Hi @bjmatusz !

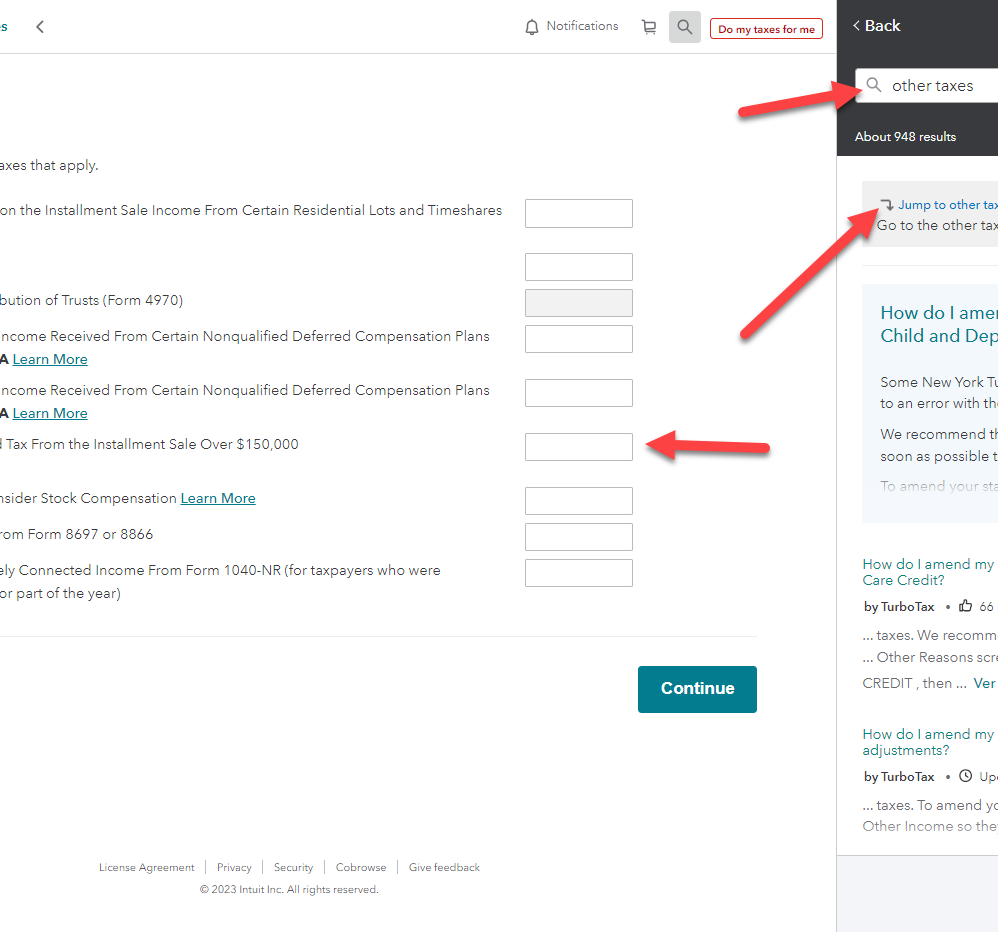

Please go to the magnifying class and search "other taxes" and select "Jump to other taxes" .

You should see the Section 453A(c) box about 3/4 of the way down.

Hope this helps!

Cindy

Thanks Cindy4, however, I'm not sure that applies in my case. That field seems to want the interest due from the installment sale.

Interest on Deferred Tax From the Installment Sale Over $150,000

(Section 453A(c))

What I have in Box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. If I add in that amount to the line item above, it seems to be treated as the total amount of interest due and not money still owed.

According to this IRS direction, it seem you have to calculate the interest amount yourself as highlighted here when you open this link:

Wonderful! You can use the form and follow the steps provided by the IRS here to determine the amount: