As a follow up, on the back of the 1099-MISC, the instructions read: Box 3. Generally, report this amount on the "Other income" line of Schedule 1 (Form 1040 or 1040-SR), or Form 1040-NR and identify the payment. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other taxable income. See Pub. 525. If it is trade or business income, report this amount on Schedule C or F (Form 1040 or 1040-SR).

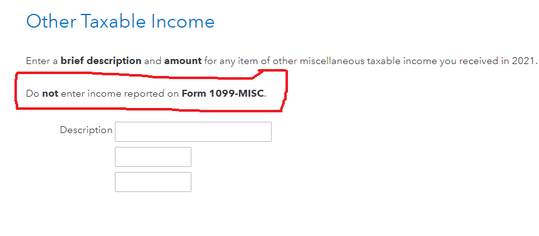

To me, this is not trade or business income. It is "other taxable income." But Turbotax will not let me enter it as such. When I go to the personal income section, and try to enter it as "Other Reportable Income," it specifically tells me not to enter 1099-MISC income here. But as a test, I did, and that is the only way I could get the amount to populate on the "Other income" line of Schedule 1, per the 1099-MISC form's instructions.

Please help if possible. Thanks 🙂

In case this comes up for anyone else, I think I may have accidentally solved the problem. I entered the 1099-MISC normally and it created an imaginary business for me, charging me SE tax etc. I then went all the way back to the beginning of the program and deleted the business. This removed the schedule c, and self employment tax but preserved the 1099-MISC information on schedule 1. Turbotax automatically populated "Other Income from box 3 of 1099-Misc" on Schedule 1 line 8, which is consistent with the 1099-MISC instructions now. I did this by accident, but I think it's correct.

What do you mean when you say you deleted the business? All I see is "Your 2020 Self Employment work summary". I can delete that item but it deletes all info including the interest amount.

"Other Reportable Income," it specifically tells me not to enter 1099-MISC income here. But as a test, I did, and that is the only way I could get the amount to populate on the "Other income" line of Schedule 1,"

For Line 3 amount, that's the right way.

you shouldn't be getting a Schedule C and then trying to delete it.

Ok. Now I see it.

Wages and Income>>Less Common Income (all the way at the bottom)>>Miscellaneous Income, 1099A, 1099C>>Other Reportable Income>>Start

You really gotta drill to find it, but this is a better solution than reporting it as self employment income then deleting it.

I found how to get the income to show up on Schedule 1 as other income without TurboTax creating a Schedule C (and making you pay self-employment income).

Enter it under Personal Income -> Other Common Income -> Income from Form 1099-MISC.

The important part is how you answer the questions after you enter the form.

Involve work that is your main job? No

How often? Only choose the current year (this is important to keep TurboTax from creating a Schedule C for it)

Intent to earn money? No (trust me, you have to choose No for this so TurboTax doesn't assume it's a business and creates a Schedule C).

That should do it.

Thank you. I had the same issue with self employment tax and your recommendation heled to solved it. CPAs seem to have no clue about crypto income. need to educate themselves a bit.

I looked there and it states; DO NOT enter income from form 1099-MISC. Any ideas if this is new or Am I missing the right category ?

|

Other income is the correct place to enter this in spite of the fact that it says not to enter 1099-MISC income there.

All this confusion comes from the IRS position that crypto is not currency, it is property.

I think part of my confusion is this thread started a year ago in 2021 and now Turbotax's interface for 2022's filings maybe a little different.

Can anyone confirm we file BlockFi's 1099-MISC under Income from Form 1099-MISC and not anywhere else such as Investments and Savings? I was able to file is successfully under 1099-MISC but did have to answer a bunch of questions where TurboTax thought it was misc income from work etc. I haven't checked yet what forms or schedules it will create as I'm still in the process of entering everything.

Thank you

If your 1099-MISC shows a figure in box 3, Other income, you are supposed to enter it in as Other Income.

I understand that may feel wrong to you, but the IRS considers crypto currencies as property, not as currency, since they are not backed by a Centralized authority. And, yes, I know that is the whole point of crypto.

