I am sorry you are having trouble deleting Form 8995. Did you try these steps (you probably did... but just to make sure),

-

While in your Tax Home,

-

Select Tax Tools on the left hand side of your scree

-

Select Tools,

-

Select Delete a Form.

Hope this helps!

Your answer did not help me. I do not have a Delete form under my tools.

Form 8995 is for Qualified Business Income deductions. What is driving this form on your return? If you have dividends reported in box 5 of a 1099-DIV, this may be creating the form for you. The dividends are already included as part of ordinary dividends in box 1, so they can be deleted out of box 5 if you would prefer to remove this form and not take the deduction.

If you have several QBI Components (from Sched C or E) and are having trouble with the program bringing up unwanted schedules for Form 8995-A, try deleting the QBI Component Worksheet. The program will generate new Component Worksheets for EACH component. All schedules related to Form 8995-A will go away.

I have the same issue. Deleted a business from 2018, no qualifying QBI and still they won't get rid of 8995 for me and won't allow me to submit. I have a feeling it's either a glitch, or they're trying to force us to upgrade TurboTax versions *only* to be able to delete a form or something. Regardless of why, it's extremely annoying and now I'm going to have to find a way to submit on my own as TurboTax forum support is simply inadequate for situations like these. Terrible.

It is possible you are receiving dividends from a REIT (Real Estate Investment Trust), which qualifies for a Section 199A deduction. This does not mean you had Qualified Business Income (QBI), but you could qualify for the deduction. REIT dividends are reported on a Schedule K-1 or in box 5 of the 1099-DIV. The import from your mutual funds may have reported these transactions.

If you have several QBI Components (from Sched C or E) and are having trouble with the program bringing up unwanted schedules for Form 8995-A, try deleting the QBI Component Worksheet. The program will generate new Component Worksheets for EACH component. All schedules related to Form 8995-A will go away.

- Under Tax Tools, choose Tools

- Choose Delete a Form

- Scroll through your return until you find QBI worksheets, click Delete to the right of the form

- Confirm that you wish to delete the form

Thank you for the reply. I do have a "0" value in 1099-DIV (though nothing else ever put in there in any year). I must have a glitch going somewhere. Any schedule C forms were deleted with removal of the business. It seems form 8995 remains but no ability to remove 1099-DIV value nor 8995. There are no other QBI forms to delete. It's just 8995 hanging blank and alone with no ability to move forward in the process. Seems I'll either need to start over entirely without importing from previous years, or print and send manually without involving TurboTax in the process at all as the program won't even let me move forward with sending offline.

I too am having a similar issue. I think there is a glitch in the application. I had created Form 8995 by mistake, and am now unable to delete it. Having spend $70 + tax on this software, and unable to file your return is very annoying. I tried deleting the Form 8995 and its worksheet, but that option is not working. Does Turbo tax have any support to sort out these issues?

Thanks

Maybe too late to be of any help to you. But this entry maybe coming from your 1099-DIV's Item 5 which reads as 'Section 199A'. This amount shows up on Form 8995, and you can update this entry to '0' and see Form 8995 go away. As long this entry (item 5) on 1099-DIV is there, Form 8995 cannot be deleted.

Thanks for the effort here, Rach_S. There may be another issue/solution you've found. For me, I think it was a bug of some kind, or an issue with other versions of the Turbotax software I had installed on the computer I was using. I had to try again from scratch and without importing on a new/reformatted machine and it ended up working without issue from there. Not ideal but satisfactory for this year. I do think stuff like this and intuit's poor support surrounding these issues is reason to switch to another product, or ideally reason to push congress away from taking their money to keep us paying for products like these instead of providing a cost-free filing option. https://www.propublica.org/series/the-turbotax-trap

