Since the gift was under $100,000 you do not need to file a Form 3520. Since the gift was over the annual exclusion amount for gift tax purposes and your parents are permanent residents, they do need to file a Form 709 to declare the gifts.

Thank you Susan for your answer.

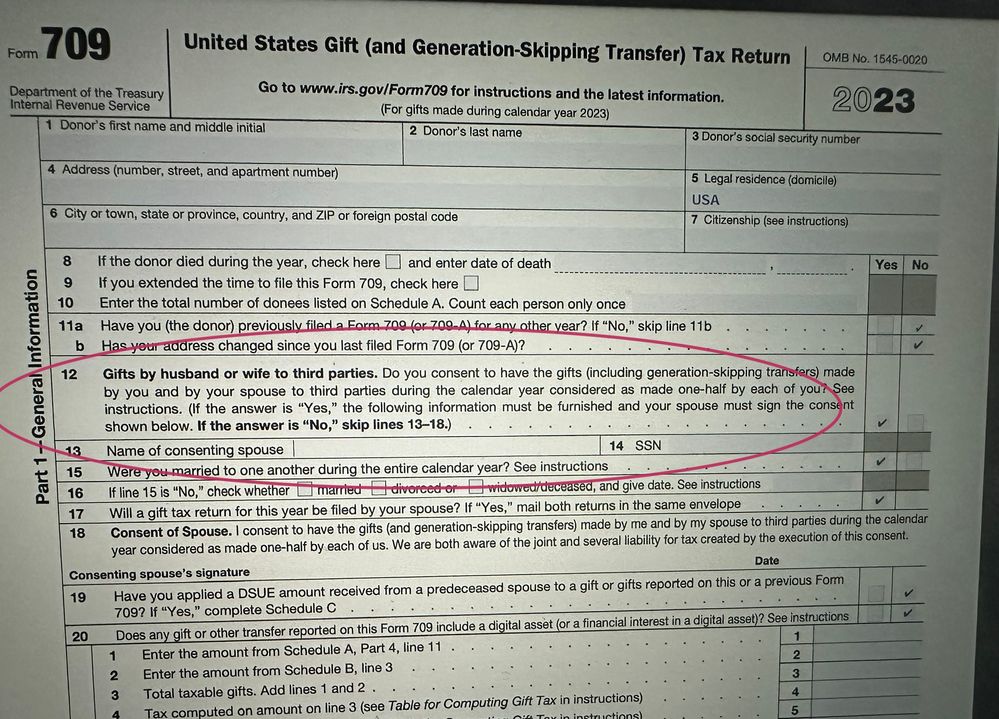

Do they need to file Form 709 separately o does Form 709 can combine both of them together? See attached please.

Thank you so much Susan.

They will each file a separate Form 709, listing the other as consenting in the section that you circled in your attachment. It is then best to mail them together in the same envelope so that they are processed properly.

You will find a bit more detail on the process HERE, but feel free to return with additional questions!

Thank you so much Susan.

I will come back for questions after I look at it more thoroughly.

You are the best👍

Hi Susan,

On Form 709, 1st page, Part 2- Tax Computation, Line 7, instructions says to put $5113800 for the applicable credit amount. Is that for everyone? Or shall I leave it blank?

Thank you so much for your help.

Since both of your parents are still living, the instructions state the following in regards to line 7.

- The applicable credit (formerly unified credit) amount is the tentative tax on the applicable exclusion amount.

- For gifts made in 2023, the applicable exclusion amount equals: • The basic exclusion amount of $12,920,000,

- PLUS • Any DSUE amount,

- PLUS • Any Restored Exclusion Amount.

My understanding is that you would enter $12,920,000 in this box. There is no DSUE because there is no deceased spouse and no restored exclusion amount.

If there was a deceased spouse and if the remaining spouse could not use a DSUE, then $5,113,000 would be entered. This does not apply in this case because both of your parents are living.

Hello,

For the Form 709, in the General Information section of the form, Box 7 Citizenship, what do green card holders/permanent residents input on this line? Instructions for this part were confusing.

Do they put US tax resident, Country of birth, or some other term?

Thank you