Yes. It sounds like you sold a few tickets that were personal in nature, not a business. If that is correct, you will not enter this on Schedule C, rather Schedule D.

Here's how to report this in TurboTax Online:

- Within your tax return go to the magnifying glass icon on the top right, type 1099-K and select the Jump to 1099-K link in the search results

- Choose Add a 1099-K

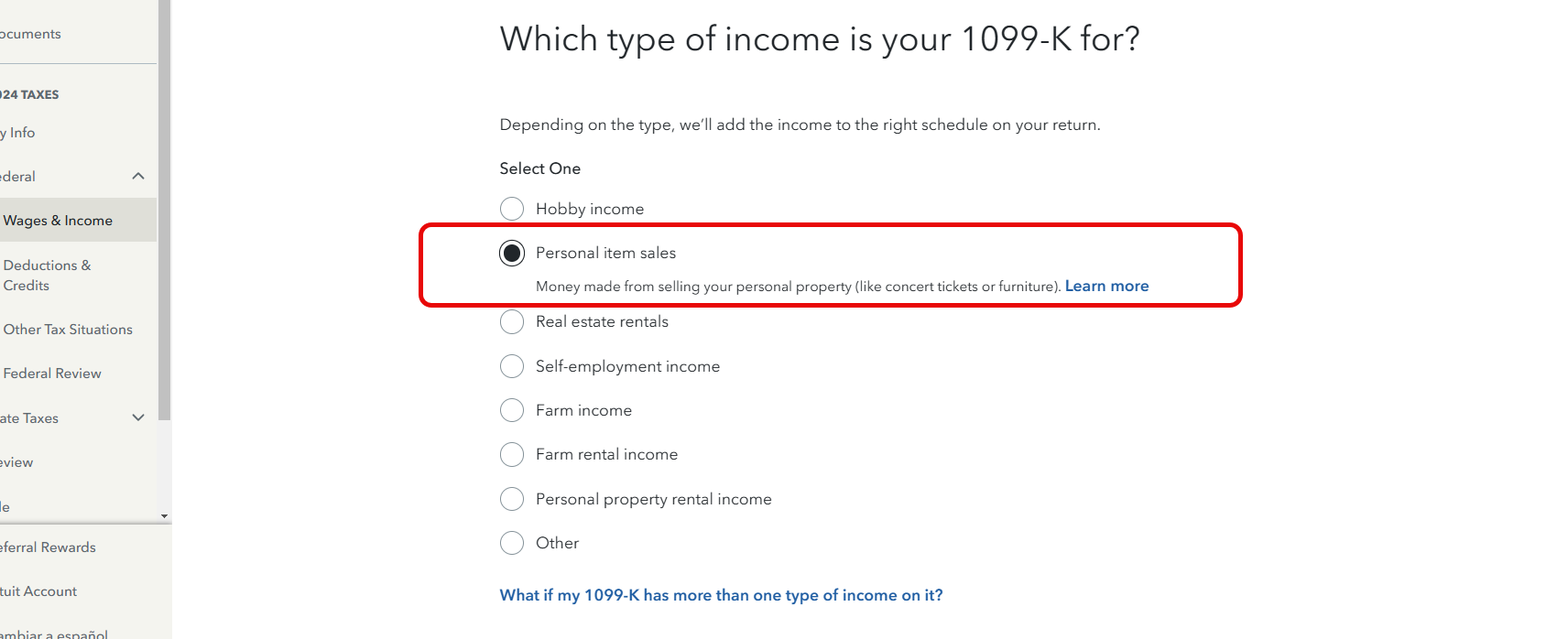

- The next screen will ask "Which type of income your 1099-K is for?" choose Personal item sales, then Continue

- Enter the information from your 1099-K, I used $5,000 as an example, report the number from your 1099-K.

- After you choose continue, the next screen will show "Personal Item Sales". If the tickets were all profitable, choose "Some items were sold at a loss or had no gain", and enter $0.

Now, TurboTax will automatically create a placeholder in investment income.

