Feb 17, 2025 7:34:11 PM

In TurboTax Business, distributions to shareholders for an S corporation are typically reported on Schedule K-1 (Form 1120-S). Specifically, these distributions are entered on Line 16d of the K-1.

If you aren't referring to an S corporation please reach back out and clarify.

Plarka

Level 2

Feb 18, 2025 9:50:01 AM

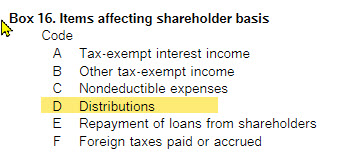

It is for S Corp. However, on the K-1 I only see a 16 that says 'Items affecting shareholder basis' and don't see a D On the 1120S I see on line 16 'Loan balance at the beginning of the corporation's tax year.'

Feb 18, 2025 1:59:22 PM

On Form 1120S Schedule K-1, distributions are reported on Line 16 using Code D. The list of codes generally supplied with Schedule K-1 shows the description for Code D as "Distributions" (see below).

You'll also find total distributions on Form 1120S Line 16d.