Delete Form 7206

Click on Tax Tools on the left side of the online program screen

Click on Tools

Click on Delete a form

I tried, but it will not delete and forces me. Then says 'cannot file because form 7206 not yet available from IRS'. Why does Turbo Tax force me to use this form? I don't have this deduction.

do you have a Schedule C or k-1. Medicare qualifies as self-employed health insurance if you have self-employment income. the form according to Turbotax will be ready 2/7

I think you are correct. Don't understand why IRS has such a delay with the form, but that is obviously the issue why I can't file my taxes. Thank you for the clarification...

Does anyone know when form 7206 will be ready which I shouldn't even need cuz I had insurance through the marketplace today is the 7th I've been trying since 12:00 a.m.

This is scheduled to be fixed with the February 7 update. The updates generally happen at night. It should be available February 8.

I got the email from TT saying the form was ready and to log back in to file, but its still not available

I got an email, a text message and a push notification stating form 7206 was ready and when I logged in it still won't let me file. I tried desktop per agents instructions and there was the same message that the form is yet not available. I googled the form and IRS has it easily available to download. I don't understand why TurboTax can't obtain it themselves instead of making us wait. The date the form will be available has changed so much that if tomorrow I cant file or see another date change for this form, I will be filing taxes elsewhere. This is the first year this happened to me and the form doesn't apply to me like many others are stating. Something is up that TurboTax not telling us, they should at least lower those high fees for the inconveniences they've caused us all Many people receiving their refunds already and we on a dang wait for something that doesn't apply to us (SMDH)

Same exact thing happened to me...got notified at 1:06 PST and its now 5pm PST.. Still nothing.

Hi Catina,

I hope you are correct. I have not received any push notifications, even though I requested email updates.

I also understand that you are not responsible for getting the update released. But I do appreciate your effort to communicate and try to keep folks informed. I do not understand why there is not better communication coming from TT.

Please keep responding if you can.

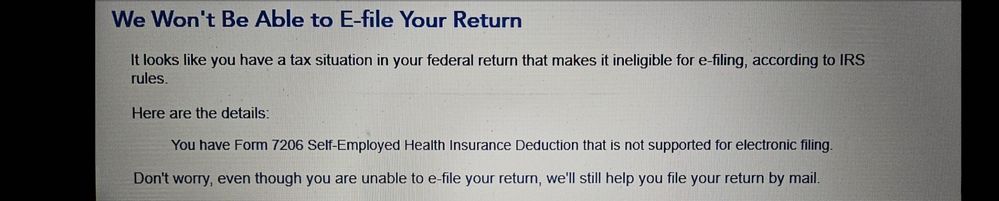

Has anything changed? Form 7206 is available but IRS (according to TurboTax) will not allow E-filing with this Form. Is this expected to change? I REALLY am not excited about filing by mail!!!!

Same here. I did the update 40 mins ago and gives me the same message. There has to be a workaround. I am Self Employed, so the form 7206 does pertain to me, but I don't understand why it's not ready even though it says it is ready. I'm going to wait a bit more; hopefully it gets resolved soon.

This has been resolved. Make sure your software has the latest update. You might also try closing TurboTax, clear your Cache and Cookies, and reopen TurboTax.

If you are still getting errors after you have done this, can you please send screenshots of what you are seeing?

I updated my laptop. Ran the TT Update and cleared cache cookies and browser. I'm still getting this message. Where can I go to run the update again? Should I start my return over?

Same exact problem here, including rebooted my PC, and nothing...

This is too frustrating and frankly I'm deeply concerned as it will roll to another day, another day.

After 8 years with TT this will be my last.

I also removed TT from my computer and re downloaded it again. It then ran the update, but still received the same error messages.

Who would mark it as solved. I am the one who started the thread, and NO, it is absolutely 'not solved'.

This is very unacceptable...

IM getting same problem....says I cant efile...because I have form 7206???

If you are not Self-Employed (filing a Schedule C, or have a K-1 or 1099-NEC in your return), and you are not claiming a Deduction for Self-Employed Health Insurance, you don't need Form 7206.

If this applies, type 'Schedule C' in the Search area, and 'Jump to schedule c'. DELETE any business entry on the Business Summary page. Then close TurboTax, clear your Cache and Cookies, and do the final review again.

If you ARE self-employed, and want the deduction for Self-Employed Health Insurance, you need Form 7206, which flows onto Schedule 1, Line 17,and then Form 1040, Line 10.

Try deleting Form 7206 from your return, closing TurboTax, clear Cache and Cookies, then re-open it and perform a manual update (if using TurboTax Desktop) to see if your issue is resolved.

Here's more info on How to Enter Self Employed Health Insurance.

@CatinaT1 Thanks for your follow up post. Since that time there have been several posts that show people are still having trouble.

There are a number of platforms that may be affected: Deluxe vs. Home and Business; on line vs.local; download vs. disk; Windows vs. Mac; versions of both browser and Op System. Perhaps it would help determine the extent of the problem if Posters would identify their full environment.

It certainly would help if TT Support responsible for the fix would communicate status and anticipated resolution. Can you make them aware of this and let us know that you were successful in escalating this issue?

There does not seem to be a good way to communicate with those who are responsible for fixing problems. In the meantime, thanks for being a responsive source..

After 8 loyal years with Turbo Tax I'm too concerned and frustrated at this point.

I've decided to spend more money and migrate my info to H & R Block online. I have a feeling I can file instantly.

I can't image such issues with TT and Form 7206, but I'm gone...

I actually decided to NOT take the Self Employment Insurance deduction by not answering certain questions. It didn't change my tax liability much and it deleted the firm completely and I was able to E-File. This is obviously a specific circumstance to me and it only worked because I chose NOT to take the deduction. I'd rather take a small hit now and get my refund early rather than wait another day or week until this issue is resolved. Intuit is going to lose a lot of business because of this, especially now that IRS is rolling out their free service.

I'm completely dissatisfied.