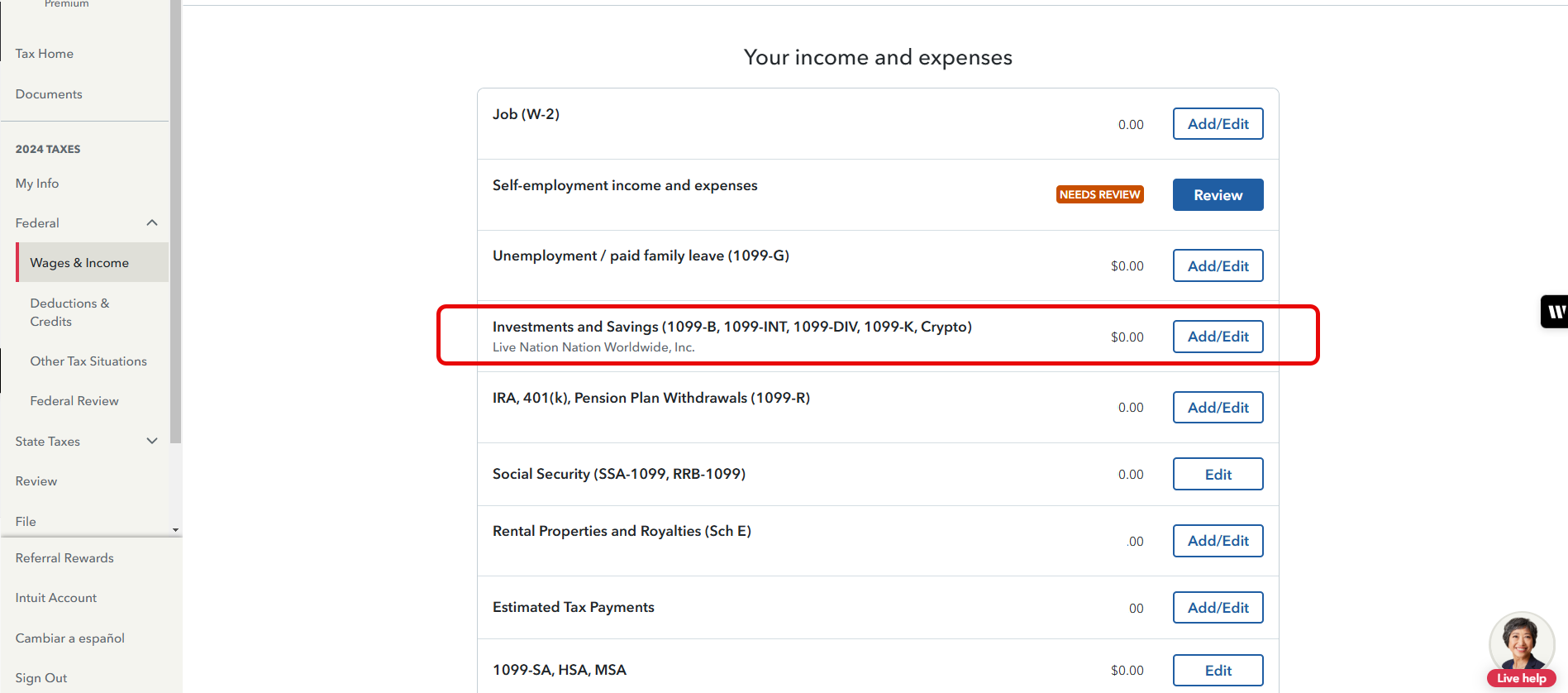

- After completing the 1099-K entry, next navigate to Federal > Wages & Income > Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) > Add/Edit

- Select Live Nation Worldwide, Inc.

- Under proceeds, you will enter the proceeds from the 1099-K

- You will enter the total amount paid, which is your cost of the tickets

- Continue on and you will be asked if you paid "sales expenses that aren't included in the sale proceeds reported on the form", here you can report the 10% fee.

Thank you Mindy!!!!

This information was fantastic! I think that I am almost there. However, after completing everything that you suggested, Turbo Tax found one error. I am hoping that you might be able to help me one more time. Below is what the error said:

- FORM 1099-k reconciliation: If checked, a copy of Form 1099-k with the payer and payment amount shown below has been linked to this worksheet. Total sales proceeds reported on the Capital Asset Sales Worksheet(s) much match the amount shown below.

