Tax_question10

Level 3

posted Apr 1, 2021 1:14:46 PM

MA State Return

Hi we trying to file taxes through

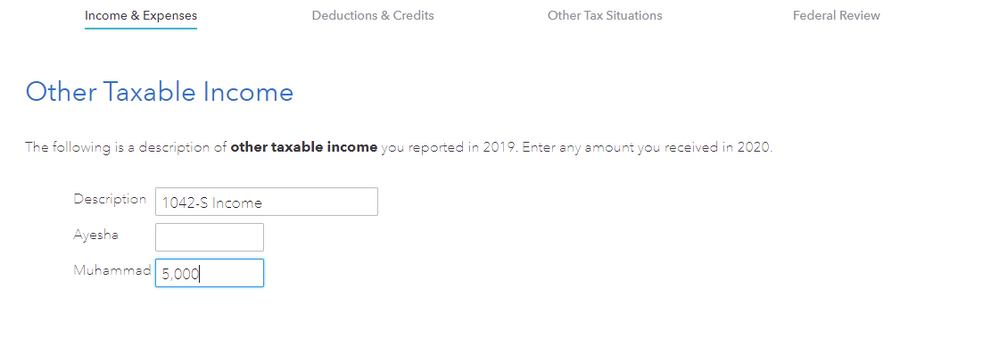

I am US citizen and my spouse is on F-1 Visa since Aug 2017. My husband have got a 1042-s form(tax treaty).

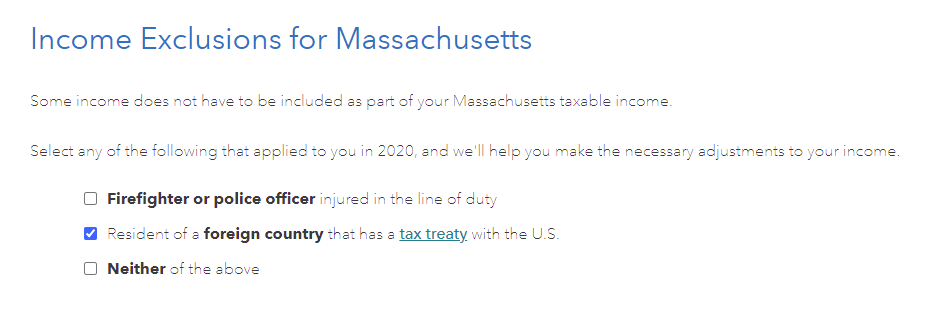

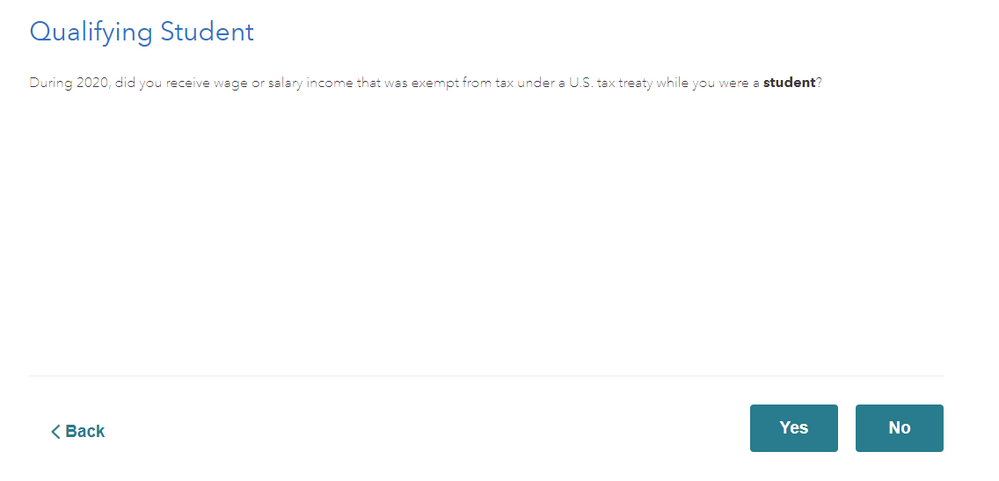

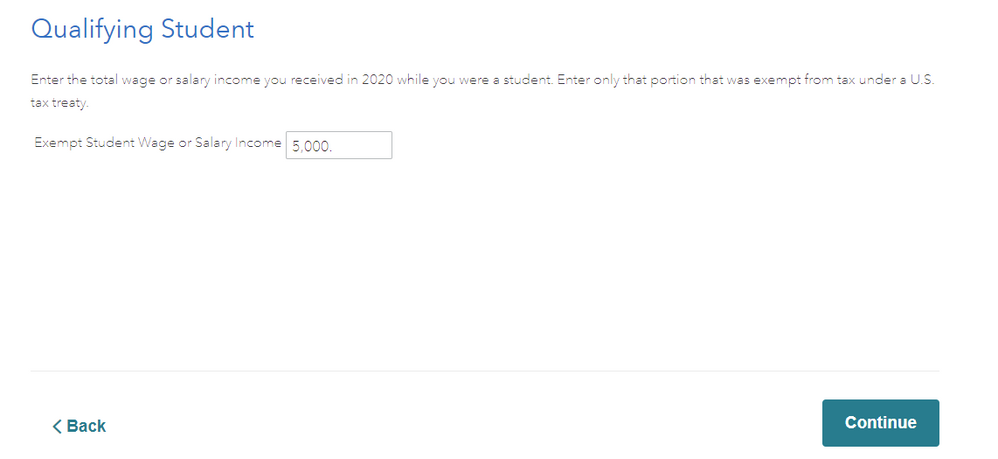

For MA state tax return "Income Exclusion for Massachusetts" Can we select "Resident of a foreign country that has a tax treaty with the U.S." and enter the amount of tax treaty in Exempt student wage of salary income.

Thanks for your time.