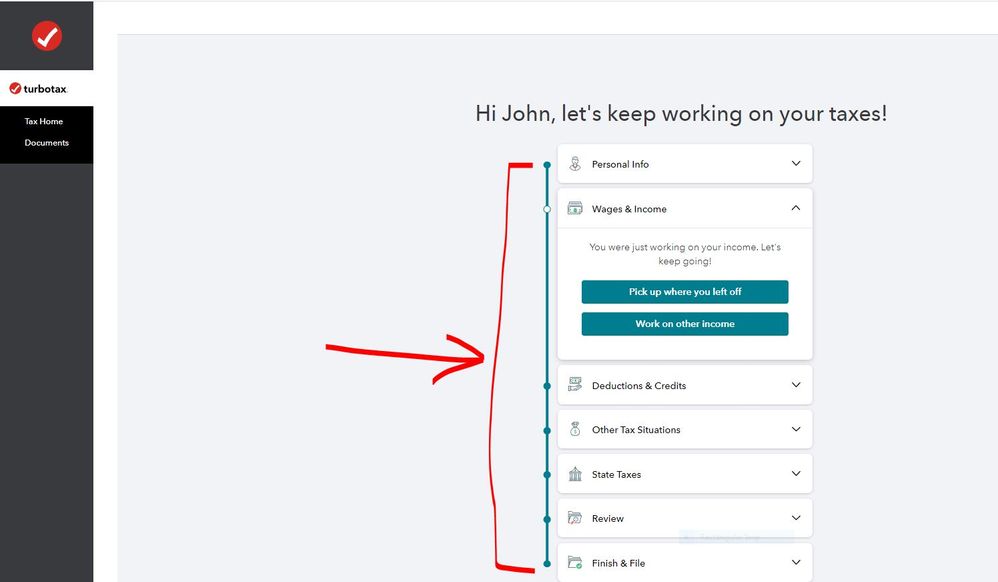

There is absolutely no button that says "tax tools" while I am in "tax home". What is going on with your organization? Your suggestions are wrong. Also, I paid extra to have access to more help. How do I get it?

I do not have a "Tax Tools" button shown on the "Tax Home" page.

I only show "Tax Home" and "Documents" below the "Tax Home" button.

@smarterresumes wrote:

I only show "Tax Home" and "Documents" below the "Tax Home" button.

You have to access your 2020 online tax return by clicking one of the boxes shown on the page. Then the links on the left side column will be available.

The tax tools answer is the solution to form deletion. But the key thing missing to her answer is those tools can only be found through an actual browser. I was able to find them simply by using iPhone’s browser.

Use an actual browser to find the tools. Problem solved.

I found them simply by using iPhone’s default browser.

I need tp delete this 8995 but I can't find the Tax Tools or the drop down people are talking about. I need very elementary step by step instructions to do this. I have the Deluxe product. Last year, I had Premier

Thanks so much

f the program wants you to take a tax credit, chances are you should take it. If you are trying to delete this form but you have something that triggers it, the program will want to replace it. Please be sure you have no investments with sec 199a dividends, no K-1, no rental, no business before deciding to delete this form.

See:

As for deleting the form 8995, the directions in How to Delete seems insufficient. Instead of the app, you should be logged into the program at www.turbotax.intuit.com

@jchmcl09

ready to efile but on checking I find that TurboTax has filled out form 8995 and I get a $1 credit.

The problem --I do not have a business and need to have this form deleted

Form 8995 - Qualified Business Income Deduction Simplified Computation is used to figure your qualified business income (QBI) deduction. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of their net QBI from a trade or business.

The form 8995 is used to figure your qualified business income (QBI) deduction. If you have a

- business income (1099s);

- an amount in box 5 of a form 1099-DIV; or

- Form K1 from a Public Traded Partnership.

If none of these situations apply, you can delete the form, using these steps:

TurboTax Online

- While in your return, click on Tax Tools > Tools (in the black bar at the side of your screen).

- In the Tools Center, under Other helpful links click on Delete a form.

- Click Delete next to the form you want to delete and follow the onscreen instructions.

- Once you have finished deleting the desired form(s) click the Continue with My Return box (in the lower right of your screen).

TurboTax CD/Download

- Go into Forms Mode by clicking on the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, click on the form you wish to open and delete.

- Click on the Delete Form box at the bottom of the screen.

- To return to the interview, click on the Step-By-Step icon in the top right of the blue bar.

Look under tools, then delete forms... If you see any worksheet forms that does a two year comparison, and it does not apply to you anymore, then delete those forms... Then scroll down to the 8995 form, and it should be deleted as well... Also if you scroll down to your state, and it shows the business name in that area that does not apply to you anymore then delete that as well...

Then back out from that page, and go back to the main page “to review”... Continue to “step 3” - “Get ready to save and file your returns”- “click start” until you get to the page where it says: “Let’s take one last look at your returns and review forms” Scroll down through your forms, and it should not be listed there anymore... Then go to your federal 1040 form to line item (13), and it should be blank with out a “0” or a number in the box...

It took me a while to figure this out myself, I hope this helps!

VictoriaD75,

Thank you so much for pointing out that Form 8995 Qualified Business Income deductions can be driven by 1099-DIV REIT dividends.

I thought Turbotax had gone nuts on my Form 8995 by claiming REIT/PTP deductions I didn't earn (along with the 1099-NEC items I expected), and I was struggling with what to do about it, when I came across your post. You explained it all very nicely.

If you have mutual funds, check for a 199a dividend from a mutual fund. Item 5 of 1099-div. Form 8995 was been generated for me based on this. The QBI designation is confusing.