Turbo Tax suggests adding sales on this worksheet with sales proceeds to match the amount report on the Form 1099-K. But I am confused, as I have no idea where the Live Nation number, the one on the 1099-k, came from as it is much higher than all of my combined sales. Can you please help me again? Thanks so VERY much!

The 1099-K amount may include the fees that Ticketmaster charged you as well as the money that you received. You will have to contact Ticketmaster to get a list of all of the sales that they show you receiving. This information may also be in your online Ticketmaster account.

I am using the Turbo Tax Premier, and am able to make the placeholder for the 1099-K. But I am not able to get to do the second part which is to add the costs of the tickets. Are the steps different or do you know what I could be doing wrong? This is the 2nd step that was mentioned that I am having trouble with:

Now, TurboTax will automatically create a placeholder in investment income.

- After completing the 1099-K entry, next navigate to Federal > Wages & Income > Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) > Add/Edit

- Select Live Nation Worldwide, Inc.

- Under proceeds, you will enter the proceeds from the 1099-K

- You will enter the total amount paid, which is your cost of the tickets

Yes, those are the correct steps as long as you first enter the 1099-K under:

Income

Other Common Income

Income from Form 1099-K START

On the “Did you get a 1099-K?” screen, select “Yes”

On the “Which type of income is your 1099-K for?” screen, select “Personal item sales” CONTINUE

Enter the 1099-K as it was reported

CONTINUE

On the next “Personal Item Sales” screen, choose “I sold some items at a loss or had no gain”

CONTINUE

Finish the interview and select done on the “Your 1099-K summary” screen

This is where you switch to the other section:

Go back to:

Income

Investment Income

Stocks, Cryptocurrency, Mutual Funds, Bonds, Other click UPDATE

The next screen should show “Personal items sales (1099-K)”

Click REVIEW to open

Enter each sale that resulted in a gain

You need to compare the 1099 from Ticketmaster to what you received. The Gross Income reported by Ticketmaster is the sale price (net sent to you PLUS the 10% fee) AND the buyer's fee. The buyer's fee is not a set amount or percentage.

Ticketmaster is reporting the net amount, seller's fee AND the buyer's fee.

You can go to 1099k.ticketmaster.com and download your 1099K as well as a list of transactions they deposited in your account for the year.

When I added the seller's fee into the cost it brought the net revenue down to almost zero.

SPHood - Maybe this should be obvious, but just want to ask - How did you know what the sellers fee was? did you take the amount of the 1099 K and subtract the proceeds?

Thanks!

Reported income from the 1099-K less the Sales price (net proceeds plus sellers fees).

Fortunately, the report from ticketmaster breaks down Sale price, seller fees and net proceeds paid for each transaction.

I have read this string 3 times and tried to do this and having some success but not completely. I have the Home and Business download. I probably sold tickets to 20 games, is someone suggesting that you need to list out each one with proceeds and cost, similar to what you do for 1099-b stock/bonds??? I just assumed I could bunch these.

One of the things I am having a problem correcting is the expenses incurred. I put in a placeholder number thinking I could go back and update but can't figure out how to do that! Tried via forms as well.

And two additional questions:

1- does anyone know what TurboTax does with the amount one types in when it asks how much is incorrectly reported (not ticket sales) as I still seem to see the gross amount and not the gross less what i said should be taken out.

2- separate from TurboTax, anyone have any clue what number TurboTax adds to your MAGI? I was assuming it would be the profit that gets reported but since I can't enter it yet don't see where it is flowing and really hoping it is not the gross amount! Thanks for any insight you may have.

You are reporting IRS form 1099-K and reporting personal sales.

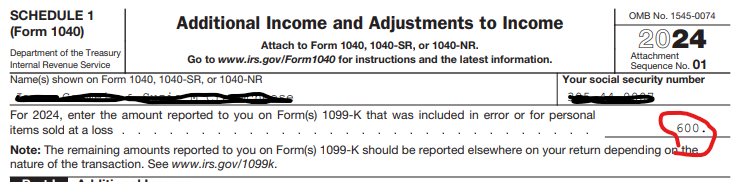

If box 1a is $1,000 and I sold some items at a loss or had no gain was $600, $400 will be reported as Proceeds on IRS form 1099-B.

