If you received a form 1099-B reporting the investment sale, you report it in the Investment Income section in TurboTax, and then Stocks, Mutual Funds, Bonds, Other. Work through the section to enter the information from your 1099-B and when you come to the screen that says Select and less common adjustments that apply choose the The cost basis on my statement is incorrect option and enter your corrected cost basis, which is normally the income reported on your W-2 form from the investment as income in box 1.

Thanks, @ThomasM125 . I have a SAR value on my W-2 in Box 14, but nothing in the Box 1 breakdown, so am I to assume the value in Box 14 was included in my gross pay for Box 1? (It seems like it was, based on the number). To me, that makes me think the SAR income has already been factored in as ordinary income and taxed (as the transaction statement from the broker shows.) I suppose I can still follow your instructions and calculate a cost basis by calculating what the total value of the award was when it was issued, versus what it appreciated to when I sold. But, I still think I am paying taxes twice on those gains, since the sale was fully taxed by the broker at the time of sale, not vest.

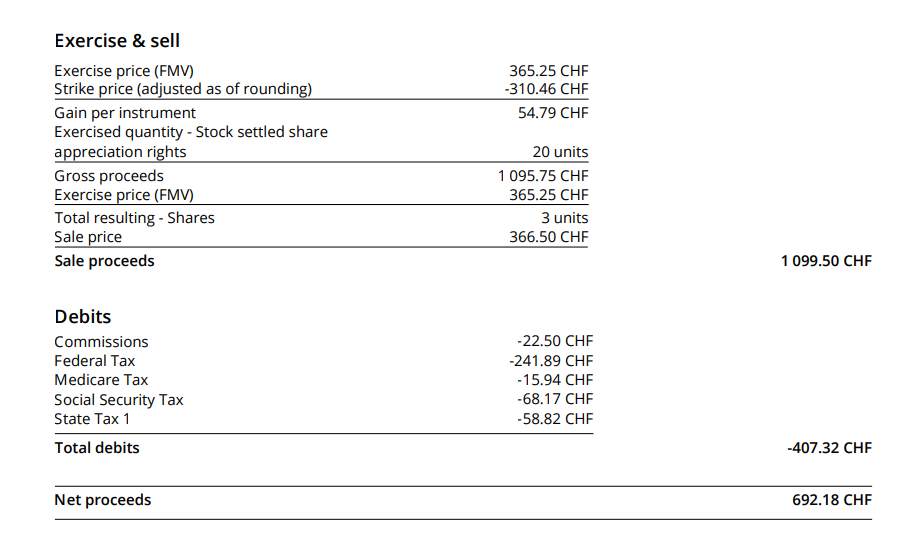

Here's an example of the broker's transaction statement for one of the sales, it looks fully taxed at the time of sale:

Yes, the income has already been factored into your wages which is why you have a cost basis. You will not see the breakdown for Box 1 per se, however your W2 does provide information in Box 14, your pay stubs may also show a breakdown or the statement is used to provide it without an additional entry on the pay stubs.

Adding the award to your wages eliminate double taxation because you have a cost basis to use against the sales price. The only income on the return from the sale will be the appreciated value on the date of sale.. You should calculate the basis at the time of the award based on the fair market value on that day (which is also the amount included in your wages and, if applicable, any amount you paid at the time. In this situation you may not have paid anything on the date of the award which is also common.

Thank you! That makes sense. This is great information. I appreciate the help.

So @wilthethril11, what did you end up using as your cost basis in this example. I have the same type of transaction twice and I'd like to avoid getting taxed on this in two places!

@lthurman15 you brought back some painful memories haha. So, I calculated my cost basis by going through my statements for each transaction. I took the value of the shares when they vested (and the taxes were automatically withdrawn) and used that as my cost basis. Then, I took the value I sold those specific shares at to determine my gains that I actually owed taxes on, since initial taxes were taken out at vesting, I should only owe the difference in what I made from vesting until the sale. What complicated this was that it was all in Swiss Francs, so I had to do the conversions for each transaction, using the exchange rate on that given date. Since I only held the shares a few months after they vested, it wasn’t a significant gain and the tax burden wasn’t much. On the vest date they took out standard payroll taxes, so that was where the biggest hit was. Also, the 1099 they issued was mostly empty and completely inaccurate, so I dismissed that altogether. Hopefully your company’s broker isn’t as difficult to parse.

Hi - It appears as the other poster and I work at the same Swiss based employer.

My question is a bit simpler as I have sold SSARs previously, but can't recall how to enter in TurboTax.

The gain (Sales Proceeds taxed as ordinary income) is on my W2 (Box 14 SSAR), as well as the associated taxes.

This transaction exercised SSARs and held shares for taxes/fees. All in CHF, but I have exchange rate (CHF-USD). The Exercise FMV is slightly different than Sale Price by less than 1 CHF.

