Apr 11, 2023 10:13:13 AM

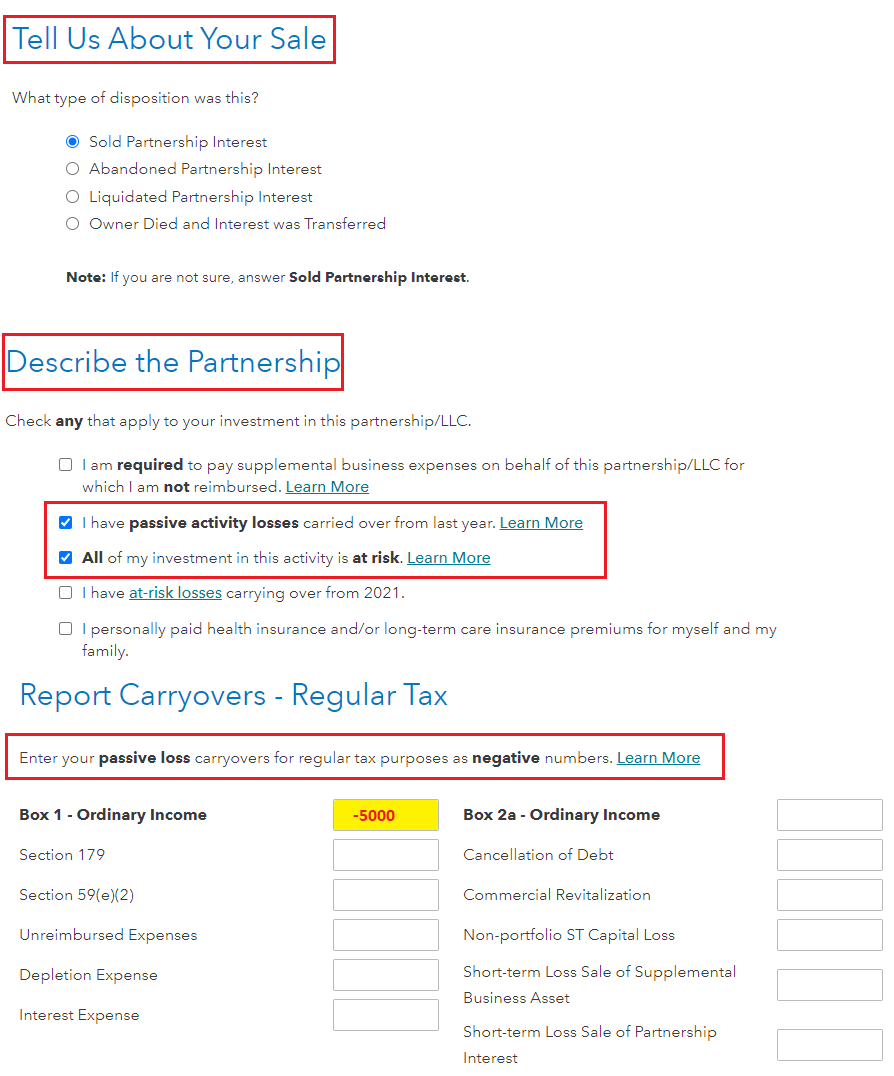

It is entered in the K1 entry in TurboTax. You should have a check box that shows this is a complete sale/disposition of the partnership and that you have passive activity losses carried over from last year. See the images below for assistance.

- Search (upper right) > type k1 > Click the Jump to... link > Continue to review your K1 entry

- See the images below