualifying person listed on your return has ever received an IP PIN, a CP01A notice, or opted into the IRS's IP PIN pilot program, that person's special 6-digit IP PIN needs to be on the return to validate their identity for e-filing.

Please see the TurboTax FAQ below for more information:

E-file reject IND-996: The Dependent/Qualifying Person Identity Protection Personal...

This Turbo Tax FAQ will show you how to add your IP PIN.

How do I add or remove my 6-digit IP PIN?

I'm having the same issue! I triple checked my IP pin and it's correct yet my return keeps getting rejected. What can I do??

Do you ever get a solution? Mine keeps rejecting for the same reason as you! UGH

The IP Pin will change each and every year. This is an Identity Protection Pin.

You can get an Identity Protection pin here, or if you lost your IP PIN, you can go here to Retrieve IP PIN.

Here are two ways to navigate to the section to enter the 6 digit IP PIN:

- Log in and open your return ("Take me to my return")

- Once the return is open, then go to the Federal Taxes tab.

- Subtab Other Tax Situations

- Scroll down to Other Return Info.

- Choose Identity Protection PIN and Start (or Revisit.)

- Next screen asks: "Did you or any of your dependents get an IP PIN from the IRS for this year's taxes?"

Or another way:

- Open your return if not already open. ("Take me to my return.")

- Once the return is open, click at the top on MY ACCOUNT, then choose TOOLS.

- In the Tools window choose TOPIC SEARCH.

- Enter IP PIN without quotes.

- In the selection list highlight IP PIN and click GO.

- Next screen asks: "Did you or any of your dependents get an IP PIN from the IRS for this year's taxes?"

Yes, I created the PINs, double checked them, and they still keep getting rejected. Do the sites need time to refresh so it can recognize the pin entered? The pins I entered are correct.

You may be entering it under the 5 Digit Pin section (also known as the signature ID) area instead of in the IP PIN area which is for the 6 digit IRS issued number.

Please see how do I add or remove my 6-digit IP PIN for steps on your IRS issued number.

There is one more option to try. I suggest updating your software and see if that assists.

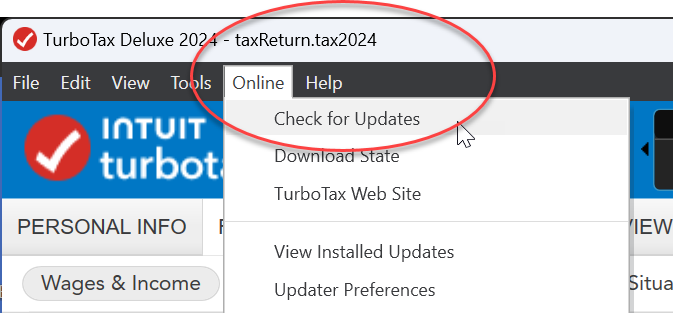

This can be done by logging into your desktop product. Select Online in the menu on the top, and then select Check for Updates.

If that does not update your program, you can also manually update your program.

If you are using TurboTax Online, the program should be automatically updated. But if you are still receiving the error message, try clearing your cache and see if that helps.

None of that works, and I am thinking it is an issue with the IRS and may have to mail it. I was just wondering if anyone heard of the site needing to refresh itself before it can communicate with the software.

Thanks.

The IRS's system is not state of the art. So it often requires time to update before it can use information that has been uploaded into it. You might want to wait 24 hours and try again.