The $600 is reported at the top of Schedule 1 Additional Income and Adjustments to Income.

Are you referring to the Modified Adjusted Gross Income (MAGI) for retirement plan purposes? There are several MAGI for different purposes. This TurboTax Help may address your question.

If you were to group your personal sales, there would be as many as four categories:

- Personal item for loss reports $0 gain/loss,

- Personal item gain long-term basis,

- Personal item gain short-term basis, and

- Personal item, no gain or loss.

Here are examples.

Selling Cost

Price Basis

T1 $500 $1,000 Capital loss on personal item = $0 gain/loss

T2 $400 $300 LT Capital gain on personal item = $100 gain

T3 $0 $0 ST Capital gain on personal item = $100 gain

T4 $100 $100 No capital gain or loss = $0 gain/loss

$1,000 $1,400

Never asked a question in this forum and I'm hoping this follows the other posts in the same discussion. Otherwise, I'm afraid it won't make any sense. I still have the same question posed by Lynn G1 several weeks ago. Like her/him when doing the final check before filing, I got an error message about Form 1099-K reconciliation, which states:

If checked, a copy of Form 1099-K with the payer and payment amount shown below has been linked to this worksheet. Total sales proceeds reported on the Capital Asset Sales Worksheet must match the amount shown below.

This question concerns a Ticketmaster (Live Nation Worldwide) 1099-K I received when I sold a few of my unused NFL tickets in 2024. The gross amount of payment is roughly 30% more than the actual amount received. I've learned from this forum that the gross amount of payment also includes both the 10% I paid Ticketmaster to sell the tickets and the service fee the buyer of the tickets had to pay to Ticketmaster, neither of which I should be paying tax on.

As RobertB4444 suggested, I did get info from Ticketmaster on the amount of the service fee paid by the buyer. However, I still do not know how to make the reconciliation the error message is requiring. I don't really understand what needs to be reconciled. TurboTax populated the worksheet number and I would not have thought I would need to reconcile what they calculated.

Any help would be greatly appreciated.

You are reporting IRS form 1099-K and reporting personal sales.

Instead of box 1a being $1,000, presume that box 1a is $1,200 with $1,000 being the sales price and $200 being the sales fees charged by Ticketmaster.

If box 1a is $1,200 and I sold some items at a loss or had no gain was $600, $600 will be reported as Proceeds on IRS form 1099-B.

$200 is reported as I paid sales expenses....

The $600 is reported at the top of Schedule 1 Additional Income and Adjustments to Income.

Here are examples.

Selling Cost

Price Basis

T1 $500 $1,000 Capital loss on personal item = $0 gain/loss

T2 $400 $300 LT Capital gain on personal item = $100 gain

T3 $0 $0 ST Capital gain on personal item = $100 gain

T4 $100 $100 No capital gain or loss = $0 gain/loss

$1,000 $1,400

Fees $200

Total $1,200

When I bought season tickets, the price for each game is different. I sold all the tickets for a gain. In TurboTax I choose "Various" for the sale date and included the cost and proceeds received for all sales combined. However, TurboTax asks to review this entry? Is there a reason why? Do I have to estimate the cost of the ticket for each game and enter them separately? Why is various given as a choice in TurboTax if it asks you to review the entry?

Various is allowed for the purchase date, but not the sale date, on this entry screen. However, if you just enter the date of the last sale it will suffice. The main purpose of these entries is to determine if your holding period is long or short-term so that the gain is treated properly on the tax return.

You could also enter each one separately but it's not likely necessary. Keep your itemized list, though, for at least 3 years on the off chance that the IRS inquires about support for this entry.

Thanks JamesG1, I understand better and corrected some erroneous entries. Unfortunately, I still get an error message when I run the federal review. The error message says:

"Form 1099-B Worksheet (Live Nation Worldwide, Inc.): Amount from Form 1099-K has an amount from linked Form(s) 1099-K, but the sales proceeds on this worksheet don't match the payment amount from Form 1099-K. Add sale(s) on this worksheet with sales proceeds to match the amount reported on Form 1099-K."