Under current IRS guidance, only sales of crypto assets are treated like investments.

Here is how to enter your 1099-MISC box 3 amount:

- Select Federal on the left side menu.

- Select Income and Expenses toward upper left.

- Expand/ scroll down the list and find the section called, Less Common Income.

- Scroll all the way down and select Miscellaneous Income, 1099-A, 1099-C.

- Select Other reportable income.

- Answer the first question Yes.

- Enter a description and amount on this page, click Continue.

When I go through the process you detailed, it specifically says "Do not enter income from 1099-MISC." Are you sure the steps you gave are still correct?

I see the warning too. Which gave me pause on submitting the Blockfi 1099-MISC through other taxable income.

1099-Misc box 3 should be reported on line 8z of Schedule 1 Additional Income and Adjustments to Income and line 8 of the Federal 1040 tax return.

You are able to track where the income is reported by viewing the entries at Tax Tools / Tools / View Tax Summary / Preview my 1040 or at Tax Tools / Print Center / Print, save or preview this year's return.

You may also report the 1099-Misc using these steps:

- Click on the search magnifying glass in the upper right hand corner of the screen.

- Enter '1099-misc'.

- Click on 'Jump to 1099-misc'.

These questions can lead to reporting the income as self-employment income subject to self-employment tax. The income is rightly reported as other income on line 8 of the Federal 1040 tax return and can be checked by viewing the tax return.

I did this, but it would not let me e-file my tax return. It was still complaining that 1099-misc needed to be linked with business income.

Any one have a workaround, or should I mail it to IRS?

1099-Misc box 3 should be reported on line 8z of Schedule 1 Additional Income and Adjustments to Income and line 8 of the Federal 1040 tax return.

Follow the steps below to report this income that is not reported as self-employment income.

- Select Federal from the left side menu.

- Click on Wages & Income.

- Scroll down to Less Common Income. Click Show more.

- Click Start / Revisit to the right of Miscellaneous income….

- Click Start / Revisit to the right of Other reportable income.

- At the screen Other Taxable Income enter the description of the income.

The income will be listed on line 8z of the Schedule 1 Additional Income and Adjustments to Income and line 8 of the Federal 1040 tax return.

You are able to track where the income is reported by viewing the entries at Tax Tools / Tools / View Tax Summary / Preview my 1040 or at Tax Tools / Print Center / Print, save or preview this year's return.

That is exactly what I did, and it is indeed showing at the lines you mentioned.

The problem is that it would not let me e-file. Turbotax is complaining that this is an error, and the message is "Form 1099-misc: A Link to Schedule C, Schedule F, Form 4835 or the other income statement must be entered. To associate this amount with the proper tax form double-click on the field provided or check the box for the form you want to link this amount to ".

I can't find how to associate it. Somehow turbo tax kept trying to link it to "Business income", which it is not.

@JamesG1 - I believe I have performed the steps as outlined by you above. However, since cryptocurrency is treated as property, I am attempting to categorize this income as passive "rental" income to offset expenses associated with a rental property (I am reporting losses for the year from the rental property). How can I categorize as such so the crypto income is offset by the rental property losses? And if it requires re-categorizing as "rental income", what address should I associate with the income?

If your 1099-Misc entry is not linking properly to Schedule E, try deleting your 1099-Misc entry and enter your 1099-Misc as Rental Income.

What would you input as "Property Address" for rental assets that are not homes/buildings with physical addresses?

I discovered a way to easily solve the problem. The online cloud based version of TurboTax is not as flexible at the desktop version. I was tearing my hair out! If you've started with the online version you can request TurboTax to give you access to the downloadable desktop software. I recommend doing this if you have a complex return. Using the desktop software you can access forms easily. This is not possible using the cloud version of TurboTax. After you've entered the 1099-MISC, you can view the 1099-MISC Wks. Simply click "Other Income" in the information for Box 3, which puts an X in the Other Income box. Now check Schedule 1 and you'll see the income listed on line 8z Other income (Other income from box 3 of 1099-Misc). No SE tax should be generated. Problem solved!