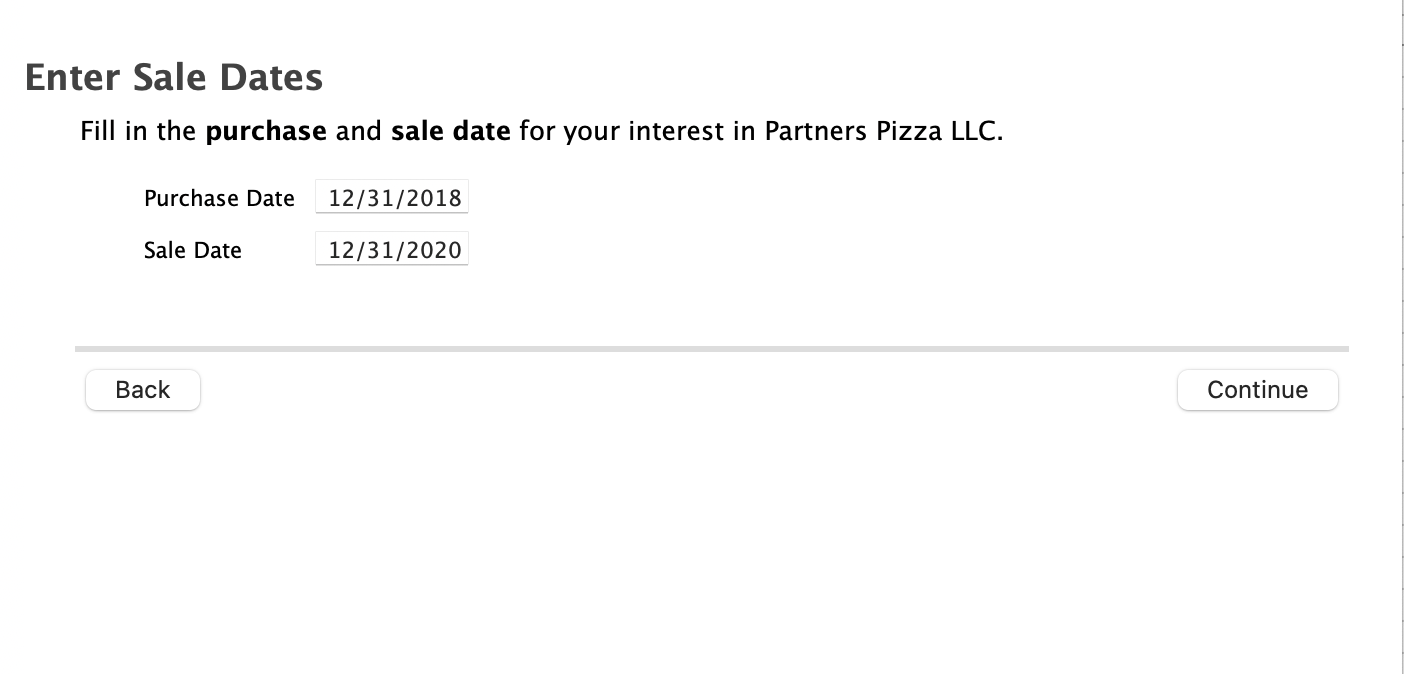

In this case, the partnership ended, disposition was not via a sale, and the "sale date" (next screen) can be 12/31/2020 or the exact date the partnership terminated (if you know).

