Yes the Windows Home & Business program still has the built in W2/1099 Reporter but it's buried.

OK, so how do you find it? Also, now that i have used Quick forms anyone knows when you get an acceptance confirmation after you submitted?

How can I e-file my forms?

- On the Forms page for the relevant business, locate and click on "E-file Forms" at the top of the page

- This action will take you to the E-File Page which lists all the forms that are "Ready To E-File"

- On the E-File Page, you have the option to select specific forms you wish to e-file

- If you prefer to e-file all forms at once, click on "E-File All Forms"

After e-filing your W-2 or 1099 form, please monitor your form status in the Forms tab of the corresponding business. The form status will change from "E-File Processing" to either "E-File Accepted" or "E-File Rejected", once the Government Agency processes the form. The status change may take up to 2 to 4 weeks. You will also receive a notification by e-mail when the status changes. For W-2 and 1099-NEC, e-file is due by January 31, 2024 . For 1099-MISC, 1099-INT and 1099-DIV, efile is due by March 31, 2024 .

After e-filing, be sure to check your state's website for W-2 or 1099 reporting requirements.

Each state's requirements vary, and most don't require the forms be submitted. Perform an Internet search for your state web address to find details. You do not need to mail anything to the IRS or SSA after e-filing with Quick Employer Forms.

Quick Employer Forms only supports e-filing of the forms with the IRS and Social Security Administration. Copy A of the Form 1099 and W-2 are only used for e-filing and are not provided for printing.

To find the Desktop Employer forms. You can do them 2 different ways from the Windows Desktop Home & Business program. Either Online using Quick Employer Forms (QEF) -or- directly on your computer with the built in W2/1099 Reporter. If you use the Reporter on your computer you have to mail them to the IRS and not efile.

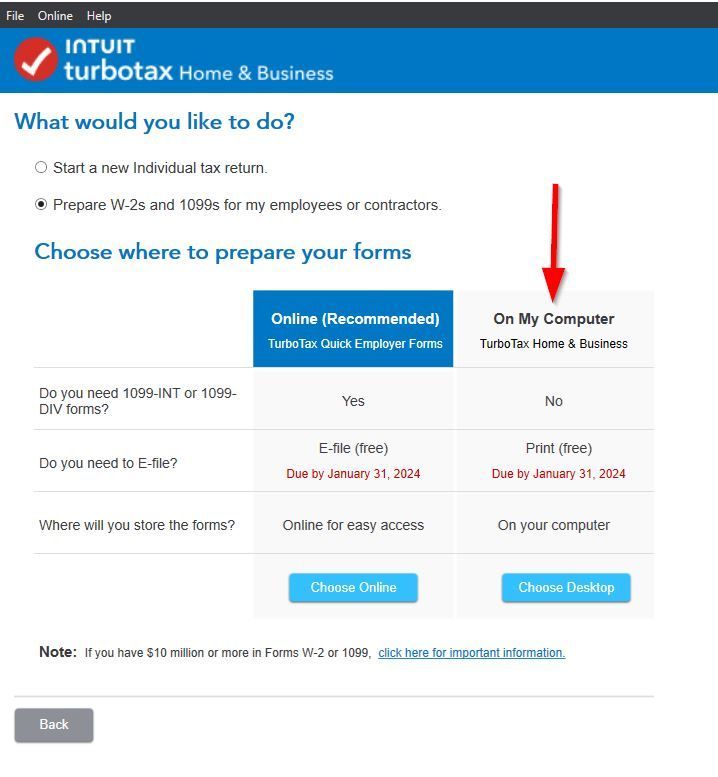

In the Window's Home & Business Desktop program to Prepare W2s or 1099s, on the first main screen there are 2 ways to start. Either

1. Go up to File-New Tax Return. If you click on Start a New Return you will get 2 choices, Check the second circle that says Prepare W-2s and 1099s for my employees or contractors. I'm not sure if this gives you the QEF or the Computer W2/1099 Reporter.

2. Click on the blue button Start a New Return. Check the second circle that says Prepare W-2s and 1099s for my employees or contractors. Then that will expand and give you a choice to prepare them Online (Recommended) or On My Computer.