I don't quite understand what Turbo Tax is telling me to do; what two numbers should match?

I've looked at the entries in Form 8949 for Live Nation, the Capital Asset Sales Worksheet for Live Nation, Part I of Schedule D which has the info for Live Nation and the Form 1099-B Worksheet relating to Live Nation and all the entries appear to be consistent. I do not know where to go from here and would greatly appreciate any help you can give.

Sorry that I was unclear.

At the screen Review this sale (1099-B) Proceeds amount should equal the amount from the screen Let's get the info from your 1099-K Box 1a.

Perhaps you reported an amount at the screen Personal Item Sales I sold some items at a loss.

If this is the case, the amount reported under Proceeds would equal Box 1a less the amount of I sold some items at a loss.

Hope this helps.

Are you also adding the Buyer's Fee that Ticketmaster included in the 1099-K to your cost? I've been unclear if the Buyer's Fee and the Seller's Fee should be included as an increase in the cost of the tickets or as an Adjustment in columns F and G on Form 8949.

Yes. Record the Buyers Fee and Sellers Fee you are being charged as part of your cost basis on the sale. It's not necessary to make those as adjustments.

Be sure to keep good records of all your transactions so you are always prepared to support your numbers.

Sorry, where are you seeing the seller and buyer fees and breakdown in the Ticketmaster report? In the transaction report I downloaded it was just showing me the money the "seller payout" I received. I'm having a hard time calculating the extra costs added by Ticketmaster. In my 1099-k all it's giving me is a lump sum of gross income for the month of November (I made 6 ticket sales in that month) and once i've subtracted my total payout for that month I'm left with amount of the extra fees.

However, based on this thread, my understanding is that I only need to add the sales that I gained on and out of the 6 sales I made that month I only profited on 2 of those so I'm trying to enter them individually - however, I only know the amount of seller payout for each sale and have no idea how much extra fees TM is attributing for those 2 sales....

You may be able to allocate the Ticketmaster fees based on the selling price of the tickets.

Example:

- Total proceeds: $1000

- TM Fees: $100

- Tickets sold at a gain: $200

- Percentage of tickets sold at a gain: 200/1000 = 20%

- Fees for sales with a gain: 20% x $100 = $20.

Also, in your third screenshot, why does TurboTax require the "Total amount paid" should be clarified to be cost basis.

For me, this error results from the confusing TurboTax process of entering the 1099-K for ticket sales under "Other Common Income - 1099-MISC, 1099-K, 1099-G, tax refunds," then getting an error message to send you back to "Investment Income - 1099-B or broker statements" and then entering the cost basis information.

As a result of this confusing process, in the second step of entering my 1099-K, TT asked for "Enter the total proceeds for items sold at a loss or no gain." Since I had entered gross proceed without entering cost basis, I entered my gain here. Otherwise, there was no reflection of cost basis (at that point). That created my issue.

Even after I got the first error and went back to "Investment Income - 1099-B or broker statements" and entered the cost basis information, I still had had to fix this.

You are correct. Total amount paid is the cost basis for the investment. The hyperlink Learn more to the right has a more complete explanation.

The posting of IRS form 1099-K for personal item sales is a two-step process.

- First, you post the IRS form 1099-K amount of box 1a.

- Second, you post the IRS form 1099-B Proceeds From Broker and Barter Exchange Transactions to report the sales proceeds and the cost of sales.

Make sure that the amount reported on the IRS form 1099-K box 1a equals the Proceeds reported for the multiple entries of IRS form 1099-B.

@HateUsernamesAlways

@RTW111 Did you figure this out? I am also only seeing seller payout on the transactions download, but not the buyer and seller fees mentioned by @SPHood. The payout matches what I have on record. However, this does not match up with the 1099-K at all due to the fees. While we can put proceeds and cost basis in separately, the 1099-K overstates proceeds so can't be directly matched without buyer and seller fees info per transaction.