I've got the same problem. Hopefully, TurboTax will come out with a fix soon.

WAIT for the form release!!!!!!!!

In mid- January , the IRS announced they were changing the "90% test" (line 5 of this form to 85%, so I suspect it's taking TT and others time to reprogram and test the software.

so the penalty could be less or eliminated once the form is updated. It depends on the math that carries through the schedule

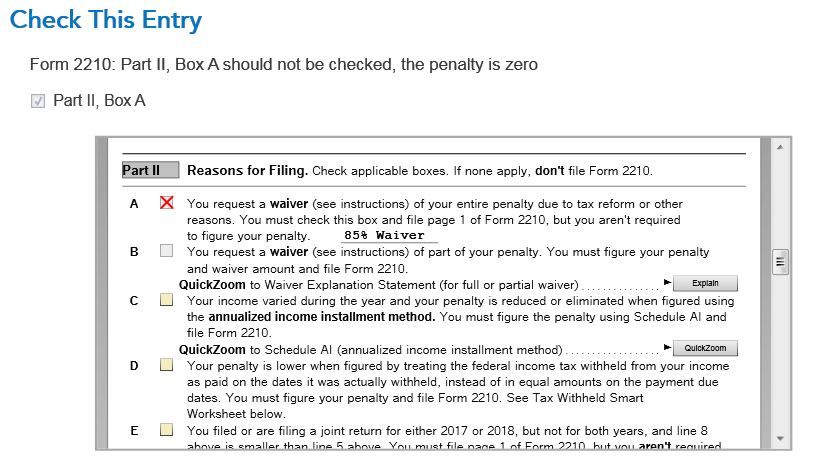

I am getting error message. Form 2210 Part II, Box A should NOT be checked, the penalty is zero. I cannot uncheck the box. If you also got this error message how did you correct.

TT just updated that form today..... maybe a bug? suggest waiting for the next update and see if that is fixed. if it is truly a bug, a lot of folks are going to have it.

I experienced the same problem with the newly released form 2210. The form does not seem to accommodate the "safe harbor" provision that there is no penalty as long as you withheld or paid estimated taxes equal to or greater than what your 2017 taxes were or 110% of your 2017 taxes, depending on AGI. Have to see what the next update bring.

What version of TT are yo using?

It works correctly in Desktop deluxe

I'm running TT Premier 2018 Desktop version. TT checked the box on the form, not me. Then TT asserted the error that the box should not be checked. My estimated taxes paid were more than what my 2017 taxes were and more than my 2018 tax liability. I did software development for 25+ years. Seems like a bug in TT to me but maybe I've missed something. Your withholding and estimated taxes paid situation may be different. For example, from looking at the form, if one has withheld more than the 2017 tax liability Form 2210 exits very early. Not my case as I pay quarterly estimated taxes, which cause a different flow through the form.

Same issue as of Feb. 15. The form 2210 is incorrectly checking Part 2, Block A is checked, but should not be checked, but no way to manually correct. Deleting the 2210 does not correct the error.

I've got the same issue as all of you. Tried everything to delete the entire form, as well as un check the box. Can't do either.

Too bad, as I would like to file my taxes as I have a refund coming.

Also, noted that when I had done the Fed taxes about 2 weeks ago, and even ran the "Smart Check", everything was fine. I thought it smart to hold off and wait a few weeks incase I got any revised documents, which I haven't. Something in the past few weeks which updated, apparently has a bug in it. Hope TT can resolve this soon.

the forms were radically changed due to IRS announcement in mid-January and it should reduce the penalty for many

before you posted the moderator posted this:

[Edited: Link invalid] This has been reported. Please sign up here for updates on when this will be resolved. Thank you!

I have the same problem and don't want to file until it is fixed but have a refund coming that I need badly. I have DeLuxe

@pippy wrote:I'm running TT Premier 2018 Desktop version. TT checked the box on the form, not me. Then TT asserted the error that the box should not be checked. My estimated taxes paid were more than what my 2017 taxes were and more than my 2018 tax liability. I did software development for 25+ years. Seems like a bug in TT to me but maybe I've missed something. Your withholding and estimated taxes paid situation may be different. For example, from looking at the form, if one has withheld more than the 2017 tax liability Form 2210 exits very early. Not my case as I pay quarterly estimated taxes, which cause a different flow through the form.

I am in exactly the same position and want it fixed before I submit my tax return. I have DeLuxe but that shouldn't matter.

How many of you make estimated payments?

Comparing to my form from last year, it seems TT isn't carrying Tax payments line 8 over to 2210 part III line 12.

Hopefully, they will fix this soon.

I am an estimated payment user. I assume most retirees do estimated payments especially if the are over 71 ½ and are required to take RMD if they have IRA's.

I'm also an estimated tax payer. I paid quarterly estimates that are MORE than required and have a refund coming. However, due to this form error, I don't want to file and screw something up. I'll just have to wait and hope it gets corrected quickly.

OK just got an update this afternoon from TT saying problem is all fixed. NOT SO. After getting the message, I spun through my tax return again, and this time NO errors, so I filed electronically.

Now I see that Fed's rejected my return due to Form 2210 Part II, Box A being checked.

I DO not have a penalty as I over paid.

NOW what ????

I have the same problem with Form 2210. I have overpaid my estimated taxes and even with the supposed correction by TT, it still says I request a waiver which I do not need. Now my Federal tax return was just rejected. Very little TT help when I open my return to fix the problem. What do I do now?

OK.....success, I think.

I had the same message, and couldn't get rid of Form 2210 even though I do NOT owe a penalty. I over paid my estimated taxes, they owe me.

I just went to Form 2210 and in the Part II, next to Box A was a button "Explain" I clicked on that, and a new section opened up where I typed in my Explanation..... I typed " I do NOT owe a penalty, I over paid my taxes, You owe me".

I refiled, and it was just accepted !!!! Hopefully, that is the end of it.

no it doesn't. Frustrating as heck. May be my last year using TT if not resolved quickly.

Hey folks!

I don't know if this works online, but...

On form 2210, I right-clicked box A asking for a waiver and chose "override". Then, I unchecked the box.

Form 2210 finally disappeared, and my return looks ready to file (accurately!).

Hope that helps.

Update: My returns were accepted!

If I could reach through the ether and kiss you, I would.

I don't need to file a 2210. My return included a 2210 and was rejected because of the 2210 Part II box A check mark.

My 2210 is now successfully deleted. I have re-filed with fingers crossed.

This error is still occurring in the TurboTax Premier web version. I cannot file my return because form 2210 box a is checked erroneously. When will this be resolved?

Please post if overriding (uncheck) Form 2210 Part II Box A allows your return to be accepted by the IRS. It appears that the last TT update removed the Error that says Form 2210 Box A should be unchecked. However, Box A is still checked when you efile and it is causing the return to be rejected. TT please fix.

I am unable to e-file due to the 2210 error. The software update TurboTax put out yesterday, got rid of the error (!) mark next to the 2210 form but when I then e-filed, it is rejected within a few hours.

TurboTax just contacted me and told me to print out my returns and mail them. This is unacceptable. I don't even own a printer.

I responded that if they don't fix this issue this week, I will contact my credit card company and have them refund me my purchase price ($69) and the $19.99 cost for my state return, which was taken when I attempted to e-file. I also let them know I will never again use an Intuit product. I am (was) a 20+ year customer.