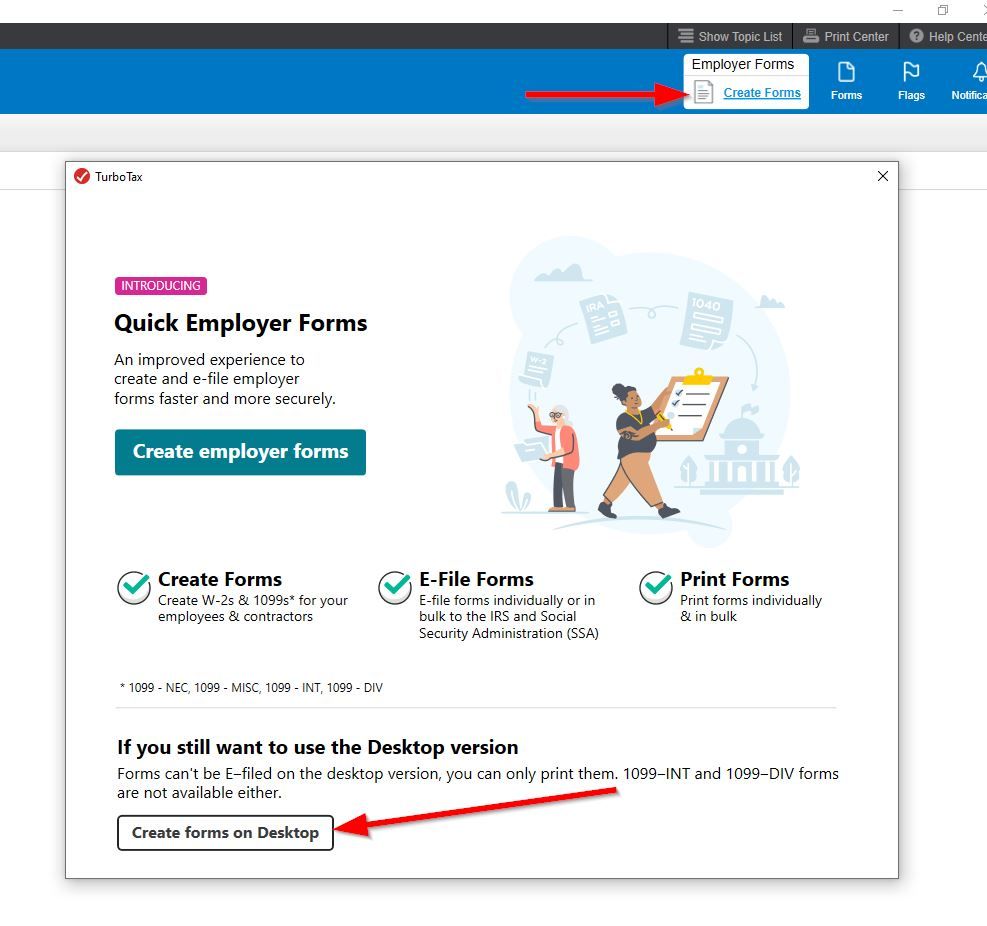

Or if you are already in a tax return there are two ways.

1. In the upper right click on Employer Forms, Create Forms you will get a box to Create employer forms using Quick Employer Forms OR you can pick Create forms on Desktop at the bottom.

2. In the Business tab you can get to the Online Quick Employer Forms under Business Expenses - Other Common Expenses - Contract Labor, click the Start here link.

Here's a couple screen shots

OR from here at bottom.

I have the same problem. I have filed 1099's and W-2's on 2 different companies (4 total E-files) and it's been a week and they are still "processing". What is going on? I filed a different form with a different company yesterday and the IRS accepted within an hour. There is a problem going on here with the Quick Employer Forms system. I have reported this to Turbo Tax but so far they have not been able to explain/resolve the issue. The forms are due tomorrow...

Karen [PII Removed], CPA

After efiling your W-2 or 1099 form, please monitor your form status in the Forms tab of the corresponding business. The form status will change from "EFile Processing" to either "EFile Accepted" or "EFile Rejected", once the Government Agency processes the form. The status change may take up to 2-4 weeks. You will also receive a notification by email when the status changes.

understand this part of it, but since we won't find out until AFTER the Jan 31st deadline, does that mean if any come back rejected that we have to do a mailed copy with a 1096, and if some are rejected and some accepted, do we only have to mail the ones that didn't get accepted? Also, do you still get a fine if there is an error, or is there a grace period to fix the errors and either attempt e file again or mail in.