I received minimal 1099B from the Swiss employer. I have the transactions statement showing conversion from CHF to USD, and the info of SSARs used to pay for basis and taxes. And my year end statement.

Basic question - do I enter this info as a RSU, a NQSO, or normal stock transaction and select "None of These"?

As this SSAR income (sales proceed) and taxes already show on my W2, Can I still enter this as a stock sale with a minimal capitol loss (short term) for commission/fees - since the income/taxes is already captured on W2?

I am unclear of what the cost basis (Box 1b) is on the initial page - I don't want to get double taxed. Wouldn't the cost basis be the Sales Proceeds plus the commision? Depending on whether I choose NQSO or RSU, it asks me questions that appear to alter my taxes owed.

Help?

Thanks.

We worked for same company it appears. Don't discount the 1099B they sent - the proceeds (box 1d) need to match the 1099B, and reported on W2. Also Box 1a, Box 1c info is important. The rest is useless.

In response to your question about cost basis, your cost basis would be the value of the shares on the day they vested. That value should be the value that was included on your W-2 and for which a certain number of shares were sold to cover your tax withholding obligations.

If you know all of the amounts that need to be entered, i.e. cost basis, sales proceeds, commissions, date sold, etc., then you can enter the transaction as a regular stock trade. Entering this information as a regular stock trade avoids the issues around RSUs or NQSOs.

thanks.

I have the info - the issue is how the enter info appropriately in TT. (btw - I found a bug - discuss later)

What I did do as filing time is upon us:

1) I entered the Gross Sales Proceeds that matches 1099B sent from Swiss Co (in USD) in TT Box 1d (this closely matches W2 income minus commission/fees)

2) Cost Basis (Box 1e) = 0

3) Fed Tax (Box 4) = 0

4) Yes-Yes for Sale of Employee Stock?

5) None of Above for Type of Employee Stock?

6) Checkmark Cost Basis is incorrect

(Cost Basis was not on 1099B)

7) Enter Correct Cost Basis (which is basically the Sales Proceeds plus commission/fee)

This result effectively leads to a small capital loss (commission/fee) as the income and taxes is accounted for on the W2. As the SSAR are taxed as ordinary income this exercise would properly pay the associated taxes required by the IRS. Also, the tax on the process should come out the same as RSU process with less complication or chance of getting double tax in entering in confusing info from Year End Statement and Documents from Swiss Co.

Make sense?

RSU bug: in researching between various options - I attempted the RSU process and then edited as discussed above, and TT gave me an error in Smart Check process where it remembered the RSU info. I had to delete and re-enter exercise info as described above.

thanks again

Yes, that makes sense. It appears you aware of the issue of not being taxed twice on the same income. Moreover, because it appears that the stock that was sold on the same day it vested, your small capital loss makes sense when you added the commission to the cost basis.

Thank you for the added information about how you resolved that RSU error message.

I work for the same company. Trying to enter the S-SAR exersale in TT and running into problems. Here is what I have done so far.

1. What type of investment to sell do I select in TT? Not sure what to select

2. How did I receive this investment? Not sure what to select

3. Entered exersale date as the date investment recieved (10/14/2022)

4. Entered excersale date as date investment sold (10/14/2022)

5. Proceeds $9191.34 taken from Form 1099-B

6. Cost basis ????? Would that be $9191.34 plus the commission (after converting to USD based on CHF rate on 10/14/2022?

7. Amount on my W2 is a little different $9213.32 SSAR

Thanks! Just want to make sure I enter it correctly!

1. What type of investment? Indicate it is a stock sale.

2. How did you receive? Indicate purchase

3. Acquisition date is the date the SARs vested.

4. Date sold will be on the 1099-B

5. Proceeds should come from 1099-B

6 Cost basis, you should use the amount that was added to your W-2, that is the amount you were taxed on at vesting, so that is your cost basis, and the amount you should use.

On the 8949:

Do the cost basis go in column (f) or (g)?

Do you use Code B?

Column (e) is for the cost basis of any sale including stock appreciation rights (SARs). The cost basis is not usually reported to the IRS in this situation so Code B would be appropriate.

(A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above)

(B) Short-term transactions reported on Form(s) 1099-B showing basis wasn’t reported to the IRS

(C) Short-term transactions not reported to you on Form 1099-B

Same situation with S-SAR exersale from same Swiss company.

I entered the 1099-B info into TurboTax Premier and checked the "Allow me to continue with incomplete info" because the 1099-B does not give a cost-basis. I selected NQSO as the option type. However, TurboTax gives a Total Proceeds Summary screen with an incorrect calculation of the Selling Price per Share that I cannot change (it takes the Total Proceeds from the 1099-B and divides it by the number of shares). This causes a small loss amount which is not real.

I don't see any option to adjust the Cost Basis. Am I looking down the wrong path?