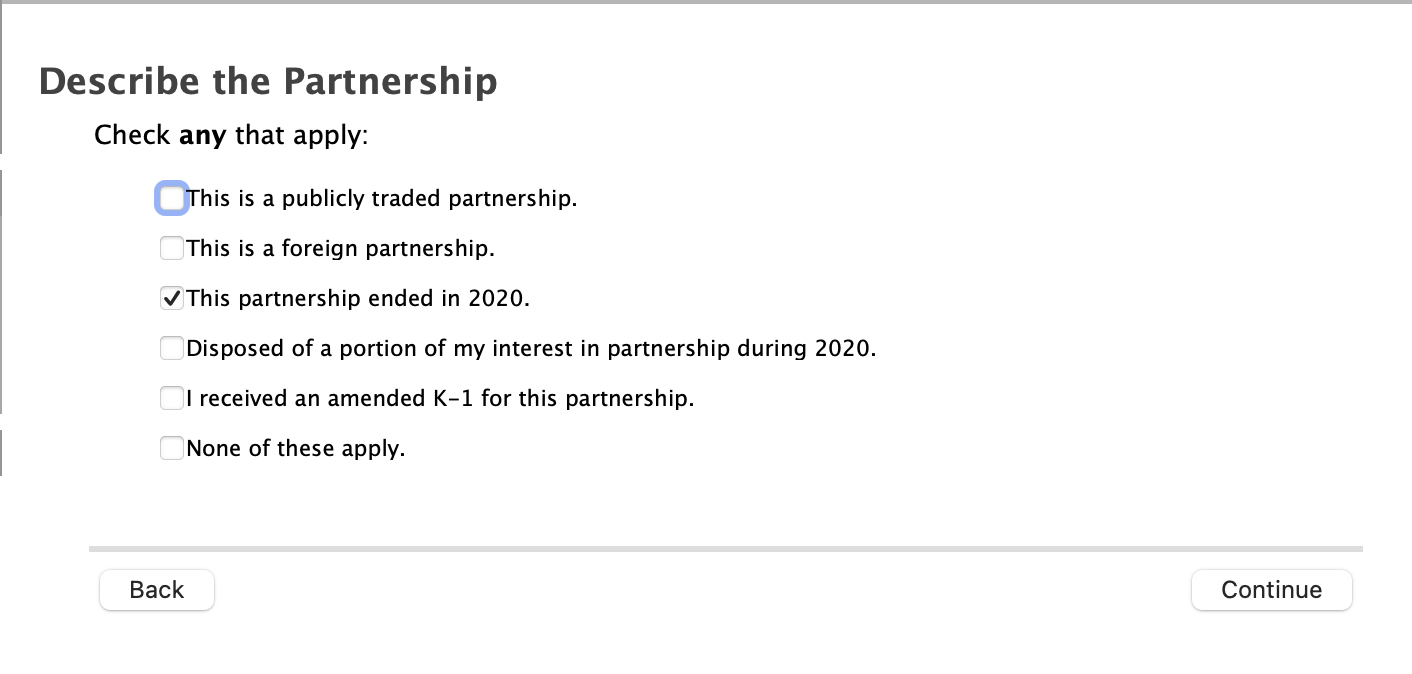

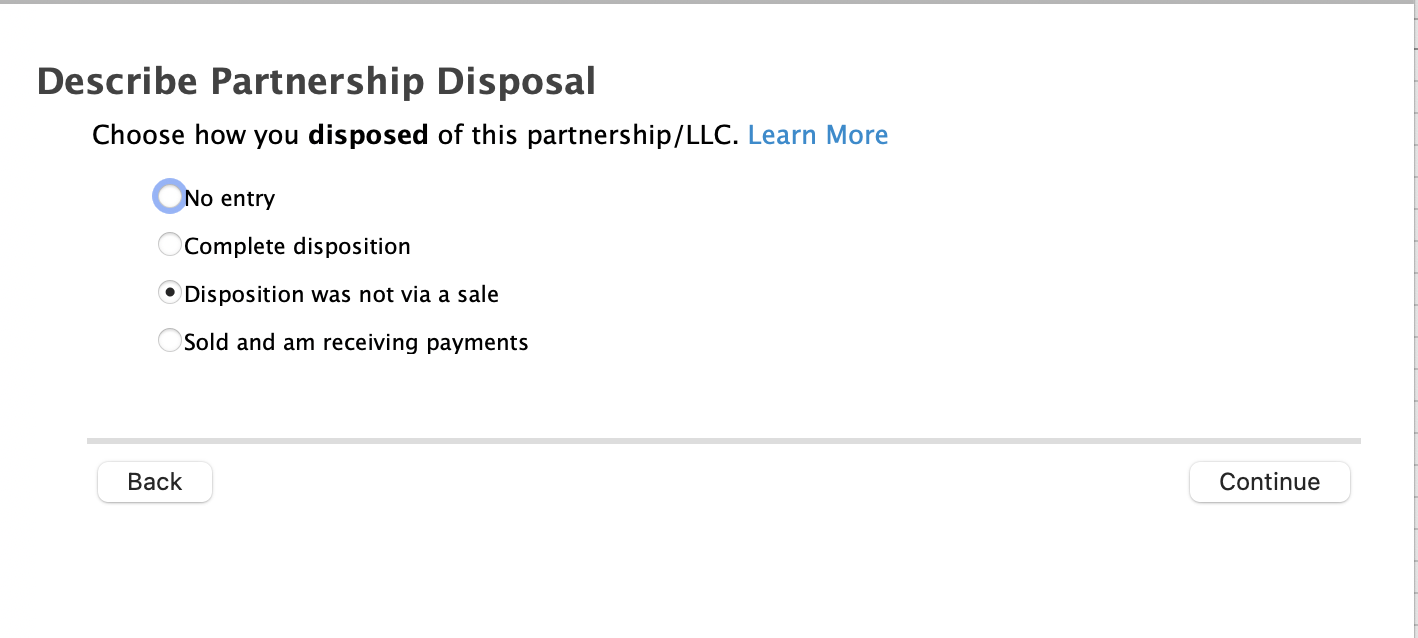

See the attached screenshots for how this looks in the K-1 interview.

Why wouldn't it be classified as a "Complete Disposition"? If this box is checked you get a far different deduction.

Either way, you should be reporting the distribution(s) you received from the liquidation of your interest in the partnership.

A complete disposition would only be the sale of your interest whereas the liquidation of the partnership would be the disposition of all interests of the partnership.

So is it then classified as a "Disposition was not via a sale" in the TurboTax question screen?