Can you clarify what error you are receiving so that we can better assist you. Are you using the online program or the cd/windows program? Is the error in the state or federal form?

There is no error code being received. The error is in the NY software. It is treating NY Pensions as private pensions and only allowing a 20,000 pension exclusion on line 29 instead of entering the entire NY pension on line 26. Example: a person has a 30,000 pension from NYS Retirement System and 25, 000 from an IRA. The person is 70 years old and the radio dial indicating 30,000 is a NYS government pension is checked when entering the info. The software is leaving line 26 blank, entering 20,000 on line 29 and calculating a NYAGI of 35,000. The software should enter 30,000 on line 26, 20,000 on line 29 for a NYAGI of only 5,000.

Also, for the past 3 years (2018, 2019, 2020) if a person elects to print and file paper, the software asks for driver's license info i n order to print. This is also an error. No identity info should be required to print a paper return. ID info is ONLY for E-filing to prevent identity theft and false e-file returns.

I'm a retired nys tax examiner.

As you know, it is important to correctly classify the pension income for New York State since some pension income (like federal, state, and local government pensions) has different exclusion levels than other pensions.

This misclassification of New York pension income for New York State is a known issue. Please see this TurboTax Help page and sign up to be notified of updates.

I downloaded the program to my MacBook Pro. I receive a Connecticut teachers pension and 25% of the taxable amount is tax exempt. in Connecticut. Turbo combined my teachers pension and my Riversource annuity which is partially tax free. It reported this amount to my state return and labeled it as my CT teachers pension. I knew it was not right because it was a greater amount than my teachers pension.

Also in the federal return you did not list the taxable federal amount of my pension, only the gross amount. A certain amount of my pension is not taxable but on the 1099R box 2b taxable amount not determined. It is determined by Turbo every year but you did list the taxable amount in my return.

I have used Turbo for at least 10 years.

My problem is not with the program, I used 2019 1095-A in stead of 2020 1095-A. I need to correct this ASAP.

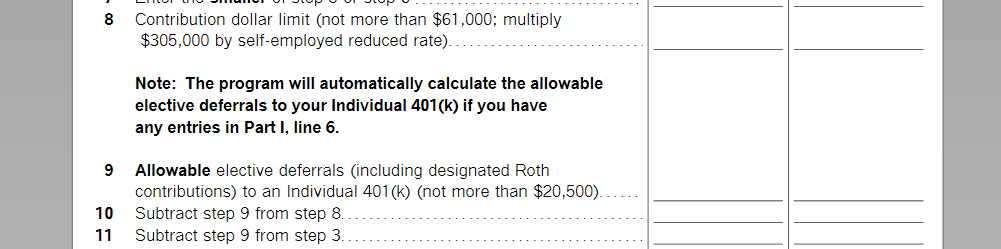

There is an error in the Keogh/SEP worksheet of my 2022 Home & Business software. Line 9 Allowable Elective auto fills with 2021 amount of $19,500. It should be $20,500.

There was an update that corrected the error. If you have not updated your desktop version, please do so. (How do I update my TurboTax CD/Download software program?) @tfnmcam

@MaryK4 Are you aware of any updates for the Schedule C Car & Truck expense worksheet? AS of 4-1-23 it's STILL broken and I CAN'T E-File

Nor can I actually reach anyone in support other than an extremely unknowledgeable virtual assistant...