TurboTax does not have chat.

You can ask your question here is this public forum - it is NOT chat. Do not post any personal information.

I am trying to find out why I did not get stimilus. Turbo tax has all info and IRS says not available?

@davidrachelgray1 wrote:

I am trying to find out why I did not get stimilus. Turbo tax has all info and IRS says not available?

Only the IRS controls when and if a stimulus payment is distributed.

Go to this IRS get my payment website - https://www.irs.gov/coronavirus/get-my-payment

If you do not receive any other stimulus payments by January 15, 2021, then the stimulus payment for which you are eligible to receive will be entered on your 2020 federal tax return as a tax credit on Form 1040 Line 30.

The TurboTax program will ask about stimulus payments in the Federal Review section of the program.

Massachusetts State download is for individual tax payer and not for joint. How do I correct.

How to I connect wit live agent to resolve a Turbo Tax download problem

To call TurboTax customer support

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

By chance do you have a new computer (purchased after 10/10/20) or are running Microsoft Version 2H20?

If so try this:

1) change the screen resolution to 800x600 (start>settings>display)

2) launch turbo tax and copy / paste the license code to activate

3) change the screen resolution back to its original setting.

If you purchased the TurboTax software for tax year 2020 from this website - https://turbotax.intuit.com/personal-taxes/cd-download/

Sign onto your download account with the exact same User ID you used to purchase the software - https://shopping.turbotax.intuit.com/unified/downloads?route=myaccounts

TurboTax minimum system requirements for Windows - https://ttlc.intuit.com/community/system-requirements/help/minimum-system-requirements-for-turbotax-...

TurboTax minimum system requirements for Mac - https://ttlc.intuit.com/community/system-requirements/help/minimum-system-requirements-for-turbotax-...

Install TurboTax for Windows - https://ttlc.intuit.com/community/refund-status/help/how-do-i-install-the-turbotax-software-for-wind...

Install TurboTax for Mac - https://ttlc.intuit.com/community/installing/help/how-do-i-install-the-turbotax-software-for-mac/01/...

Troubleshoot install for Windows - https://ttlc.intuit.com/community/troubleshooting/help/troubleshoot-installing-and-running-turbotax-...

Troubleshoot install for Mac - https://ttlc.intuit.com/community/installing/help/turbotax-for-the-mac-installation-troubleshooter/0...

I purchased a 2019 filing package for 2019 and entered everything last nite. This morning I can not find it. Need help restoring

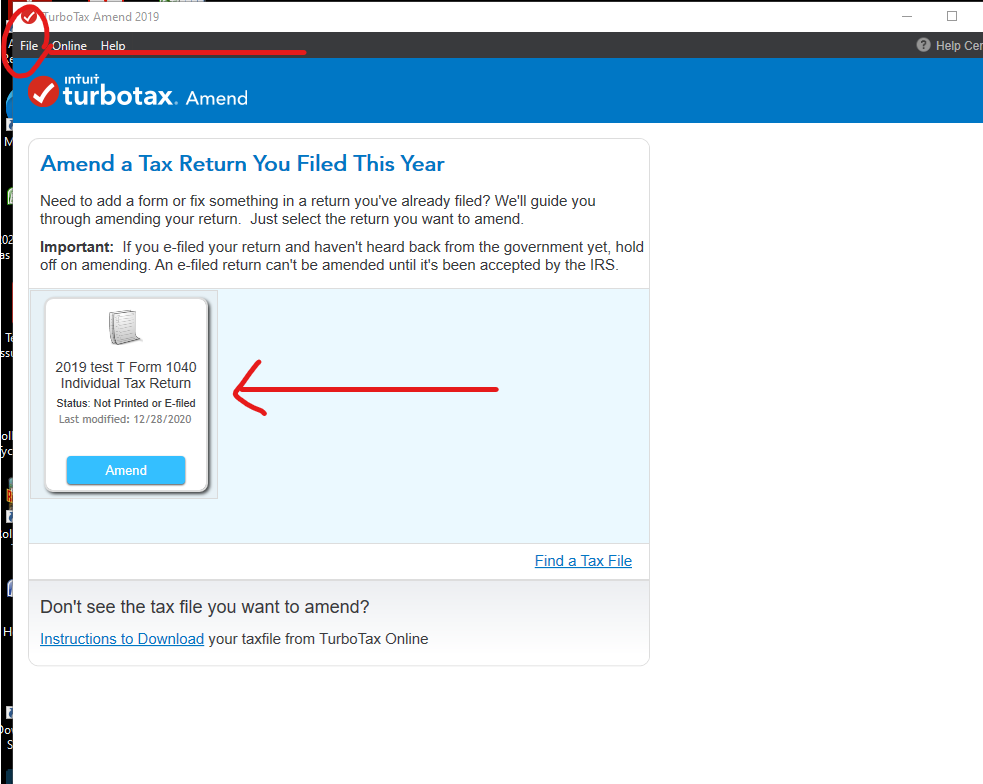

You must be using the 2019 downloaded version so can you not open the program ? When you closed the file last night you would have been prompted to save the return ... so did you ? If you did not then nothing was saved and you have to start over. If you did then there should be a BIG tile on the home screen to click to open the return ... if not then click on the FILE option in the menu bar (upper left) to look for the file ...

HELLO, LAST YOUR I USED MY TURBOTAX TO DO MY SON’S BED, BATH AND BEYOND TAXES. THIS YEAR I WOULD LIKE TO USE FOR MYSELF. HOW CAN I DO SO? PLEASE ADVISE. THANK YOU.

You should start by going here to set up an account.

I cannot install Turbotax Standard on my personal computer running Windows 10. I have tried everything without success and am becoming Very Frustrated. I have used turbotax for the last 10 years but I'm having doubts now if I want to use it again!

Bob

This is the US forum....

Here is the Canada website

http://turbotax.intuit.ca/tax-software/index.jsp

TT Canada Forum

https://turbotax.community.intuit.ca/tax-help

TurboTax Canada Support

The US program is having some issues with the new 20H2 ... see if this will also work for the canadian version...

Did you try this? Appears the issue is anyone who has Windows Version 20H2 (Start>settings>system>about); this version is installed on all new computers purchased after Oct. 10, 2020) - does that fit you?

- Change your resolution to 800 x 600 (start>setting >system resolution. once it's been changed, your screen size will look very big. REMEMBER your initial resolution setting!

- Launch TT and the activation screen should launch. copy / paste in your activation code. you should get the 'all set' green check mark

- Change your resolution back to what is was originally.

My state estimated payment amounts were not correct on the state form. How do I change them?

If you made estimated tax payments in 2020 towards your federal, state, or local taxes, enter them in the Estimated and Other Income Taxes Paid section.

- With your return open, search for the term estimated tax payments.

- Select the Jump to link.

- Choose Start next to the type of estimated tax payment you'd like to enter.

- Enter the amount of estimated tax you paid at each of the quarterly due dates.

- If you paid 2019 estimated taxes in 2020, you'll enter just one amount for each state of locality.

- Where to enter Estimated Payments